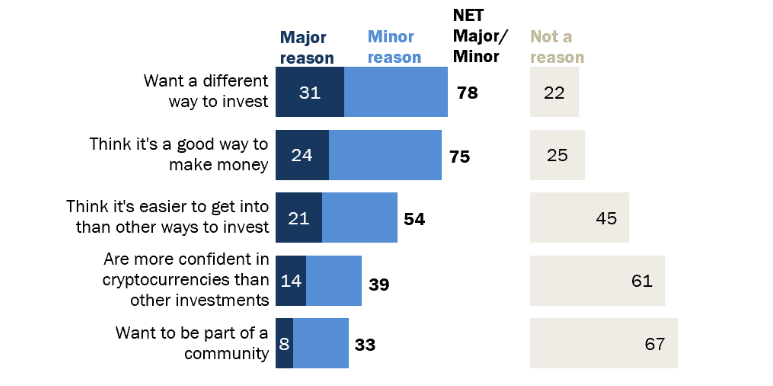

It's too bad, as a majority of the crypto investors surveyed said they became interested in crypto as they thought it was a good way to make money.

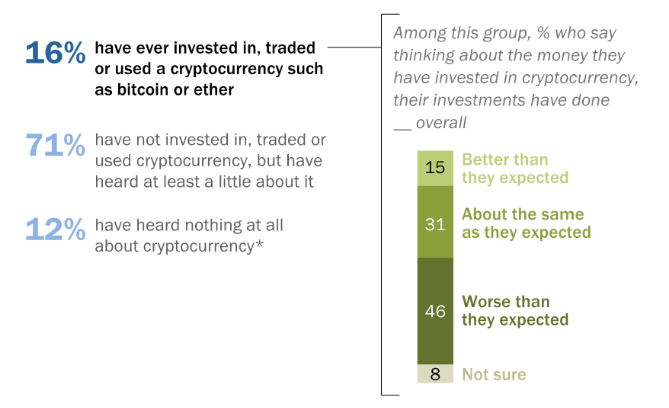

Amid the ongoing crypto winter, new data from a Pew Research Centre survey has shown that 46% of adult crypto users in the United States are seeing lower than expected returns on their crypto investments.

The survey gathered responses from over 6,000 randomly-selected adults across the United States, with panelists participating in self-administered web surveys.

Conducted from July 5 to 22 of this year, the majority of respondents who said they had invested in crypto said they saw lower than expected returns than expected while only 15% of people surveyed said their crypto investments had done better than expected. Meanwhile, around 31% said it was "about the same as they expected."

Source: Pew Research Center

It’s unfortunate, given the vast majority of crypto user respondents said they became interested in cryptocurrency because they were looking for a “different way to invest,” and thought it was a “good way to make money.”

Women made up over half of the respondents and people over 50 years old represented the largest sample size. Overall, only 16% of total respondents said they had invested, traded, or used a cryptocurrency at some point in their lives.

U.S. investors piled into crypto in its heyday

The high proportion of disappointed crypto investors could be attributed to a sharp rise of crypto adopters in the country in 2021 when the market was at its all-time high.

Cointelegraph previously reported that roughly 70% of crypto hodlers in the U.S. started investing in cryptocurrencies such as Bitcoin (BTC) in 2021, the year that saw BTC reach an all-time high (ATH) of roughly $67,582 on November 8, 2021.

Source: Pew Research Center

Massive institutional adoption, growth in altcoins, easier access to cryptocurrency trading, and celebrity endorsements were all cited as possible reasons for the huge spike.

However, most people who jumped into the crypto market during the 2021 boom are likely to be feeling the pain now, with Bitcoin plummeting over 69% from its ATH to $21,403, and Ethereum (ETH) falling 66% from its ATH to $1,640.

Boomers and Gen X

A separate poll by financial service provider deVere Group found nearly half of their more than 700 Baby Boomer (born between 1946 and 1964) and Generation X (born between 1965 to 1985) clients from all over the world already own cryptocurrency or are planning to buy it before the end of 2022.

Nigel Green, deVere Group CEO and founder believes most people born between 1965 and 1980 are investing as "part of a wider retirement planning strategy."

However, he also cautioned anyone from investing in crypto without first seeking professional advice, "As this year has proven again, the crypto market remains known for its volatility."

"Therefore, retirees or those on the cusp of retirement need to bear this in mind and not over-commit, as this could put the wider retirement strategy in jeopardy."

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Ripple on-chain metrics show bullish signs amidst legal struggle with SEC, XRP eyes recovery

Ripple made a comeback above $0.48 on Tuesday and hovers above that level in Wednesday’s European session. Ripple on-chain metrics such as transaction volume and Network Realized Profit/Loss have turned bullish, supporting a recovery in the altcoin.

Bitcoin price falls amidst German government transfers, miners activity

Bitcoin (BTC) extends correction on Wednesday and hovers around $61,000 after finding resistance near the $64,000 level on Monday. Recent on-chain data indicates heightened selling activity from Bitcoin miners early in the week.

Crypto Today: Bitcoin erases gains from end of June, Ethereum declines while Ripple holds

Bitcoin wipes out gains from the last week of June and falls below $60,000 on Wednesday. Ethereum and top altcoins ranked by market capitalization erased gains as the inflation outlook worsened. Ripple holds on to recent gains and hovers above $0.48 on Wednesday.

Three reasons why altcoins could shake off losses this week

On-chain data from Santiment shows that altcoins are currently in the opportunity zone, or generating buy signals. The top three altcoins in the buy zone are Basic Attention Token (BAT), Chromia (CHR), and Highstreet (HIGH), per Santiment.

Bitcoin: BTC price correction could end in July, according to seasonal data

Bitcoin (BTC) price appears poised for a decline this week, influenced by slight outflows in US spot ETFs, selling activity among BTC miners, and a combined transfer of 4,690.28 BTC to centralized exchanges by the US and German governments.