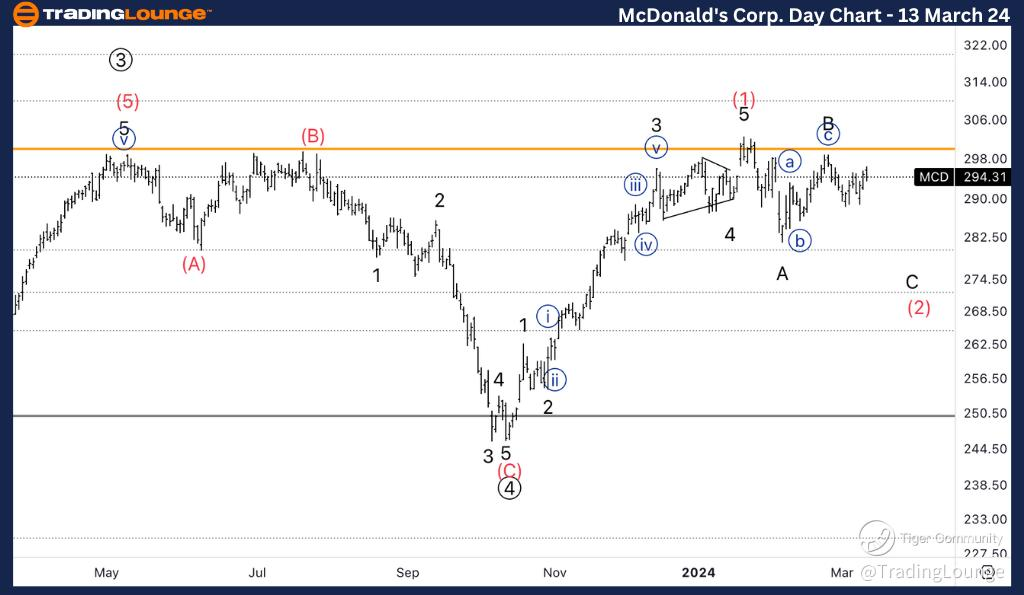

MCD Elliott Wave technical analysis

Function: Counter Trend.

Mode: Corrective.

Structure: Flat.

Position: Wave (2) of 3.

Direction: Downside into wave C of (2).

Details: After breaking ATH at 300$, we’ve seen a pullback which appears to be bullish corrective. We are therefore looking for continuation higher once the pullback is complete.

XOM Elliott Wave technical analysis – Daily chart

In our analysis, we identify a counter trend function characterized by corrective mode and a flat structure. Positioned in Wave (2) of 3, our attention is on the downside movement into wave C of (2). Despite breaking the all-time high (ATH) at $300, we've witnessed a pullback that appears to be part of a bullish corrective pattern. Consequently, we anticipate a continuation higher once the pullback completes its course.

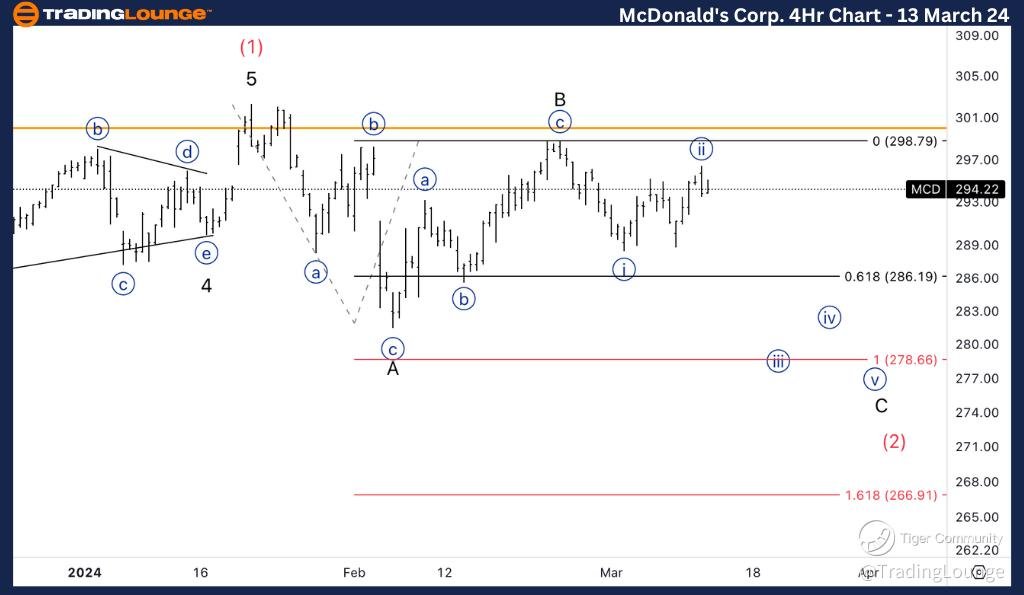

MCD Elliott Wave technical analysis

Function: Counter Trend.

Mode: Corrective.

Structure: Flat.

Position: Wave C of (2).

Direction: Wave {iii} of C.

Details: Looking for downside into wave {iii} as we need complete wave C. We could also see a sideways wave B before resuming lower.

XOM Elliott Wave technical analysis – Four hour chart

Here, we also observe a counter trend function marked by corrective mode and a flat structure. Positioned in Wave C of (2), our focus is on wave {iii} of C, anticipating downside movement to complete wave C. Additionally, we may see a sideways wave B before the downward trajectory resumes.

MCD Elliott Wave technical analysis [Video]

As with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.

Recommended content

Editors’ Picks

AUD/USD holds ground as RBA leaves the door open for a hike

Tuesday's session witnessed the Australian Dollar clearing losses against the US Dollar following the release of the hawkish RBA minutes and the US JOLTs figures from May. For the USD, the confidence of Jerome Powell on inflation coming back down sooner on the prospects of a cooling labor market weakened the Greenback.

USD/JPY extends gains near 161.50 ahead of US data, FOMC Minutes

The USD/JPY pair trades on a stronger note near 161.40 after reaching a new high for this move near 161.75 during the early Asian trading hours on Wednesday. Market players remain focused on the possible foreign exchange intervention from the Bank of Japan, which might cap the pair’s upside.

Gold falls amid falling US yields, soft US Dollar

Gold price slid during the North American session as market participants digested Federal Reserve Chair Jerome Powell’s comments at a European Central Bank forum in Portugal. Powell turned slightly dovish, yet US Treasury yields remained firm. The XAU/USD trades around $2,324.

Ethereum ETFs set for $5 billion inflows despite ETH Foundation's continuous sales

Ethereum is down more than 1.4% on Tuesday following another ETH sale from the Ethereum Foundation. Meanwhile, crypto exchange Gemini's recent report reveals that ETH ETF could see about $5 billion in net inflows within six months of launch.

Benefit of the doubt: US consumer confidence and elections

Despite widespread expectation for the US economy to be in recession in 2024, that fate has been avoided thanks to a resilient consumer. Yet it is difficult to square this undaunted spending with consumer confidence and sentiment readings that are lackluster at best.