GBP/USD Forecast: Bears could wait for a correction to 1.3140

- GBP/USD has gone into a consolidation phase after Monday's drop.

- There could be a technical correction to 1.3140 before the next leg lower.

- BOE Governor Bailey's cautious tone on rate outlook hurts the British pound.

GBP/USD has gone into a consolidation phase near 1.3100 early Tuesday after having suffered heavy losses at the beginning of the week. The near-term outlook suggests that the pair could extend its recovery but sellers are likely to retain control unless 1.3140 resistance fails.

While speaking at a virtual event on Monday, Bank of England (BOE) Governor Andrew Bailey noted that they have to be very cautious on the forward guidance language due to heightened uncertainty surrounding the economic outlook. When asked directly whether or not there will be another rate hike in May, "the situation is very volatile," Bailey responded.

Although the dollar rally lost its stream on retreating US Treasury bond yields in the second half of the day, GBP/USD ended up losing more than 100 pips on Monday, reflecting the negative impact of Bailey's comments on the British pound.

The positive shift witnessed in risk sentiment seems to have helped the pair shake off the bearish pressure early Tuesday. The UK's FTSE 100 Index is up 0.8% and the greenback stays on the back foot with the US Dollar Index posting modest daily losses near 99.00.

Later in the session, the Conference Board's US Consumer Confidence data for March will be looked upon for fresh impetus. Investors will also keep a close eye on the Fedspeak. Following Bailey's latest remarks, it's clear that the Fed looks to tighten its policy in a more aggressive way than the BOE in the upcoming meetings. Hence, GBP/USD's rebounds are likely to remain limited by key technical levels.

GBP/USD Technical Analysis

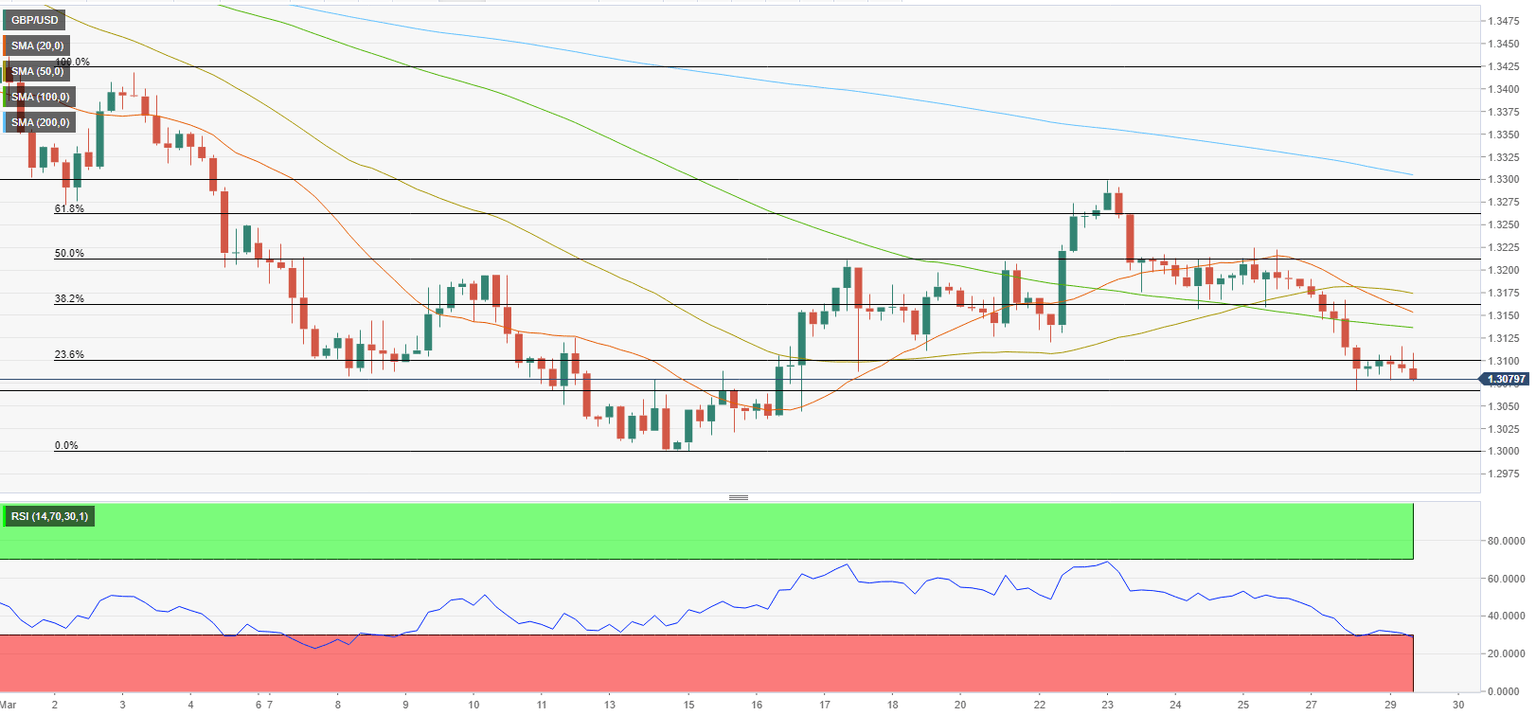

On the four-hour chart, the Relative Strength Index (RSI) indicator is about to cross below 30, suggesting that the pair is on the verge of turning technically oversold.

On the upside, 1.3100 (psychological level, Fibonacci 23.6% retracement of the latest downtrend) aligns as the first technical resistance. With a four-hour close above that level, the next recovery targets could be seen at 1.3140 (100-period SMA) and 1.3160 (Fibonacci 38.2% retracement).

On the flip side, a drop below 1.3060 (static level) could open the door for an extended decline toward 1.3000 (psychological level, static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.