Here is what you need to know on Wednesday, October 26:

Equity markets rallied on Tuesday as investors remain confident of lower interest rates. We had the "Fed pause" article from The Wall Street Journal, which got the market's hopes up. This then has continued with some stronger-than-expected earnings.

Overall,129 companies have so far reported from the S&P 500, and 73.6% have beaten admitedly lowered estimates, according to Refinitiv. That view was challenged afterhours with a shocker from Alphabet (GOOGL), which is currently trading some 6.4% lower in the premarket. Stocks are less hopeful this morning based on that, especially the tech-heavy Nasdaq. The consumer remains in good shape, though it would appear at least at the lower end of the spectrum. Inflation is being passed on, and this is further reinforced by Kraft Heinz this morning posting solid earnings.

The dollar, meanwhile, continues to step back as a combination of sterling optimism (misplaced in my view), yen caution and hawkish Australian inflation all combine to send the dollar index back to 110.20. Oil is boosted by the weaker dollar to $86.20, while Bitcoin is the big mover up to $20,300. Gold too is taking the risk on the mandate and pushing to $1,670.

European markets are mixed: Eurostoxx is flat, FTSE -0.4%, and Dax +0.2%.

US futures are negative: Dow is flat, S&P -0.8%, and Nasdaq -1.8%.

Wall Street (SPY) (QQQ) top news

UK fiscal plan is delayed.

US mortgage demand continues to fall.

Boeing (BA) misses on top and bottom lines.

Alphabet (GOOGL) is down nearly 6% on poor earnings.

Microsoft (MSFT) posts strong cloud revenue as it beats on top and bottom lines but is dragged lower by PC demand and the dollar.

Kraft Heinz (KHC) beats on top and bottom lines.

Bed Bath & Beyond (BBBY) names CEO.

Hilton (HLT) travel remains strong as it lifts profit forecasts.

Visa (V) sees solid consumer spending as it beats on EPS and revenue.

Mobileye (MBLY) self-driving division of Intel (INTC) set to IPO today at $21.

Barclays (BCS) earnings are strong.

Deutsche Bank (DB) also reported strong earnings.

Spotify (SPOT): EPS misses, revenue beats, mentions slow advertising growth.

Canopy Growth (CGC) to create a holding company to fast-track entry to US market.

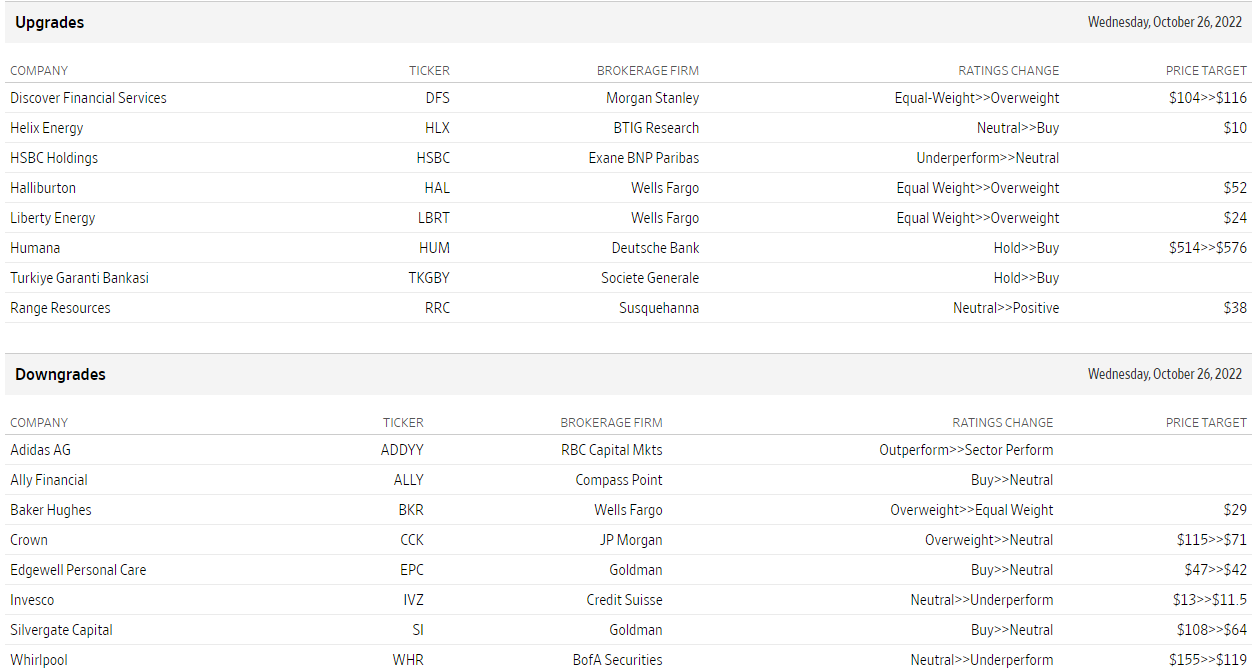

Upgrades and downgrades

Source: WSJ.com

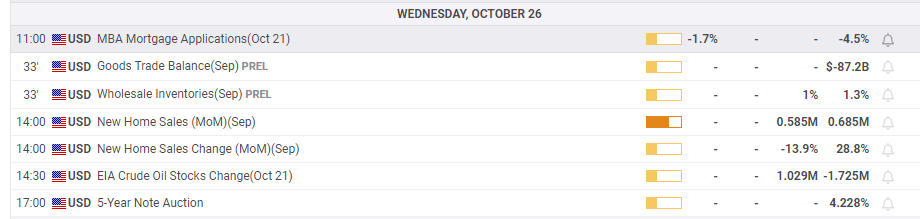

Economic releases

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

GBP/USD stays firm above 1.2750 after a landslide Labour victory

GBP/USD keeps its range above 1.2750 in early European session on Friday. The Pound Sterling stays unperturbed by the landslide Labour Party victory in the UK general election while the US Dollar awaits the Nonfarm Payrolls data for fresh directives.

USD/JPY falls hard toward 160.50, US NFP data awaited

USD/JPY is falling hard toward 160.50 in Asian trading on Friday, having reversed from near 161.40. The pair drops on renewed US Dollar weakness and Japanese verbal intervention, which rescues the Yen. The focus shifts to US jobs report.

Gold price steadily climbs back closer to two-week high, focus remains glued to US NFP

Gold price extends its consolidative price move during the Asian session on Friday and remains well within the striking distance of the highest level since June 21 touched earlier this week. The recent softer US macro data reaffirmed market bets that the Federal Reserve will begin cutting rates in September.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bitcoin falls below $56,000 level

Bitcoin breached the weekly support level of $58,375 on Thursday; as of Friday, it is trading 2.8% lower at $55,314. Ethereum and Ripple have dropped below crucial support thresholds, suggesting a potential downtrend for these assets in the coming days.

US NFP: Nonfarm Payrolls forecast to grow by 190K in June as Fed ponders rate-cut timing

With US Federal Reserve Chairman Jerome Powell’s Sintra appearance out of the way, all eyes now remain on top-tier Nonfarm Payrolls data for June, due on Friday at 12:30 GMT.