Here is what you need to know on Tuesday, October 25:

Equity markets remain on the bullish path but are treading cautiously. For the most part, earnings before the open continue the positive trend, but Microsoft (MSFT), Meta Platforms (META) and Alphabet (GOOGL) loom large after the close. Those companies will be the key event of the day.

Interest rates remain calm and slightly doveish still, which is helping equities. The combination of a dovish WSJ article, falling yields and strong earnings can push this rally further once big tech earnings are out of the way. Energy prices continue to fall in the face of warm weather, full EU storage levels and fears for global growth. Oil is lower to $83.75. The dollar is more or less as it was, remaining flat at 112 for the Dollar Index. Bitcoin trades at $19,300, and Gold is also lower at $1,641.

European markets are lower: Eurostoxx -0.2%, FTSE and Dax both -1%

US futures are lower: Nasdaq is flat, Dow and S&P both -0.4%

Wall Street top news (QQQ) (SPY)

New UK PM Sunak talks of difficult decisions.

Adidas (ADDYY) cuts ties with Ye (Kanye West), says move could cut profit by $250 million.

Coca-Cola (KO) beats and upgrades forecasts.

General Motors (GM) beats on earnings and misses slightly on revenue.

HSBC's new CFO causes the stock to fall.

Microsoft (MSFT) earnings out after the close.

Alphabet (GOOGL) is out after the close.

Meta Platforms (META): WhatsApp is having outage problems ahead of earnings after close.

Archer Daniels Midland (ADM) beats on estimates.

JetBlue (JBLU) misses on EPS, beats on revenue.

United Parcel Service (UPS) beats on EPS but misses on revenue, reaffirms full-year outlook.

General Electric (GE) cuts forecasts.

3M (MMM) cuts forecasts on strong dollar problems.

Centene (CNC) beats on earnings and raises outlook.

Haliburton (HAL) beats on revenue and earnings.

XEROX (XRX) is down on weak earnings.

SAP (SAP) up on strong earnings.

Logitech (LOGI) is up on strong earnings.

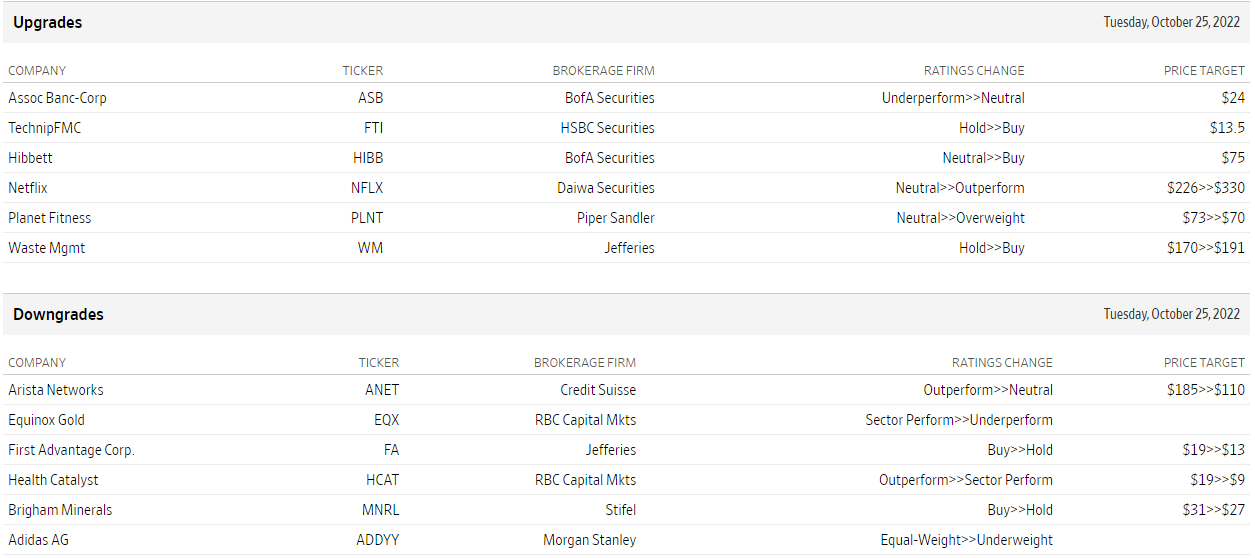

Upgrades and downgrades

Source: WSJ.com

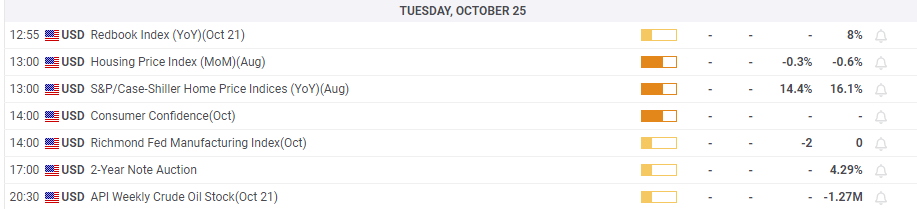

Economic releases

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

GBP/USD stays firm above 1.2750 after a landslide Labour victory

GBP/USD keeps its range above 1.2750 in early European session on Friday. The Pound Sterling stays unperturbed by the landslide Labour Party victory in the UK general election while the US Dollar awaits the Nonfarm Payrolls data for fresh directives.

USD/JPY falls hard toward 160.50, US NFP data awaited

USD/JPY is falling hard toward 160.50 in Asian trading on Friday, having reversed from near 161.40. The pair drops on renewed US Dollar weakness and Japanese verbal intervention, which rescues the Yen. The focus shifts to US jobs report.

Gold price steadily climbs back closer to two-week high, focus remains glued to US NFP

Gold price extends its consolidative price move during the Asian session on Friday and remains well within the striking distance of the highest level since June 21 touched earlier this week. The recent softer US macro data reaffirmed market bets that the Federal Reserve will begin cutting rates in September.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bitcoin falls below $56,000 level

Bitcoin breached the weekly support level of $58,375 on Thursday; as of Friday, it is trading 2.8% lower at $55,314. Ethereum and Ripple have dropped below crucial support thresholds, suggesting a potential downtrend for these assets in the coming days.

US NFP: Nonfarm Payrolls forecast to grow by 190K in June as Fed ponders rate-cut timing

With US Federal Reserve Chairman Jerome Powell’s Sintra appearance out of the way, all eyes now remain on top-tier Nonfarm Payrolls data for June, due on Friday at 12:30 GMT.