Nvidia rebounds as bullish outlook faces sustainability questions

Nvidia staged a decent rebound on Tuesday the 25th of June, rising 6% after a tumble that had seen $430 billion, wiped out in value. Despite the recent pullback, the stock has surged over 156% this year, briefly claiming the title of the world's most valuable company. This remarkable performance, driven by the surge in artificial intelligence, has attracted significant investment into tech-focused funds. However, recent market volatility has tempered the stock's upward trajectory, raising questions about its sustainability.

Despite these impressive gains, analysts are wrestling with how to accurately value the chipmaker. Nvidia's projected sales for the next 12 months position it as the most expensive stock in the S&P 500 based on its price-to-sales ratio. However, the uncertainty surrounding actual revenue figures presents a significant challenge.

The core of the issue lies in the extraordinary demand for Nvidia's AI chips. This demand has consistently outstripped even the company's own projections, let alone those of Wall Street analysts. This discrepancy between expectations and reality raises questions about the stock's true valuation.

Analysts like Brian Colello of Morningstar have adapted their models, adjusting estimates upwards by up to $4 billion per quarter to account for the unpredictable supply-demand dynamics. Others, like Ben Reitzes of Melius, have repeatedly revised their price targets upwards. He raised his price target on Nvidia for the fifth time this year to $160 from $125, implying a gain of 26% from last week’s closing price.

However, concerns remain. The AI landscape is evolving rapidly, and it's unclear whether the current level of demand will persist in the long term. Moreover, as Nvidia grows, its ability to consistently beat expectations at the same rate might diminish, potentially impacting its valuation. Skeptics also question whether the AI boom can truly live up to its lofty expectations and deliver sustainable returns on investment. If the AI revolution fails to materialize as anticipated, demand for Nvidia's chips could cool significantly, leading to a sharp correction in the stock's valuation, which currently stands at 23 times projected sales.

Such a scenario would be reminiscent of the dot-com bubble of the late 1990s. Analysts like Michael Kirkbride warn that overspending and excessive optimism, similar to the telecommunications sector then, could lead to a market downturn if the AI hype doesn't deliver substantial long-term value. He cites the example of Cisco Systems Inc., whose stock, propelled by overspending and optimistic projections in the 1990s, still hasn't recovered to its peak levels more than two decades later.

With major clients like Microsoft pledging further investments in Nvidia's technology, the near-term outlook appears positive. However, the long-term sustainability of this growth trajectory depends on the continued adoption of AI and the return on investment it delivers to Nvidia's customers.

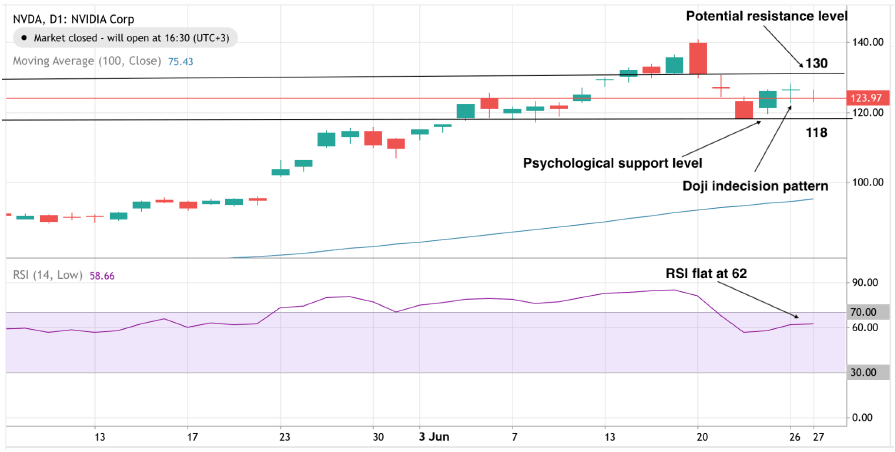

While fundamental analysis struggles to keep pace with Nvidia's unprecedented performance, technical analysis may offer additional insights into the stock's potential trajectory. At the time of writing, the chip stock appears set to continue its rebound, though the recent doji pattern indicates indecision in the market. Sentiment remains on the bullish side as prices remain elevated above the 100-day moving average. The RSI appearing flat at 62 hints at an easing in upside momentum which could mean an impending pause within the up move.

Source: Deriv MT5

A decisive move up could see buyers face a hurdle at the $130 mark, with follow-up buyers likely to face resistance at the $140 psychological resistance price point. Conversely, a move down could be held at the $118 psychological support level.

Author

Prakash Bhudia

Deriv

Prakash Bhudia, HOD – Product & Growth at Deriv, provides strategic leadership across crucial trading functions, including operations, risk management, and main marketing channels.