Fed Sentiment Index

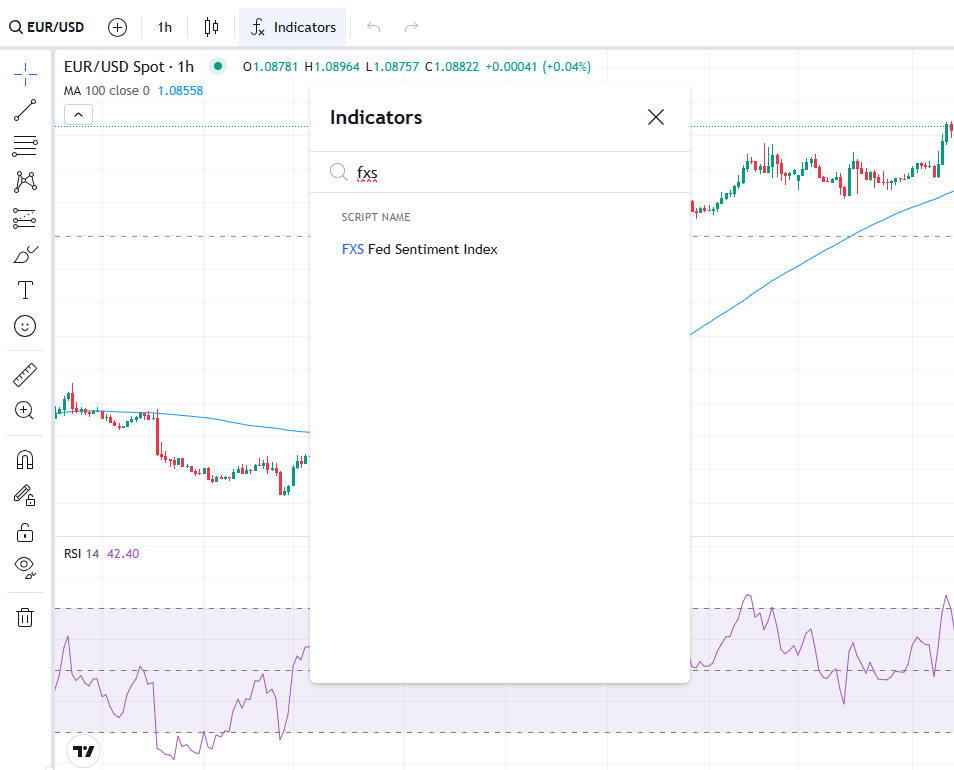

FXStreet Fed Sentiment Index: Tracking Fedspeak changes to find a trading edge

Deciphering Fedspeak: Why it is crucial to understand monetary policy shifts

In the recently updated FAQ section of its official website, the Fed explains:

“Forward guidance is a tool that central banks use to tell the public about the likely future course of monetary policy. When central banks provide forward guidance, individuals and businesses can use this information in making decisions about spending and investments. Thus, forward guidance about future policy can influence financial and economic conditions today.”

The Fed has two mandates: Achieving maximum employment and promoting stable prices. The Fed doesn’t take asset prices into consideration when setting its monetary policy. That, however, doesn’t change the fact that monetary policy decisions and comments on the outlook have a significant impact on financial markets.

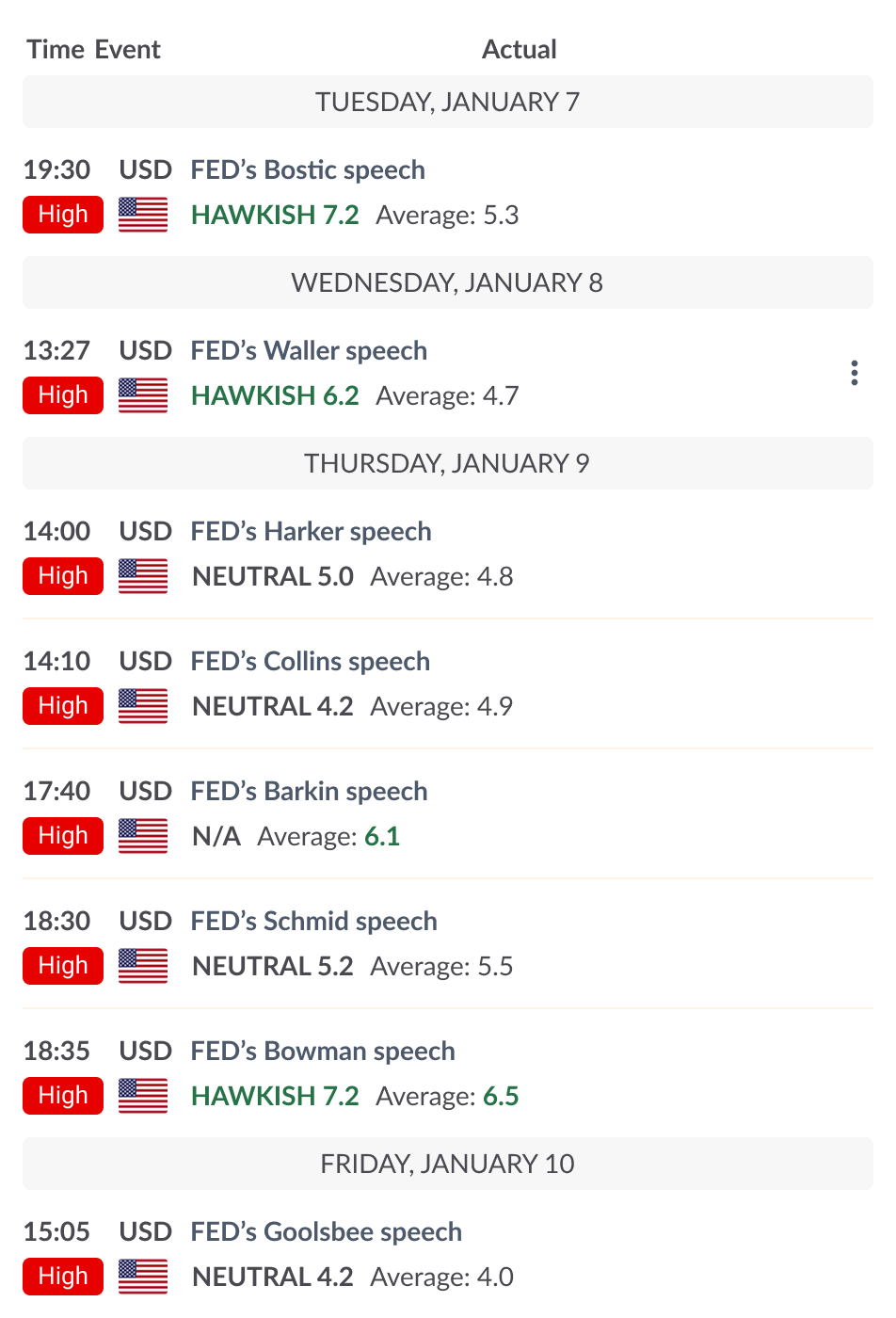

Interpreting comments from Fed policymakers and reading between the lines in official communications is not an easy task, especially for beginner traders. At FXStreet, we have developed a custom AI model – the Speech Tracker, which analyzes all the relevant speeches by the FOMC members and rates them on a dove-hawk scale. This allows us to provide traders with real-time notifications on our Economic Calendar on how each Fedspeak could influence the USD’s valuation.

Introducing FXStreet Fed Sentiment Index

FXStreet Fed Sentiment Index presents the Fed’s tone as a single value, taking into consideration comments from all voting and non-voting members of the FOMC in TV appearances, conferences, interviews, as well as the Fed’s official written communications and more.

A value of 100 represents a neutral tone. An increasing value above 100 points to a hawkish tilt in the Fed’s language, while a decreasing value below 100 suggests a dovish change in sentiment. The highest the index is, the most hawkish FOMC speakers are sounding ahead of the next monetary policy meeting and vice versa, lower levels suggest dovish shifts in the future Fed policy stance.

FXStreet Fed Sentiment Index is adjusted every time a Fed policymaker delivers comments on the policy outlook. While our Speech Tracker provides valuable insights into possible short-term reactions to individual FOMC speeches, our Fed Sentiment Index aims to explain how markets perceive the Fed language in its totality, over a longer period of time. Hence, its value cannot be understated with regard to spotting changes in USD-related asset price patterns, assessing inter-market correlations, and identifying divergences between near-term market reactions and long-term trends.

HOW TO USE FXSTREET FED SENTIMENT INDEX

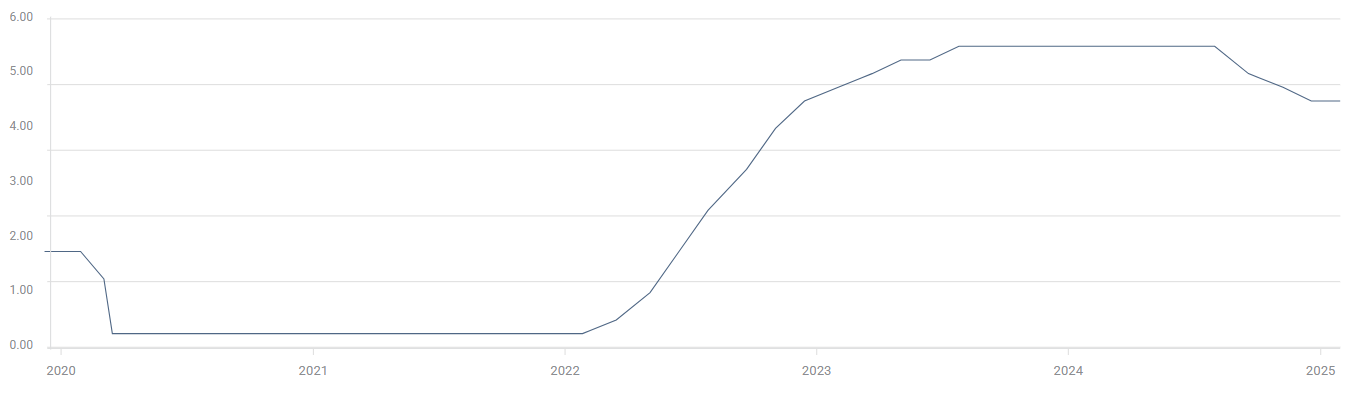

FXStreet Fed Sentiment Index performance in 2024: Fed’s dovish quest halted by Trump’s triumph

The downtrend continued for one more month, while the Fed materialized a second rate cut at its early November meeting, but it has completely turned around since the US election.

Donald Trump’s clear victory, and his well-known intentions to use tariffs and tax cuts, which could trigger new legs of inflation, have seemingly affected how FOMC members perceive future monetary policy. As a result, the index turned hawkish to begin the new year.

Educational Reports

Editors' picks

EUR/USD: US Dollar to remain pressured until uncertainty fog dissipates Premium

The EUR/USD pair lost additional ground in the first week of February, settling at around 1.1820. The reversal lost momentum after the pair peaked at 1.2082 in January, its highest since mid-2021.

Gold: Volatility persists in commodity space Premium

After losing more than 8% to end the previous week, Gold (XAU/USD) remained under heavy selling pressure on Monday and dropped toward $4,400. Although XAU/USD staged a decisive rebound afterward, it failed to stabilize above $5,000.

GBP/USD: Pound Sterling tests key support ahead of a big week Premium

The Pound Sterling (GBP) changed course against the US Dollar (USD), with GBP/USD giving up nearly 200 pips in a dramatic correction.

Bitcoin: The worst may be behind us

Bitcoin (BTC) price recovers slightly, trading at $65,000 at the time of writing on Friday, after reaching a low of $60,000 during the early Asian trading session. The Crypto King remained under pressure so far this week, posting three consecutive weeks of losses exceeding 30%.

Three scenarios for Japanese Yen ahead of snap election Premium

The latest polls point to a dominant win for the ruling bloc at the upcoming Japanese snap election. The larger Sanae Takaichi’s mandate, the more investors fear faster implementation of tax cuts and spending plans.