- Cryptos seem to have bottomed out with Ethereum leading the charge.

- Technical levels are finally looking better.

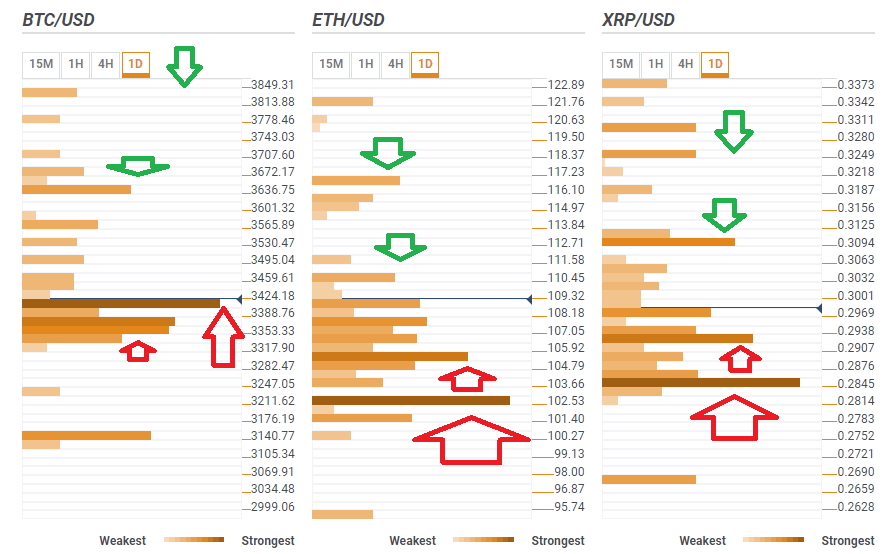

- Here are the levels to watch according to the Confluence Detector, our proprietary tool.

Cryptos are finally rising. Bitcoin marked a double-bottom instead of another lower low. Ethereum is surging and Ripple is also on a roll.

News that SEC Commissioners said he thinks regulators will eventually approve a Bitcoin ETF may be behind the rally. Perhaps the upcoming delayed deployment of Constantinople for Ethereum is the reason.

In any case, long days of listless downdrift may be nearing their end ahead of the weekend. Are cryptos ready to rally? The technical picture has certainly improved, with more support than resistance seen on the charts.

BTC/USD conquers resistance, eyes $3,636, then $3,831

Bitcoin climbed over a substantial resistance level. At $3,402 we find a dense cluster of resistance lines including the Simple Moving Average 5-1h, the Pivot Point one-day Resistance 2, the Fibonacci 23.6% one-week, the Bollinger Band 15min-Middle, the SMA 5-1d, the BB 1h-Upper, the SMA 10-15m, the Fibonacci 161.8% one-day, the SMA 5-15m, the SMA 200-1h, and the Pivot Point one-day R3.

The next support is also significant and close by. $3,370 is the convergence of the Fibonacci 23.6% one-day, the Fibonacci 38.2% one-day, the SMA 5-4h, the SMA 10-4h, the SMA 50-1h, the SMA 100-15m, the BB 1h-Middle, the SMA 200-15m, and the Fibonacci 61.8% one-day.

Resistance lines are few and far between. At $3,636 we find the Fibonacci 38.2% one-month and the Bollinger Band one-day Upper.

The ultimate target is $3,831 where see the Fibonacci 61.8% one-month.

ETH/USD made an impressive move, eyes $116.50

Ethereum is the leader of the rise and it has surpassed quite a few critical levels. Most notably, $105.30 is where we find the confluence of the SMA 50-1h, the SMA 200-15m, the BB 4h-Middle, the SMA 10-4h, the Fibonacci 61.8% one-day, and the Fibonacci 23.6% one-week.

The most significant support is at $102.50 where we see the Bollinger Band 4h-Lower, last month's low, and the Pivot Point one-day Support 2.

Weak resistance awaits at $110.45 which is where the previous 4h-high and the Fibonacci 61.8% one-week converge.

The upside target for ETH/USD is $116.50, where we see the Fibonacci 23.6% one-month.

XRP/USD more complicated, but more support than resistance

Ripple has more significant resistance than its peers, but this is nonetheless weaker than support. Support for XRP/USD awaits at $0.2922 where we see the confluence of the Fibonacci 61.8% one-day, the SMA 10-4h, the SMA 200-15m, the SMA 50-1h, the Fibonacci 38.2% one-day.

The most significant support awaits at $0.2845 which is a dense cluster including last month's low, the Pivot Point one-week Support 3, the BB one-day Lower, the Fibonacci 161.8% one-day, and the BB 4h-Lower.

Resistance awaits at $0.3094 where we see the confluence of the Fibonacci 23.6% one-month and the Bollinger Band one-day Middle.

Further resistance is at $0.3250 which is where the Fibonacci 38.2% meets the price.

More: Crypto analysis: Don't fear the reaper

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto Today: Bitcoin gets less interest from traders, Ethereum ETF could attract $5 billion inflows

Bitcoin market sees a decline in volatility per on-chain data from Crypto Quant. Bitcoin ETFs saw a net inflow of $129 million on July 1; on-chain analysts predict a relief rally in BTC.

Ripple escrow timelocks expired on Monday, one billion XRP unlocked as altcoin ranges above $0.47

Ripple (XRP) escrow unlocked 1 billion tokens on Monday as part of the planned unlock until January 2025. XRP hovers around $0.48 early on Tuesday, adding more than 1% to its value on the day.

Bitcoin holds above $61,000 as Daily Active Addresses is highest since mid-April

US spot Bitcoin ETFs registered slight inflows on Monday. On-chain data shows that BTC's daily active addresses increased, signaling greater blockchain usage. German Government transferred 1,500 BTC, valued at $94.7 million, out of its wallet on Monday.

Chainlink poised for a rally as whales buy the dips

Chainlink’s price bounced from the weekly support level at $13.15 and extends recovery on Tuesday. On-chain data shows that whales have accumulated 2.08 million LINK in the past seven days.

Bitcoin: BTC price correction could end in July, according to seasonal data

Bitcoin (BTC) price appears poised for a decline this week, influenced by slight outflows in US spot ETFs, selling activity among BTC miners, and a combined transfer of 4,690.28 BTC to centralized exchanges by the US and German governments.