Here is what you need to know on Wednesday, December 8:

Apple surged to more all-time highs on Tuesday as stocks rebounded sharply. Volume was strong in what was another broad-based rally. Indeed, the percentage of rising volume was over 80% of total volume, a strong signal of the broad strength of the market and a useful signal for future health going forward.

Wednesday may see investors pause for breadth after two strong solid days, but with more and more benign data from Omicron being released it appears we can relax and look forward to Christmas dinner with the family without the hazmat suits after all. At least the hazmat suits are elasticated for post-turkey expansion.

Speaking of expansion, the Fed balance sheet is due to be trimmed down after a notable few years of feasting, and this has investors worried. We will soon be publishing our S&P 500 forecast for the year, and so far all the data we have poured through makes us think that the Fed does have a chance of managing its balance sheet reduction without hammering equities. It will be a tightrope walk. We do live in interesting times, as the Chinese say, and they certainly seem intent on making it interesting for investors in Chinese tech anyway. Weibo finished 7% lower in its Hong Kong debut.

The dollar is largely flat this morning at 1.1285 versus the euro. Gold is at $1,785, and Bitcoin is a touch lower after a strong rally at $49,200 now. Oil is also pausing after a strong rally and steady at $72. The Vix is back near 20, and yields are again lower, but again the yield curve remains a tad flat for our liking.

See forex today

European markets are lower: Eurostoxx -0.5%, FTSE flat, and Dax -0.4%.

US futures are positive: S&P, Nasdaq and Dow are all a neat +0.3%.

Wall Street (SPY) (QQQ) stock news

Pfizer (PFE) and BioNTech (BNTX): WSJ reports that three doses neutralize Omicron.

FT reports that the UK to unveil further covid-related restrictions.

Stitch Fix (SFIX) down 23% premarket on lower guidance.

PagerDuty (PD) up 10% on earnings.

Goodyear Tires (GT) upgraded by Deutsche Bank.

Campbell Soup (CPB) beats EPS but revenue behind.

Weber (WEBR) beats on EPS, shares up 1%.

Toll Brothers (TOL) beats on earnings, up 1% premarket.

Robinhood (HOOD) files to end a share sale by backers.

Apple (AAPL): production of iPhone 13 is 20% short of plans for September and October, according to Nikkei. see more.

Visa (V) launces a global crypto advisory service.

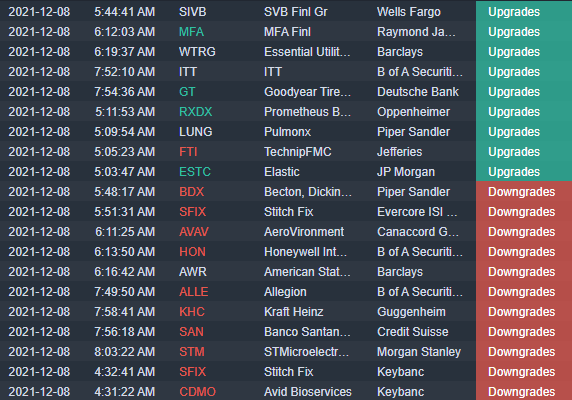

Upgrades and downgrades

Source: Benzinga Pro

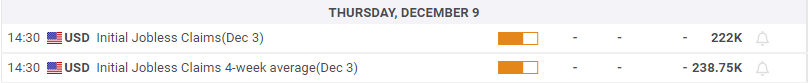

Economic releases

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to daily recovery gains above 1.0700 after US data

EUR/USD stays in positive territory above 1.0700 in the second half of the day on Thursday. Following the mixed macroeconomic data releases from the US, the US Dollar (USD) struggles to gather strength and helps the pair hold its ground.

USD/JPY retreats below 106.50 on renewed USD weakness

USD/JPY extends its correction from multi-decade high it touched earlier in the day and trades below 160.50. Verbal intervention from Japanese officials seems to be helping the JPY shake off the selling pressure, while the mixed US data hurt the USD.

Gold back to its comfort zone around $2,330

Gold bounces off the psychologically important $2,300 level and trades above $2,320 on Thursday. The benchmark 10-year US Treasury bond yield stays in negative territory following latest US data, allowing XAU/USD to extend its rebound.

VanEck files for Solana ETF in the US

VanEck filed to list a Solana spot exchange-traded fund in the US after the approval in January of Bitcoin ETFs. The asset manager says it considers Solana "a commodity, like Bitcoin or Ether."

Indices fall back as inflation worries return

Higher inflation in Australia has not helped matters, and raises the uncomfortable prospect that major bugbear of the past two years is set to make an unwelcome return, leading to rate hikes once again.