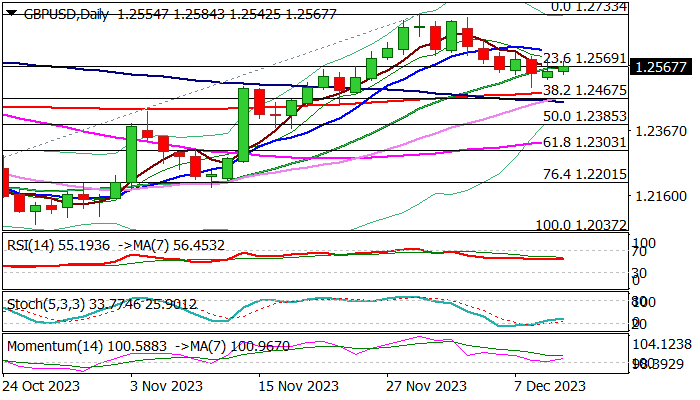

GBP/USD outlook: Cable remains constructive above 200DMA but more action at the upside needed to confirm

Cable edged lower on sub-forecast Uk November earnings which adds to talks about possible rate cuts, although the BoE signals that cuts are still not on the table, with hawkish hold expected on Thursday’s policy meeting. Near-term structure remains positively aligned while the price stays above 200DMA (1.2491), but break above 10DMA (1.2608) is needed to generate positive signal and shift near-term mode from sideways to bullish.

Positive momentum on daily chart supports the notion, as larger uptrend from 1.2037 (Oct 4 low) is still intact. Caution on loss of lower pivots at 1.2491 (200DMA) and 1.2467 (Fibo 38.2% of 1.2037/1.2733) which would open way for deeper correction. Read more...

GBP/USD drifting ahead of US inflation

Tuesday’s UK employment report was notable for the decline in wage growth. Earnings excluding bonuses rose 7.3% in the three months to October, down from 7.8% in the three months to September. This was lower than the consensus estimate of 7.4%.

Wage growth is an important driver of inflation and the decline is an encouraging sign for the Bank of England. Still, earnings are rising much faster than inflation, which suggests that the BoE won’t be cutting interest rates anytime soon. Inflation has fallen to 4.6%, but this is more than double the Bank’s target of 2%. Read more...

GBP/USD clings to gains near daily peak after mixed UK jobs data, focus remains on US CPI

The GBP/USD pair gains some positive traction for the second straight day on Tuesday, albeit struggles to capitalize on the move and remains below the overnight swing high. Spot prices move little following the release of the UK monthly jobs data and hold steady around the 1.2580-1.2585 region, up over 0.25% for the day.

The UK Office for National Statistics (ONS) reported that the number of people claiming unemployment-related benefits rose to 16K in November as compared to the 20.3K anticipated. Adding to this, the previous month's reading was also revised down to 8.9K from the 17.8K reported originally. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD stands tall just below its highest level since January touched on Wednesday

The AUD/USD pair holds above the 0.6700 mark during the Asian session on Thursday. The Australian Dollar continues to draw support from the upbeat domestic Retail Sales data released on Wednesday, which strengthened the case for a rate hike by the Reserve Bank of Australia.

EUR/USD lurches higher after US data dumps Greenback

EUR/USD found a leg up on Wednesday, climbing briefly above the 1.0800 handle after a broad miss in US economic figures hinted at further signs of a weakening US economy, sparking fresh hopes for an accelerated pace of rate cuts from the Federal Reserve and markets flowing out of the safe haven US Dollar.

Gold reaches $2,360 on broad USD weakness

Gold gathers bullish momentum and trades at its highest level in nearly two weeks above $2,360. Following the disappointing ADP Employment Change and ISM Services PMI data from the US, the 10-year US yield declines sharply, helping XAU/USD extend its daily rally.

PolitiFi meme coins surge as Biden support lowers

Several political meme coins related to Vice President Kamala Harris rallied on Wednesday as prediction market odds favor her as the preferred Democrat nominee in the upcoming US presidential race.

Could the post-UK elections market moves resemble 1997 and 2010?

Thursday's UK elections expected to bring political change. Similar developments in both 1997 and 2010 weighed on the Pound. History points to a significant easing in Pound volatility across the board. Recent FTSE 100 performance matches the 2015 pre-election moves.