- The barrel of WTI drops to multi-day lows near $55.50.

- President Trump criticized OPEC for higher prices.

- Saudi Arabia expected to cut its output further.

Prices of the barrel of the American reference for the sweet light crude oil are reverting Friday’s gains and are now navigating in 4-day lows in the mid-$55.00s.

WTI offered on Trump’s comments

The barrel of the West Texas Intermediate remains on the defensive at the beginning of the week after President Trump resumed his attacks to the oil cartel, this time suggesting the OPEC to ‘relax and take it easy’.

Comments by President Trump relegated the increasing optimism around the US-China potential trade agreement following recent progress at the Beijing and Washington meetings as a broad-based driver for crude oil and the rest of the risk-associated assets.

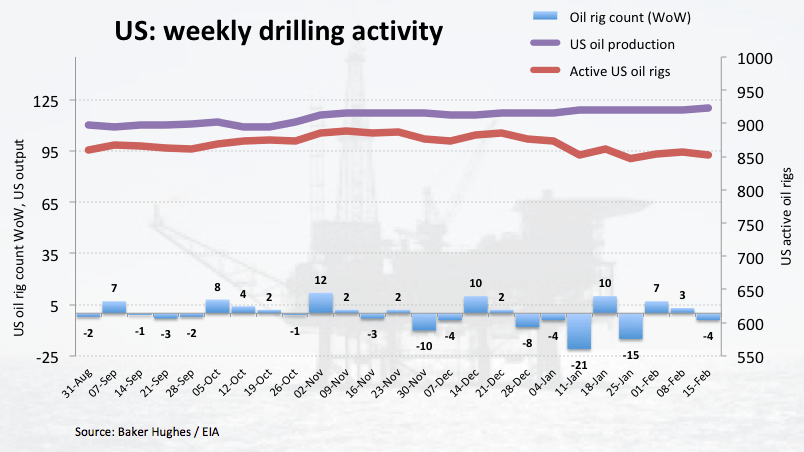

Additionally, driller Baker Hughes reported US oil rig count dropped by 4 during last week, taking the total US active oil rigs to 853.

Looking ahead, the usual weekly reports on US crude oil supplies by the API and the EIA are due on Tuesday and Wednesday, respectively.

What to look for around WTI

Today’s attack from President Trump to the OPEC’s policy of higher prices could undermine a more serious bull run in crude oil, mainly if US lawmakers are willing to invoke the NOPEC act. On the shining side, optimism around a US-China trade deal should remain supportive of crude oil as well as Saudi Arabia’s (so far) commitment to curb its oil production more than expected (the so-called ‘Saudi put’). Also bolstering prices emerge the ongoing US sanctions on Iranian and Venezuelan oil exports.

WTI significant levels

At the moment the barrel of WTI is losing 1.55% at $55.87 and a break below $55.40 (low Feb.25) would aim for $54.42 (21-day SMA) and finally $51.15 (low Feb.11). On the upside, the initial hurdle is located at $57.45 (2019 high Feb.22) seconded by $58.00 (high Nov.16 2018) and then $59.63 (50% Fibo retracement of the October-December drop).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD climbs back above 1.0750 ahead of ADP, Fed Minutes

EUR/USD has regained lost ground above 1.0750 in the European session on Wednesday. The pair draws support from the renewed US Dollar weakness, in the aftermath of the dovish Fed Chair Powell's comments. Eyes turn to US ADP data, Fed Minutes.

GBP/USD retakes 1.2700, looks to US data/Fed minutes

GBP/USD is battling 1.2700 in European trading on Wednesday, attempting a modest bounce. Traders appear reluctant and prefer to wait on the sidelines ahead of the FOMC minutes while the UK elections on Thursday also keep them on the edge. US ADP data eyed as well.

Gold jumps toward $2,350, with eyes on key US events

Gold price is closing in on $2,350 in the European trading hours on Wednesday, staging a rebound amid a fresh leg down in the US Dollar. Gold price capitalizes on dovish Fed Chair Powell's remarks on Tuesday, which added to the September rate cut expectations. US ADP data and Fed Minutes on tap.

Bitcoin price struggles around $61,000 as German government transfers, miners activity weigh

U.S. spot Bitcoin ETFs registered slight outflows on Tuesday. The German Government transferred another 832.7 BTC, valued at $52 million, on Tuesday.

US markets back on top after Powell's confidence in disinflation

Speaking at the ECB conference on Tuesday, the current Fed’s chief noted that the US is back on a "disinflationary path". Of course, this was followed by caveats that more data is needed to decide on a rate cut.