- The upgrade will improve the proof-of-work which will increase protection against attacks by ASICs.

- The 23.6% Fib retracement level while to the downside, the major support level is at $163.

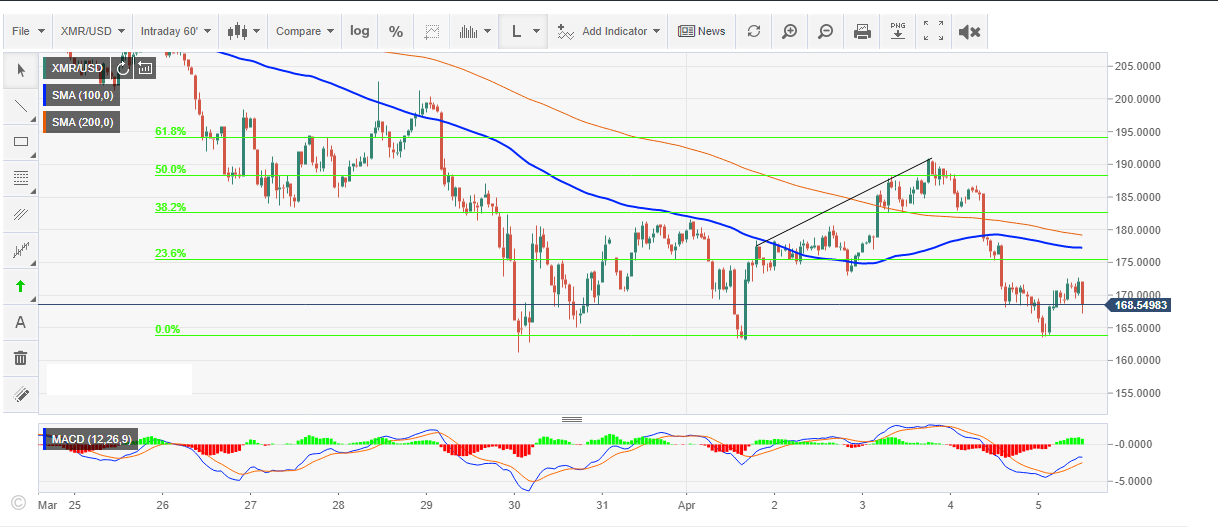

Monero price is down 3.45% on Thursday, as most of the cryptocurrency market bleeds red. The downside movement was initiated at $188 but the support level at $170 level could not hold the declines. Currently, XMR/USD is completing the second shoulder of the inverse neck-and –shoulder pattern near $170.

Monero’s GUI software will be updated on April 6th to the next version v0.12.0.0 “Lithium Luna.” The upgrade will improve the proof-of-work which will increase protection against attacks by ASICs while at the same time raise the ring signature inputs. In addition to that, the software upgrade will fix bugs and also make general improvements.

In other news, Canadian bank has decided that it will not allow clients to buy cryptocurrencies using its Interac debit cards. The report says that XMR could have been banned with the ongoing clampdown. An official from the bank said:

“As a financial institution, we have an obligation to assist in the fight against financial crime and money laundering. It is important for us to secure ourselves from anti-money laundering and these virtual currencies do not provide enough transparency to hold up to our obligations. This is why we have to discontinue cryptocurrency trading on our platforms.”

Monero price technical analysis

Monero price lacked the momentum to push above $190 when retracing towards $200. Instead, the price embarked on a downside movement that broke below key support area close to $185 and $170 respectively. At the moment XMR/USD is trading below both the near term 100 SMA and the longer term 200 SMA. There is a bullish momentum forming around $167 as indicated by the MACD on the hourly chart. The 23.6% Fib retracement level with the last high at $213 and a low $163, on the other hand, will offer resistance close to $175. The immediate support for XMR/USD is at $163.

XMR/USD hourly chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Heads up on Fetch.ai's token merger with OCEAN and AGIX

Fetch.ai (FET) announced in an X post on Wednesday that it will begin the ASI token merger with Ocean Protocol (OCEAN) and SingularityNET (AGIX) on July 1. The process, which has two phases, will conclude the long-awaited token integration across the three Artificial Intelligence (AI) protocols.

Could profit-taking from FLOKI holders lower its price?

Trading bot that will burn FLOKI tokens announcement fails to impact its price. FLOKI's In-the-Money Addresses reveal a sharper correction may occur if the market continues its downward movement. FLOKI's Token Age Consumed shows long-term holders may have been taking profits.

Ethereum ETFs may launch on July 4, could see 40% rally afterwards

Ethereum (ETH) is down 1% on Wednesday following reports that the Securities & Exchange Commission (SEC) could approve spot ETH ETFs on July 4. Meanwhile, brokerage and financial services firm, StoneX, predicted ETH to see a 40% gain in two months after ETH ETFs go live.

Shiba Inu price poised for 18% rally after three-month-long downtrend

Shiba Inu (SHIB) price found support at the 200-week Exponential Moving Average and is currently trading up 2.3% on Wednesday. On-chain data indicates SHIB experienced a capitulation event on June 24, with supply on exchanges decreasing, suggesting bullish momentum could drive SHIB's price higher in the coming days.

Bitcoin: Is BTC out of the woods?

Bitcoin appears poised for a slight decline this week, influenced by factors such as the German Government's deposit of over 1,700 BTC in exchanges, decreasing outflows in US spot ETFs, and on-chain data indicating no signs of BTC DeFi liquidation.