Solana on-chain metrics suggest rising activity and declining fees, supporting bullish outlook

- Solana on-chain activity shows signs of growth in the last thirty days.

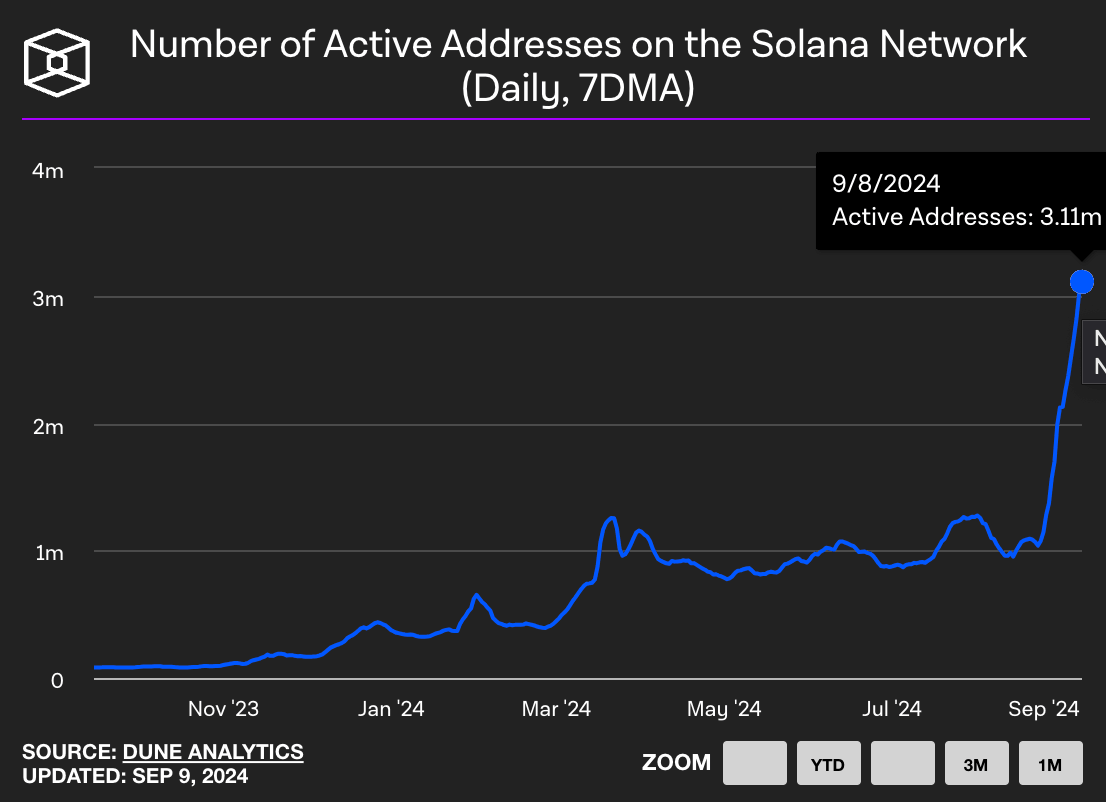

- Daily active addresses grow threefold, rising to 3.11 million on Monday.

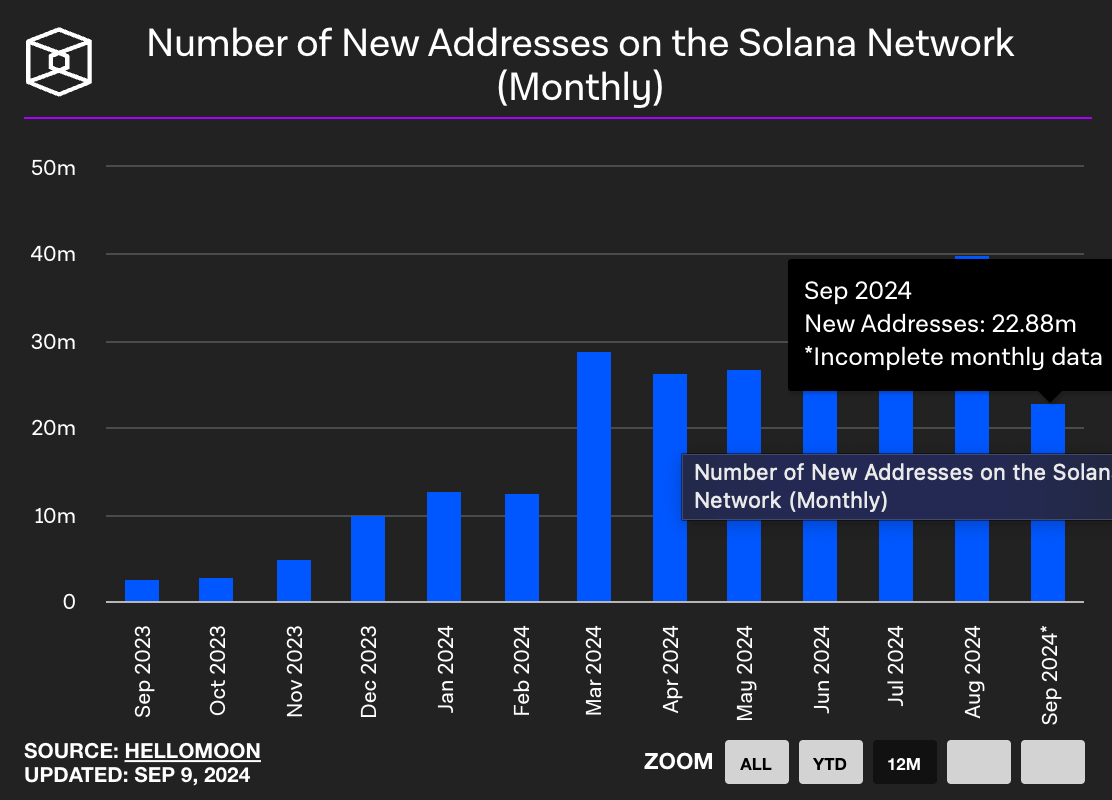

- The number of new addresses on Solana in the first ten days of September is more than half of that registered in August for the entire month.

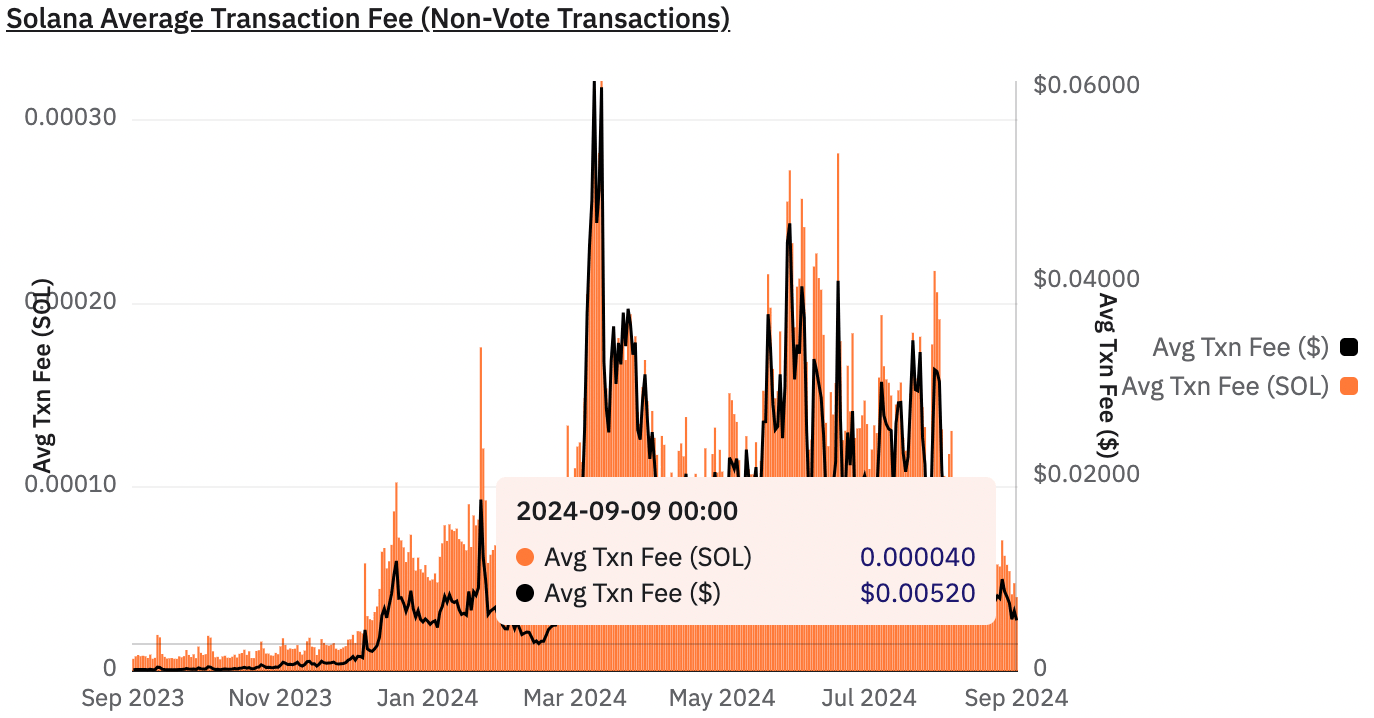

- Solana network’s average transaction fee is down 68% in the last thirty days.

Solana (SOL) price could be set for a rally as the altcoin’s on-chain activity has increased significantly in the last thirty days. The Ethereum-competitor chain has observed a steep decline in transaction fees and a rise in daily active addresses, likely driving higher demand for SOL and Solana-based assets among crypto market participants.

Solana metrics signal growth potential

Data from Dune Analytics, a crypto intelligence platform, shows that Solana has noted an increase in the daily active addresses. The metric tracks the activity of wallet addresses active on the SOL chain. A rise in active addresses is typically associated with an increase in demand for the altcoin or higher utility among traders.

SOL daily active addresses have climbed threefold in the last 30 days to 3.11 million, highest level in nearly one year.

Daily active addresses in Solana

Meanwhile, the number of new addresses has also increased significantly. The indicator tracks new wallet addresses created, in this case on the SOL chain, a factor that is associated with rising demand for the altcoin. An increase is often considered a sign of higher adoption.

Within the first ten days of September, the number of new addresses created stood at 22.88 million, according to Hellomoon data, representing 57% of August’s overall number of new addresses. This shows a fast-paced adoption of SOL among new traders.

Number of new addresses on Solana

Solana Average Transaction Fee

At the time of writing, Solana trades at $133.83, down less than 1% on the day.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.