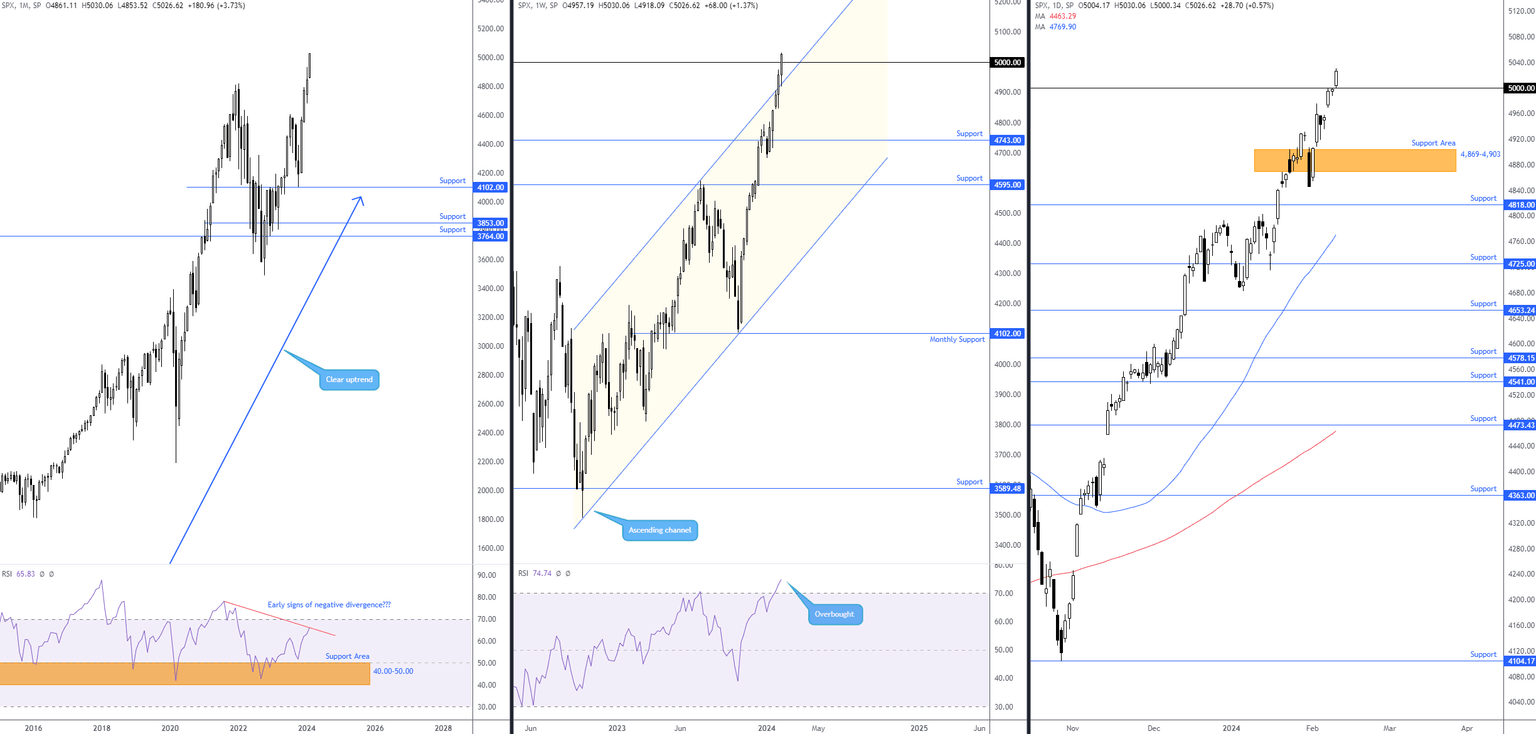

S&P 500 shakes hands with 5,000 and moves on – What's next?

Major US equity indices continued to navigate higher terrain last week. Both the Nasdaq 100 and the S&P 500 refreshed all-time highs, with the latter exploring space north of the 5,000 level (lifted higher on resilient economic activity and disinflation). The index first hit 4,000 at the beginning of April 2021; that’s a 1,000-point gain in less than three years.

All about the 5,000 level this week

While the Relative Strength Index (RSI) on the monthly chart demonstrates the potential for negative divergence and a clear-cut overbought signal being seen on the weekly timeframe, the uptrend is undeniable. Couple this with last week’s action retesting channel resistance as support (taken from the high of 4,607), it is quite simply all about the 5,000 base this week.

Follow-through buying or a bull trap?

In view of the uptrend, and given that the price pencilled in a close north of 5,000 on the weekly and daily charts, some breakout buyers will likely commit at current levels while more conservative players may seek a retest of the big figure before pulling the trigger. You may also find that traders move down to the lower timeframes this week to view the approach should a retest of 5,000 unfold. An approach/reaction indicating a bullish vibe—think AB=CD pattern approach, double-bottom formation or trendline resistance breach, for example—could be enough to pull in buying interest to refresh all-time highs this week. Although Bull Traps are common around widely watched levels, a close back under 5,000 (albeit in line with monthly and weekly RSIs) would face immediate price support from the channel structure on the weekly timeframe. Therefore, further upside above 5,000 this week is the more likely view.

Needless to say, it should be another interesting week for the US equity space, particularly with US inflation data, retail sales numbers and the consumer sentiment survey gracing the economic calendar.

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,