After months of controversy, aggressive dialectics and daily turmoil among the two main candidates, the US Presidential Election campaign has finally entered its final stretch. Next Tuesday 8th of November, American citizens will elect the successor of Barack Obama for the upcoming four-year term and their decision will certainly and broadly impact the financial markets.

Markets have already been tracking for months the developments of the campaign, at first during volatile Democratic and Republican primaries and later scrutinising with more attention the dramatic Hillary Clinton versus Donald Trump showdown, which has included three major debates and all kinds of head-scratching headlines.

Surrounded by this political turmoil and flooded by daily headlines, we decided to ask our contributors several questions to have a better understanding of the big picture here: from the expected outcome of the Election to the possible effects on the main market assets. Our contributors' consensus gives the clear edge to Clinton, but many warn of an underestimation of Trump’s odds and don’t think a Republican win would have a Black Swan effect.

Asset-wise, a Clinton win is mostly seen as priced-in and mildly positive for the US Dollar and the stock markets, while negative (positive for yields) on US Treasury bonds. All in all, the consensus is that the Fed policy won’t change under a Clinton administration.

The Trump scenario brings much more uncertainty, the word most written by the experts when developing their answers. It is no surprise then that answers for the Trump-win scenario are a bit more spread when trying to figure out how will the Fed policy look like with the Republican candidate as President. The USD and stock market reaction still is viewed as broadly negative in the short-term, making Election Day a considerably binary event.

But that’s all considering the short-term. The longer-run? That’s a different story, with different opinions all over the place dominated by the main repeated theme: a whole lot of uncertainty.

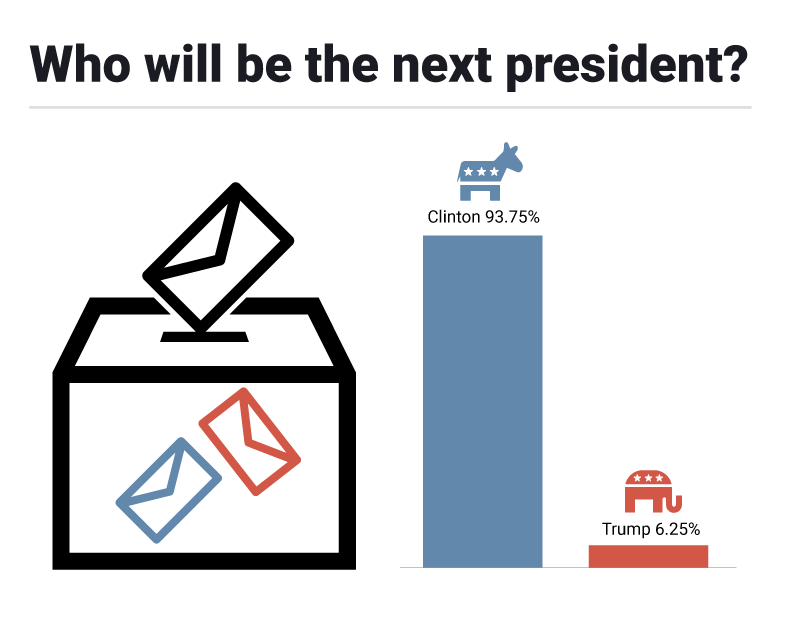

Who will be the next President of the United States?

National polls have been showing a notable Clinton lead for weeks but in the last days have shifted to a more close outcome, with some giving a close lead to Donald Trump after the FBI reopened investigations on the email case against the Democrat candidate. Here is how our experts answered to the question:

We must note here that the answers to this survey were given prior to this late turn of events, so the results might have looked a bit less lopsided if the same question was asked today. That said, several experts warn of a more uncertain result than “what is expected”.

Oisin Breen, Technical Analyst at Accendo Markets, notes that “journalists and generally most people I talk to are 100% convinced it will be Clinton and the rationalist in me tends to agree, however, recent events put analytical certainty, regarding politics at least, in question. Presently, amongst a sizeable proportion of the populations of developed nations, there is a strong and consistent backlash against the expert and against fact”.

While Breen still picks (as all the experts but one do) Clinton to win, he foresees a race much closer than the 80% odds that were out there for her to be elected. He was not the only one to give such kind of an answer, as Joseph Trevisani, Chief Market Strategist at World Wide Markets, also brought this reasoning: “it is difficult to gainsay the polls, but I think the election will be much closer than predicted and Trump’s chance of winning is considerably higher than portrayed by the media”. And with the margin between candidates narrowing according to the latest polls, they might already have been right.

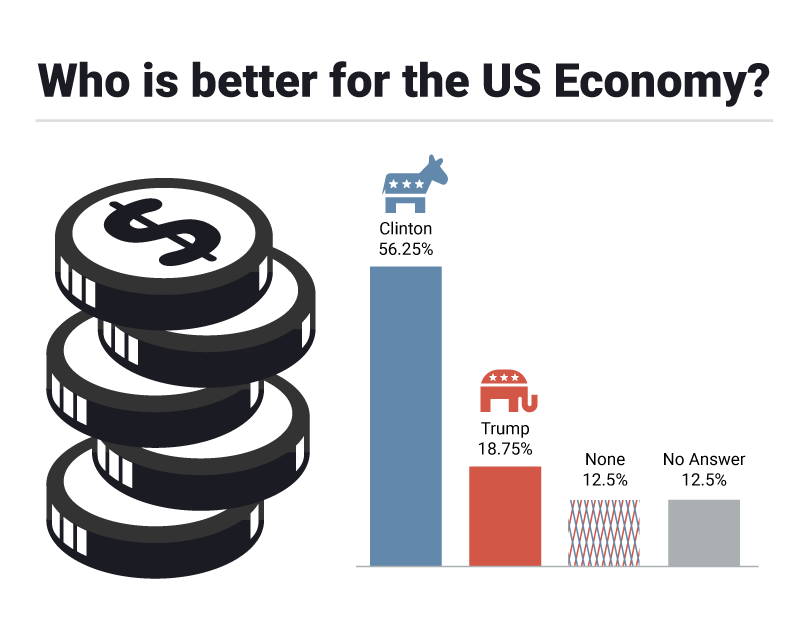

Who is better for the US economy?

Well, here we tried to grasp the sentiment of our experts regarding the two candidates, who have not been the most popular ones during a rather wild and unconventional campaign. These are not answers trying to give a scope on market behaviour in the short-term, but still, they give a good look on how the two candidates are viewed by the markets. And it is not pretty.

Even though Clinton gets the edge over Trump here, the arguments made are more like “the less of two evils” than a saviour for the US economy.

Look at what David Morrison, Senior Market Strategist at SpreadCo, says: “Trump’s tax cuts would provide an enormous economic stimulus, boosting GDP, wage growth, employment and business investment. Unfortunately, they would lead to huge budget deficits and add to the federal debt. Clinton’s tax rises probably wouldn’t bring in all that much in terms of revenues and they’d be a drag on investment, employment and growth”. For the record, this answer qualified as “None” in the survey.

Nicola Delic, CEO at Singapore Grand Capital, adds to this argument with the following quote: “After what we have seen in the last few months on TV none of these two have the knowledge to move us to a better US Economy, but let's say Clinton have more chance to get love from the market.” Yes, the Clinton backers, even if being a majority, don’t show much enthusiasm, with answers like this one: “Clinton is better, as it is more of the same”.

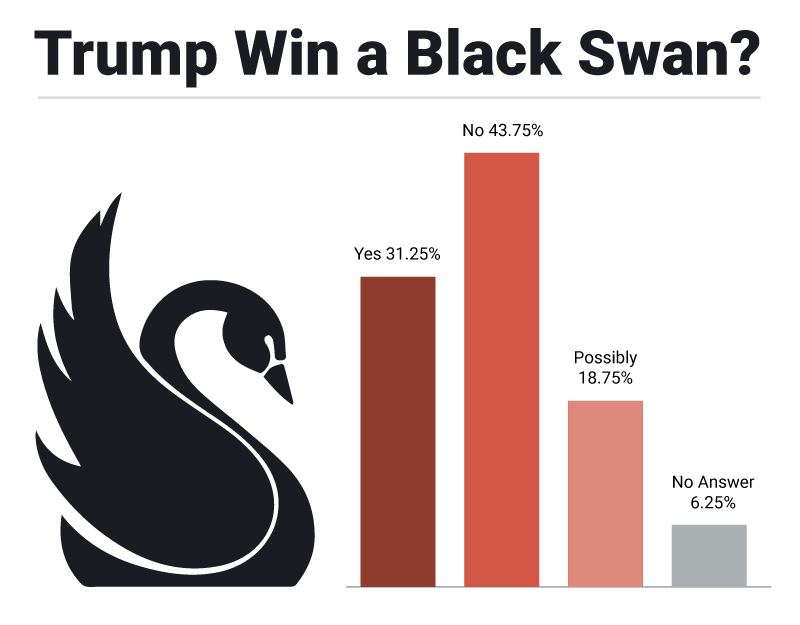

Would a Trump win/Clinton defeat be a Black Swan for the markets?

The third question of the first part of the survey focuses on trying to grasp the amount of certitude in the markets of a Hillary Clinton win. This is probably the question most affected by the developments of the last week, as markets have been pricing out a bit the priorly viewed as a widely expected outcome.

It is interesting to note, though, that the Black Swan event scenario didn’t take the lead in the answers even with all-but-one experts viewing Clinton as the candidate to be elected. Barbara Rockefeller, President of Rockefeller Treasury Services, explains why: “A black swan is something we have never imagined. Alas, we can imagine Trump. A better term would be ‘a horrible shock’.” That was a quite popular reasoning. David Morrison essentially agrees: “I’m not sure it would be a Black Swan as you can still get odds on it. But there’s no doubt that the markets are pricing in a Clinton win. Consequently, a Trump win would be perhaps even more of a shock than the UK referendum result”. Piers Curran, Head of Trading at Amplify Trading, had the same view: “Not a Black Swan event as we are aware of this risk - but markets are basically 99% priced for Clinton win”. So, expect a Trump win to be a “big shock” to the markets, but not a Black Swan.

Still, it is worth mentioning that there were also experts foreseeing such an event. Joseph Trevisani had a brief but tough answer: “Yes, a Trump win would be a Black Swan of major proportion”. On the opposite side, Chris Pulver, a trading veteran and analyst, reminded another factor to cope: even if a big surprise happened, a Black Swan event “is not likely as central banks want price stability”. Nope, central bankers are not getting a pass even when they have close-to-nothing-to-do with the topic.

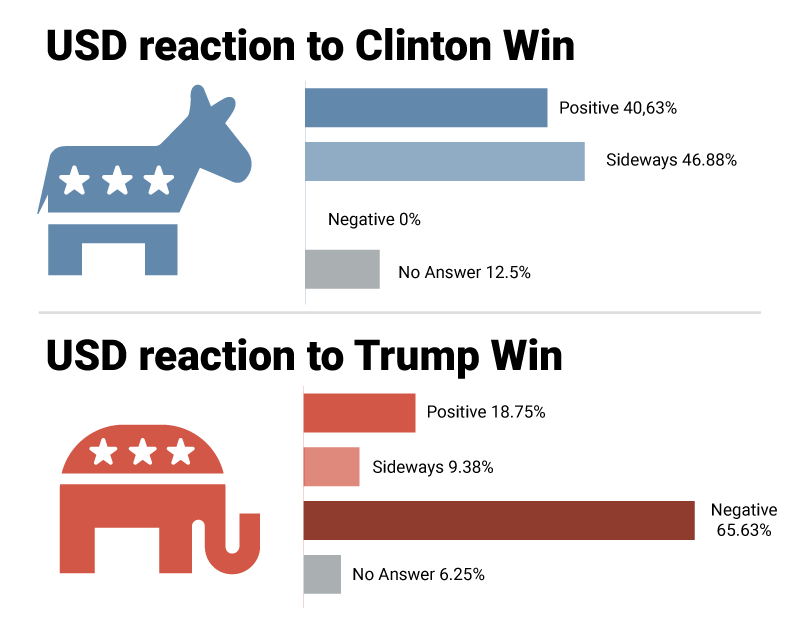

USD reaction to the Election

The second part of the survey tries to figure out the market impact of the upcoming election. Even if we still got a couple of reasonings on the mid-to-long term, answers here were mainly focused on the short-term, so that’s how the results should be read.

This picture doesn’t give much room to interpretations. Expect the US Dollar to have a mildly positive reaction in the likely outcome of a Clinton win and fasten your seatbelts to be prepared for a USD sell-off if Donald Trump reaches the White House.

Here we’re not talkin’ about practice anymore, but the real game. So it is nice to have some price levels. Stuart Cowell, Senior Market Analyst, at HotForex, is boldly USD-bullish in the event of a Clinton win, as he foresees the Dollar Index to 105, the USDJPY to 110, the EURUSD to 1.07 and the GBPUSD to 1.15. But most of the answers were quite more moderate, as Barbara Rockefeller summarises: “Dollar will not move much although may rally a small amount in relief”.

The Trump scenario on the greenback is a much more clear one, with negative answers across the board for the short-term, but a brighter picture on the longer-term. Joseph Trevisani has a textbook answer to that argument: “The initial uncertainty from a Trump win would harm the dollar, but not seriously since U.S. economic uncertainty would quickly become global, benefitting the USD. Medium term it will depend on Trump’s economic program, especially on trade. A strong protectionist bent will be negative for the dollar. Long term I would expect a Trump administration to be business friendly which would be beneficial for the dollar”.

Oisin Breen has a similar forecast, but he takes it with a bit more of salt: “Negative at first, followed by a rally, shorting the dollar might be an idea in the immediate aftermath. As things settle down, expect a tentative rally as the markets test the water. After that, it all depends on whether he can show a different side of himself from office. Trump the peacemaker does, however, seem unlikely”. Building walls will not build Trump a candidacy to the Peace Nobel Award.

Stock markets reaction to the Election

There is a sense in the public opinion that Wall Street loves Hillary Clinton, which may be kind of playing against her candidacy in an Election where the establishment has been despised by so many in both parties. Well, next Tuesday we’ll figure out if that ends up benefitting Trump, but what our experts definitely agree on is that the stocks markets will rally in a Clinton win and fall in the event of a Trump victory.

It is easy to summarise this chart (which features answers for the short-term reaction) with a couple of quotes for both scenarios. Steve Ruffley, Chief Market Strategist at Intertrader.com, gets the call here: “Many experts predicted a US Election Trump win would cause a major sell off in the indices. With the S&P and DOW hitting record highs this would have been the perfect opportunity for investors to take profit and re-asses the global outlook with the leader of the free world being such an unknown political quantity. Clinton, on the other hand, seemed to be the darling of Wall Street, with many fortune 500 companies backing her campaign (not one single company backed Trump), so does this mean stocks will rally?”

Ruffley thinks so in the short-term, but warns of a sell-off in the longer run: “Once Clinton is made President, this is ‘known’. For me and many out there Clinton was always going to be elected so this is ‘priced’ into the market. The logical thing to happen is once the result is known is that the stocks react in a positive manner. However, as many investors will have pushed the markets up prior to this highly anticipated outcome I see a sell off inevitably happening in the stocks.”

This is where things get interesting, trying to gauge the flow of the major stock indexes in the long-term. David Morrison expects the stock markets to struggle after a first initial relief rally “to break above resistance at 18,450 and 2,180 respectively” in the case of a Clinton win. On the other hand, if Trump reaches the White House, Morrison foresees some opportunities for “bargain hunters” after “an initial knee-jerk sell-off”. The analyst believes that the Republican candidate “should be good for defence, oil pipelines, oil drillers, construction, drugs and biotechnology sectors”.

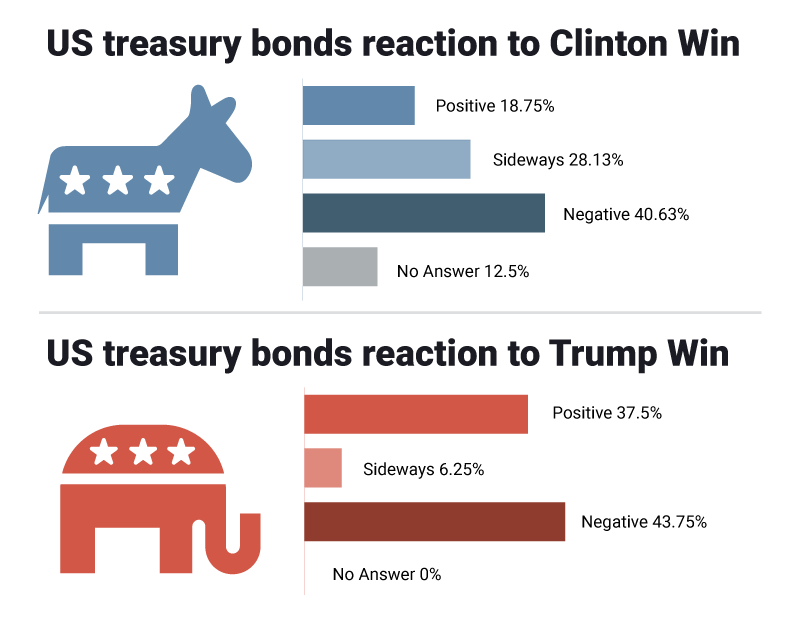

US treasury bonds reaction to the Election

If the greenback and the stocks seem easy to track on the short-term for each scenario, the bond markets look a little bit more tricky from our contributors’ point of view. Neither candidate seems to bring certainty to a market factored by many Xs and Os.

The Clinton presidency scenario appears to be bond negative and yield-positive according to most of our experts, but not by a big margin. Wayne Ko, Head of Research & Education at Fullerton Markets, expects that outcome to encourage risk appetite: “Funds will move from safe to risk assets amid optimism”, which would derail bond prices and cause yields to surge.

Joseph Trevisani agrees with this short-term development, but again, it is long-term that may swing the action and trouble the markets: “With Yellen to continue, the Fed’s hesitation will quickly become an issue in 2017. If the Fed cannot convince that the economy will tolerate additional hikes next year, bonds will reverse, and yields will soon fall again. If the US, supposedly the strongest global economy, still needs extremely low rates eight years after the recession, what does that say about the overall global economy?” Not many good things, that’s for sure.

The Trump win scenario is even more divisive for our pool of experts. Reversal arguments here have some predicting a safe-haven inflow to US Treasuries, but there are even more experts expect a rise of the yields. Barbara Rockefeller predicts that “risk premium” to bring the 10-year yields over 2%. Edoardo Fusco, an independent analyst, agrees: “uncertainty on the future of the US economy will reach significant levels and bring higher spreads”.

Again, with the Trump scenario, the key word is uncertainty. David Morrison adds to this idea bringing up the Fed policy: “A Trump win makes a December rate hike from the Fed less likely due to market uncertainty. This should be supportive for fixed income”. So, let’s check our last question, maybe the most decisive one for the markets.

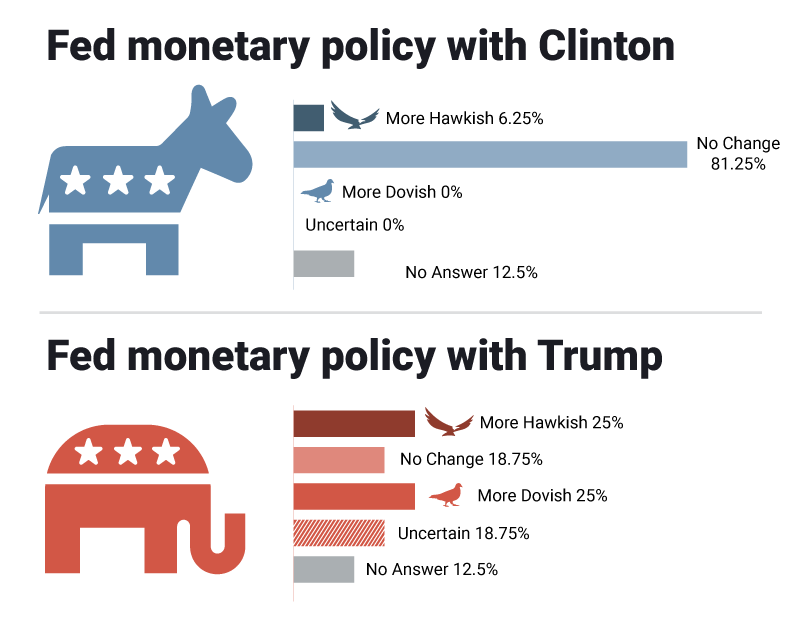

Fed monetary policy outlook after the Election

Sure, the Federal Reserve is a private institution with a public mandate to act independently from the government, so should its policy be affected by the US Presidential Election? Hell yeah, if Donald Trump wins. Some of the thousands of headlines that the Republican candidate has gifted the press during the campaign have been about replacing Janet Yellen as the head of the Fed. There’s nothing to be surprised about this results, then.

The consensus among our experts is big on Hillary Clinton being ‘more of the same’ for the Fed. Expect the Yellen-led Board of the Governors to continue its current slower-than-a-snail hiking quest trying to normalise rates while focusing on Inflation going back to the 2% target.

A Trump win? That would change things. This is the scenario where ‘uncertainty’ answers peak. There’s the same amount of experts (4) predicting the Fed to be more hawkish and more dovish and there are even three answers that can’t decide and just opt for an ‘uncertain’ answer.

Wayne Ko brings the most well-known about Trump not being “a fan of maintaining low interest rates” and foreseeing a more hawkish Fed policy under his presidency. On the opposite side, Edoardo Fusco, who believes that a Trump administration would “encourage a more dovish FED, creating the condition for a new phase of monetary expansion, thus giving a fresh stimulus to stock market valuations”. In the middle of both, we can find Stuart Cowell, who is sceptical about Trump bringing change to the monetary policy, even with the threat of a Yellen replacement: “it will still be too dovish”.

It’s the dismissal of Janet Yellen what brings more uncertainty to our pool of experts. Barbara Rockefeller stresses that point of view: “Trump will fire Yellen and name some unqualified persons that the Senate will refuse to confirm. Monetary policy will be uncertain for months”.

Well, that would really be something to watch. Maybe that’s what a Trump win will mean for the markets: shifting the focus from a bunch of economists sitting monthly in the FOMC board discussing about macroeconomic data to a bunch of politicians on the US Senate trying to make some sense out of the presidential decisions.

Check out all the Survey answers in this table:

| Who will be the next president? | Who is better for the US Economy? | Trump Win a Black Swan? | USD reaction to Clinton Win | US stocks reaction to Clinton Win | US treasury bonds reaction to Clinton Win | Fed monetary policy with Clinton | USD reaction to Trump Win | US stocks reaction to Trump Win | US treasury bonds reaction to Trump Win | Fed monetary policy with Trump | |

| Adam Daniel | Donald Trump | Hillary Clinton | No | Positive | Positive | Positive | More hawkish | Negative | Negative | Negative | More dovish |

| Adam Jepsen | Hillary Clinton | - | Possibly | - | - | - | - | Negative | Negative | - | Uncertain |

| Barbara Rockefeller | Hillary Clinton | Hillary Clinton | Yes | Sideways | Positive | Sideways | No change | Negative | Negative | Negative | Uncertain |

| Chris Pulver | Hillary Clinton | Donald Trump | Possibly | Sideways | Positive | Positive | No change | Negative | Negative | Positive | More dovish |

| David Cheetham | Hillary Clinton | Hillary Clinton | Yes | Positive to Sideways | Positive to Sideways | Sideways to Negative | No change | Sideways to Negative | Negative | Positive | More hawkish |

| David Morrison | Hillary Clinton | None | Possibly | Sideways | Positive to Sideways | Negative | No change | Negative | Negative | Sideways | More dovish |

| Edoardo Fusco | Hillary Clinton | Hillary Clinton | No | Sideways | Sideways | Sideways | No change | Negative | Negative | Negative | More dovish |

| Efthivoulos Grigoriou | Hillary Clinton | Donald Trump | No | Sideways | Negative | Negative | No change | Positive | Positive | Positive | More hawkish |

| Hans Nilsson | Hillary Clinton | Hillary Clinton | Yes | Sideways | Sideways | Sideways | No change | Positive | Negative | Negative | No change |

| Joseph Trevisani | Hillary Clinton | Donald Trump | Yes | Positive | Positive | Negative | No change | Sideways to Negative | Negative | Positive | No change |

| Nicola Delic | Hillary Clinton | None | No | Positive | Positive | Sideways | No change | Negative | Sideways | Negative | - |

| Oisin Breen | Hillary Clinton | Hillary Clinton | No | Positive | Positive | Positive | No change | Sideways to Negative | Negative | Negative | Uncertain |

| Piers Curran | Hillary Clinton | Hillary Clinton | No | Sideways | Positive | Negative | No change | Positive | Negative | Positive | More hawkish |

| Steve Ruffley | Hillary Clinton | - | - | - | Positive | - | - | - | Negative | - | - |

| Stuart Cowell | Hillary Clinton | Hillary Clinton | No | Positive | Positive | Negative | No change | Negative | Negative | Negative | No change |

| Wayne Ko | Hillary Clinton | Hillary Clinton | Yes | Positive | Positive | Negative | No change | Negative | Negative | Positive | More hawkish |

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD accelerates losses to 1.0930 on stronger Dollar

The US Dollar's recovery regains extra impulse sending the US Dollar Index to fresh highs and relegating EUR/USD to navigate the area of daily troughs around 1.0930 in the latter part of Friday's session.

GBP/USD plummets to four-week lows near 1.2850

The US Dollar's rebound keep gathering steam and now sends GBP/USD to the area of multi-week lows in the 1.2850 region amid the broad-based pullback in the risk-associated universe.

Gold trades on the back foot, flirts with $3,000

Gold prices are accelerating their daily decline, steadily approaching the critical $3,000 per troy ounce mark as the Greenback's rebound gains extra momentum and US yields tighten their retracement.

Can Maker break $1,450 hurdle as whales launch buying spree?

Maker holds steadily above $1,250 support as a whale scoops $1.21 million worth of MKR. Addresses with a 100k to 1 million MKR balance now account for 24.27% of Maker’s total supply. Maker battles a bear flag pattern as bulls gather for an epic weekend move.

Strategic implications of “Liberation Day”

Liberation Day in the United States came with extremely protectionist and inward-looking tariff policy aimed at just about all U.S. trading partners. In this report, we outline some of the more strategic implications of Liberation Day and developments we will be paying close attention to going forward.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-636137782875962782.png)