- The Euro is seeing limited recovery against the Pound Sterling after a half percent backslide last Friday.

- The EUR/GBP tested into a 14-day low on Monday before bouncing back.

- Euro traders to keep an eye out for EU Retail Sales in the mid-week.

The EUR/GBP is seeing a rebound on Monday after tipping into a 14-day low of 0.8650, heading for 0.8700 as the Euro recovers following an improved reading of the Euro Sentix Investor Confidence.

The EUR/GBP kicked off the new trading week slipping to a 3-week low before an improvement in the Sentix Investor Confidence indicator, which reversed course from September's -21.9 to print at -18.6 for October. The indicator remains deeply in bearish territory despite the improvement, and Euro upside gains are set to be limited.

Pound Sterling traders will be looking out for any drastic swings in BRC Like-For-Like Retail Sales due on Tuesday, which is expected to decline from 2.8% to 2.4% for the year into October.

Wednesday will see a speech from Bank of England (BoE) Governor Andrew Bailey, while the Euro side sees EU Retail Sales, which is expected to accelerate into the downside for the year into September, from -2.1% to -3.2%.

Room to moderate hawkish expectations for the UK – TDS

The big barn-buster for UK data this week will be UK Gross Domestic Product (GDP), slated to cap off the trading week on Friday.

UK quarterly Gross Domestic Product last printed at 0.2% for the 2nd quarter, and the 3rd quarter print is forecast to slump back into negative territory at -0.1%.

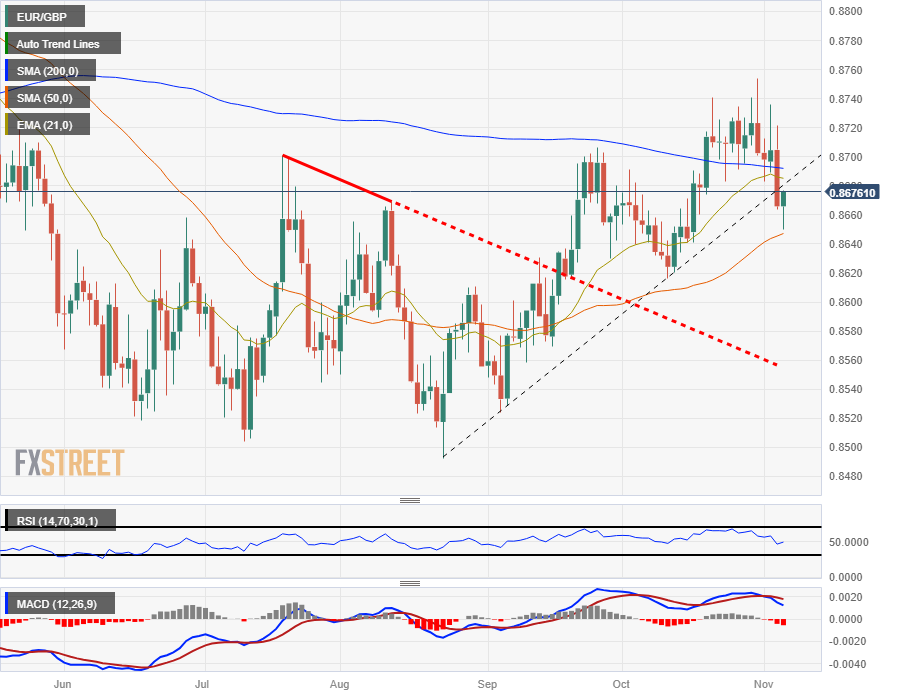

EUR/GBP Technical Outlook

Friday's Euro backslide saw the EUR/GBP tumble through a rising trendline from late August's swing low below 0.8500, and Monday's Euro rebound could see the pair set to re-challenge the trendline break, with the 200-day Simple Moving Average (SMA) acting as a hard barrier just below 0.8700.

The EUR/GBP saw a Monday rebound from just above the 50-day SMA near 0.8650, and a bullish continuation will see a higher lower etched in from here, while a bearish reversal will see a challenge of the previous swing low near 0.8620.

EUR/GBP Daily Chart

EUR/GBP Technical Levels

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD retreats from daily highs, holds above 1.0800

EUR/USD loses traction but holds above 1.0800 after touching its highest level in three weeks above 1.0840. Nonfarm Payrolls in the US rose more than expected in June but downward revisions to May and April don't allow the USD to gather strength.

GBP/USD struggles to hold above 1.2800 after US jobs data

GBP/USD spiked above 1.2800 with the immediate reaction to the mixed US jobs report but retreated below this level. Nonfarm Payrolls in the US rose 206,000 in June. The Unemployment Rate ticked up to 4.1% and annual wage inflation declined to 3.9%.

Gold approaches $2,380 on robust NFP data

Gold intensifies the bullish stance for the day, rising to the vicinity of the $2,380 region following the publication of the US labour market report for the month of June. The benchmark 10-year US Treasury bond yield stays deep in the red near 4.3%, helping XAU/USD push higher.

Crypto Today: Bitcoin, Ethereum and Ripple lose key support levels, extend declines on Friday

Crypto market lost nearly 6% in market capitalization, down to $2.121 trillion. Bitcoin (BTC), Ethereum (ETH) and Ripple (XRP) erased recent gains from 2024.

French Elections Preview: Euro to “sell the fact” on a hung parliament scenario Premium

Investors expect Frances's second round of parliamentary elections to end with a hung parliament. Keeping extremists out of power is priced in and could result in profit-taking on Euro gains.