It's the same story.

I've spoken with several people in the past week about their trading.

Let's start with some context.

Before entering the industry, I was a retail trader facing the same challenges:

Navigating a minefield of 'how-to' advice from those who haven't figured out consistent profitability.

Here's a quick summary of those conversations.

-

Age bracket: 40-60.

-

Trading experience: 4-8 years.

-

Problem: Not consistently profitable.

Cause of the problem?

Taking a surfboard to a snowstorm. Let's break it down.

The harsh reality is that despite winning trades, you’re not consistently profitable. Why?

Losing traders fund winning traders. Hold that thought:

A few winning trades ignite a powerful feeling: Hope.

You feel trading successfully is within your grasp. It's a powerful force.

It's so powerful that you're still trading after four, eight, or even more years without consistent profitability. Sound familiar?

There's a saying in the casino business: 'Keep 'em coming back to the tables.' Maybe you've heard it?

You need those wins to keep coming back. Without them, you'll walk away feeling Hope-Less.

But if you have some wins, you keep trading.

Over four, eight or more years, your losses to pay winning traders are exponentially greater than the losses of those who walk away early.

That's why you're winning some of the time. Because the market needs you at the 'tables'.

Often, this is mistaken for 'I’m so close to turning the corner.' Let me clarify:

I don't win at trading because of superior technical analysis skills, reading price action, using a profile or footprint, seeing order flow, or trading off a DOM.

Everyone can do all that

It's like bringing a surfboard to a snowstorm. To win consistently, you need the right solution.

I'll outline the skills in a moment. But first, let me show you how they apply to actual trading (from Tuesday).

We don't need to go too deep, just enough to illustrate how differently I approach trading compared to most people.

Before placing a trade, I first understand what the market is saying.

One

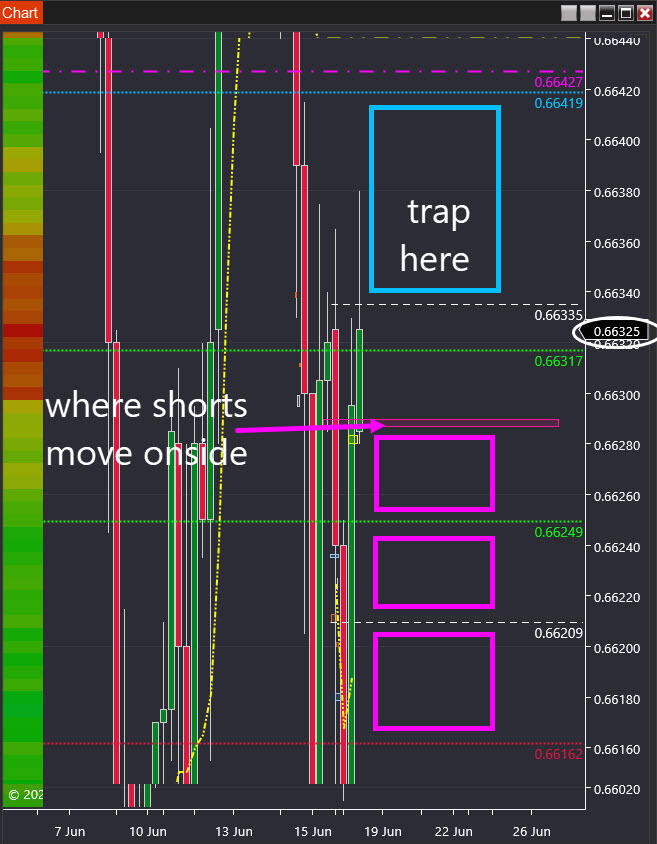

A large group of short sellers is taken marginally offside (when the price moves to the upper white dotted line) but not far enough to spook them out of their positions.

As the price moves lower, they feel the threat has passed.

Some sellers will now increase their short positions. New short sellers will enter due to the lower perceived threat.

If the price reaches a level where the majority are onside (pink arrow), late short sellers will enter, and existing short sellers will tighten their stops.

It all depends on how safe they feel.

In the short term, it’s a chance to join the crowd on the short side (pink boxes). Why?

Statistically, the odds favor the market continuing in one direction.

But since short-selling is just the appetiser and not the main course, I've included a chart of these executions at the end.

Two

The higher-up range (see 'trap here') is where large participants have no interest in trading. But the short sellers don't know it.

If the price moves here, shorts face a brutal short-covering rally, forced to exit at higher prices.

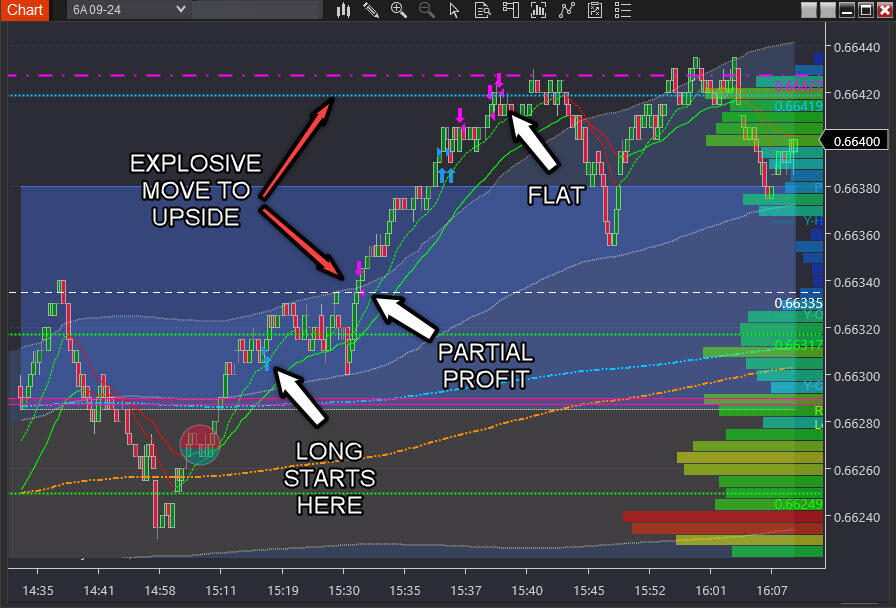

This lack of interest in taking the other side of their trades creates immense pressure on the price, causing a near-vertical explosive move to the upside.

Short sellers then compete to exit at prices much worse than anticipated.

Three

The trade I'm describing is the right trade to go big on (unsuitable for most trades).

To go big, I must enter before the market thrusts upward rapidly.

Otherwise, I’ll end up paying higher prices, just like the short sellers. Make sense?

Four

What if I'm wrong? Without a crystal ball, I must enter at the right moment to limit losses to a paper cut.

This is a learned skill, but what do you notice about the entry below?

Before the trade 'takes off,' there's no uncomfortable, account-threatening drawdown.

Earlier, I traded shorts with less size. It’s a different opportunity.

There were three separate short trades. One was scratched; the others included partial profit-taking and adding back before getting flat.

What's your next move?

Once you realise you're playing the wrong game, you stop if reaching consistent profitability is your priority.

You might quit trading because developing this skill is daunting unless you’re truly passionate.

But If trading resonates with you deeply, you want the instruction, guidance, and support to take your game to the next level. Agree?

It makes perfect sense

As in any elite competition, winning at trading requires more than surface-level thinking. Right?

Here’s a brief list I shared to illustrate what it involves.

As you familiarise yourself with the list, notice how each skill played a role in the trading discussed?

- Focus on understanding how, why, and when your opponents will act (Game Theory)

- Avoid absolutes: Work with the assumption that you are only correct to a degree and make high % choices.

- Consider branches of outcomes, not just a single path.

- Engage in problem-solving within a nuanced, complex, and variable environment.

- Map out multi-move strategies: Anticipate permutations and how they evolve with new data.

- Learn the language the market speaks.

Guess what?

These skills improve once you reach around 50 years of age.

There are plenty of young traders with lightning-fast reflexes that you can't compete with. But you don't need to.

Instead, you beat them by out-thinking them due to your superior problem-solving skills.

Summary

In summary, this is how you transform yourself—as a trader and person.

It’s not just about changing your approach but cultivating a new trading identity that fosters deeper confidence within yourself.

This profound shift in self-belief paves the way for a more assured version of you.

When you discuss trading, your significant other, colleagues, or friends will notice newfound clarity and conviction in your words.

Remember, only a fraction of traders 'make it.' This transformation places you in that rare group.

Forex and derivatives trading is a highly competitive and often extremely fast-paced environment. It only rewards individuals who attain the required level of skill and expertise to compete. Past performance is not indicative of future results. There is a substantial risk of loss to unskilled and inexperienced players. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent

Editors’ Picks

EUR/USD stays below 1.1850 after dismal German sentiment data

EUR/USD stays in negative territory below 1.1850 in the second half of the day on Tuesday. Renewed US Dollar strength, combined with a softer risk tone keep the pair undermined alongside downbeat German ZEW sentiment readings for February.

GBP/USD falls toward 1.3550, pressured by weak UK jobs report

GBP/USD remains under bearish pressure and extends its decline below 1.3600 on Tuesday. The United Kingdom employment data suggested worsening labor market conditions, bolstering bets for a BoE interest rate cut next month and making it difficult for Pound Sterling to stay resilient against its peers.

Gold recovers modestly, stays deep in red below $4,950

Gold (XAU/USD) stages a rebound but remains deep in negative territory below $4,950 after touching its weakest level in over a week near $4,850 earlier in the day. Renewed US Dollar strength makes it difficult for XAU/USD to gather recovery momentum despite the risk-averse market atmosphere.

Canada CPI expected to show sticky inflation in January, still above BoC’s target

Economists see the headline CPI rising by 2.4% in a year to January, still above the BoC’s target and matching December’s increase. On a monthly basis, prices are expected to rise by 0.1%.

UK jobs market weakens, bolstering rate cut hopes

In the UK, the latest jobs report made for difficult reading. Nonetheless, this represents yet another reminder for the Bank of England that they need to act swiftly given the collapse in inflation expected over the coming months.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.