GBP/USD Price Analysis: Choppy trading conditions leave the pair without a bias

GBP/USD in a chop as the bulls and bears battle it out within familiar ranges. Bulls need to get above 1.3110 for the near term. GBP/USD is stuck in ranges across the time frames without a clear bias one way or the other. The following illustrates this across the weekly, daily and hourly time frame. Read more...

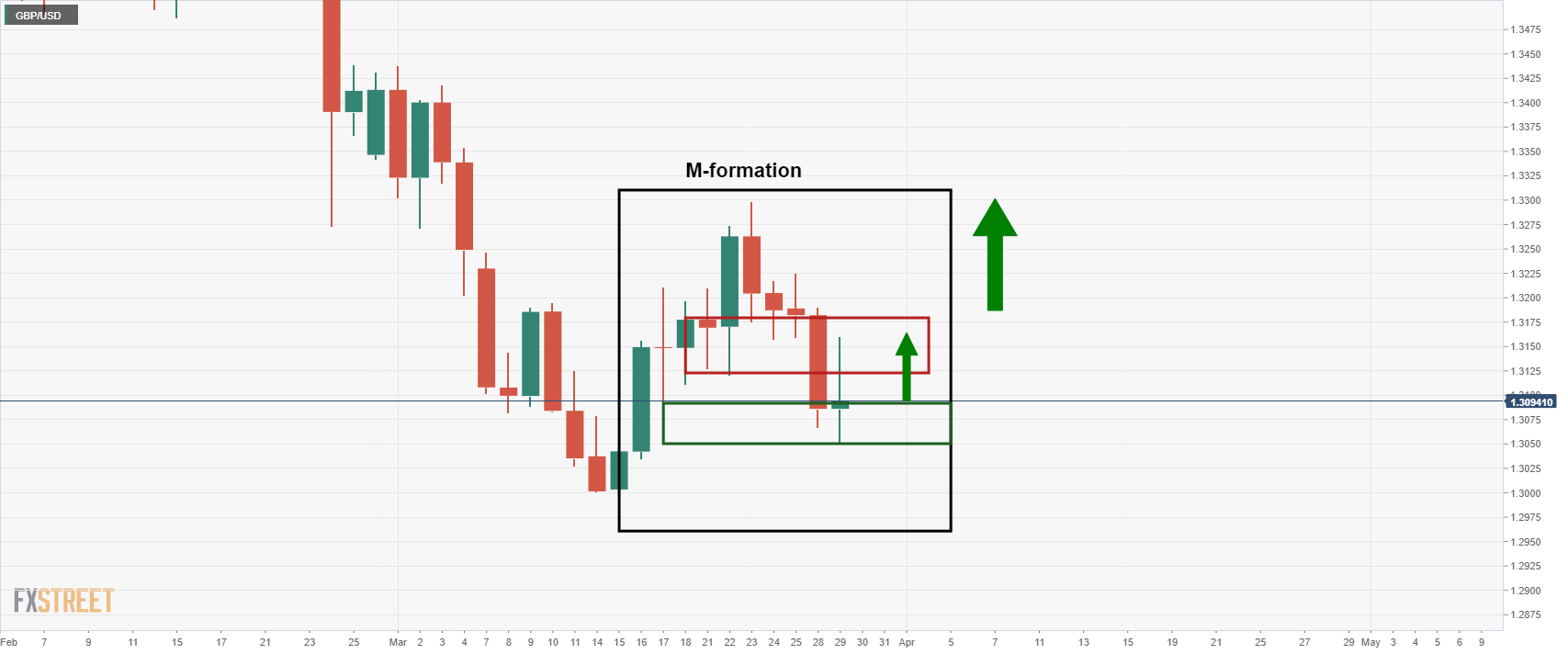

GBP/USD Forecast: Bears could wait for a correction to 1.3140

GBP/USD has gone into a consolidation phase near 1.3100 early Tuesday after having suffered heavy losses at the beginning of the week. The near-term outlook suggests that the pair could extend its recovery but sellers are likely to retain control unless 1.3140 resistance fails. While speaking at a virtual event on Monday, Bank of England (BOE) Governor Andrew Bailey noted that they have to be very cautious on the forward guidance language due to heightened uncertainty surrounding the economic outlook. When asked directly whether or not there will be another rate hike in May, "the situation is very volatile," Bailey responded. Read more...

GBP/USD flirting with the possibility of approaching $1.30

From a technical perspective, this week’s downside picture should not surprise. Here’s where we left our week-ahead technical briefing on the weekly timeframe: Not only is the trend to likely weigh on upside efforts, prime resistance is a focal point on the weekly timeframe at $1.3473-1.3203 with the chart demonstrating scope to drop as far south as weekly support from $1.2719. Trend direction has been southbound since late 2007 tops at $2.1161. As a result, the 25 percent move from pandemic lows in March 2020 to February 2021 might be viewed as a pullback within the larger downtrend. This, of course, places a question mark on the 8.5 percent ‘correction’ from February 2021 to March 2022, suggesting the possibility of continuation selling. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.