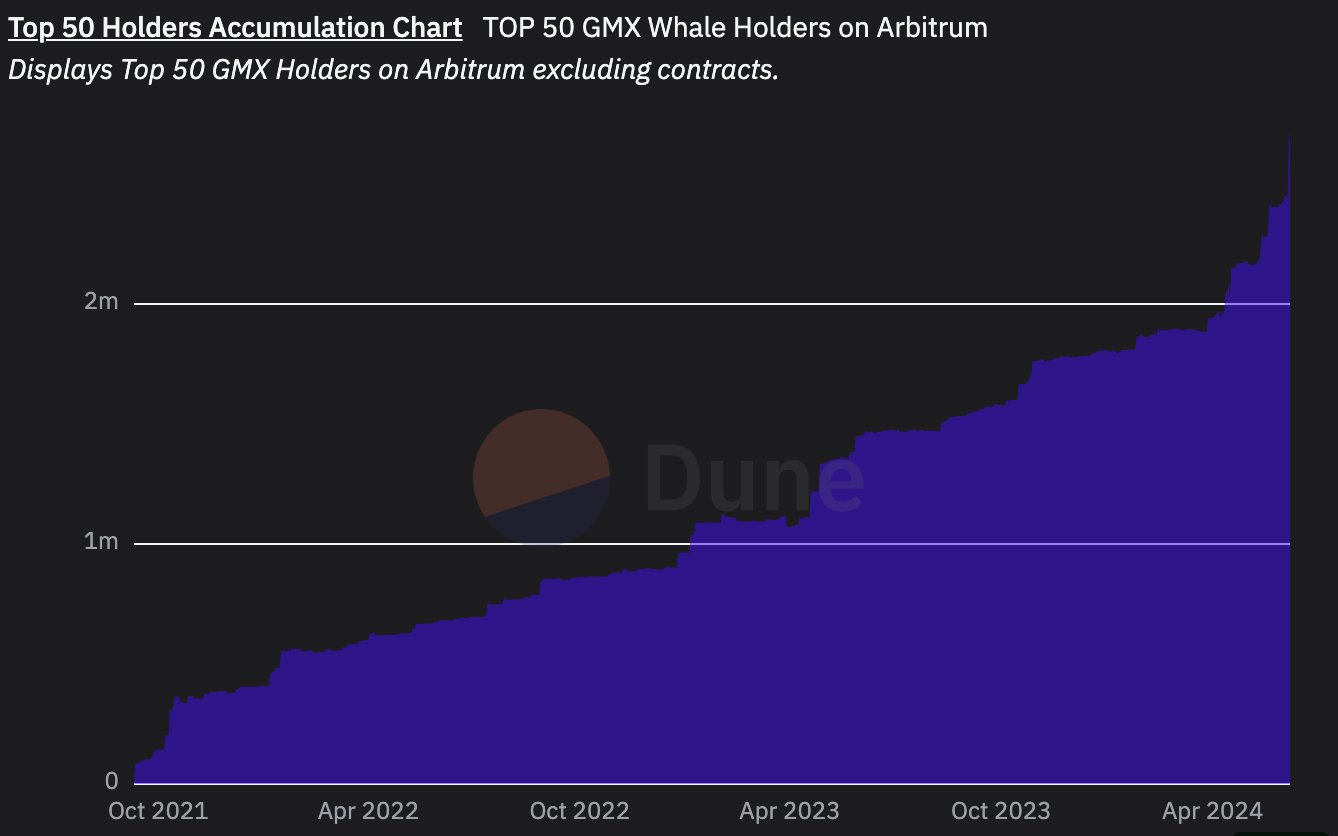

- GMX’s top 50 holders bags have been on a non-stop uptrend in 2024.

- According to data analytics sources, institutions have been accumulating and withdrawing GMX out of exchanges.

- GMX price has shot up more than 20% in the past two days and is likely to continue its ascent.

GMX, a Decentralized perpetual exchange, seems to be making waves as many speculate that the exchange might have something big planned. The reason for this spike in social activity surrounding GMX is the whale activity and rally in the asset’s price.

Also read: XRP sinks as Ripple moves 200 million tokens, inviting community suspicion

GMX whales on buying spree

Lookonchain, a data analytics platform, posted that whales or institutions are buying GMX tokens. It stated that six fresh wallets withdrew $15.3 million worth of tokens (344K GMX).

Whales/institutions are buying $GMX, and the price of $GMX has increased by ~24% in the past 2 days.

— Lookonchain (@lookonchain) June 7, 2024

6 fresh wallets withdrew a total of 344,502 $GMX($15.3M) from #Binance in the past 2 days.

Wallets:

0x68fdea13878d7ce741cc596db55564909d9ecc8a… pic.twitter.com/Err6YfdYrb

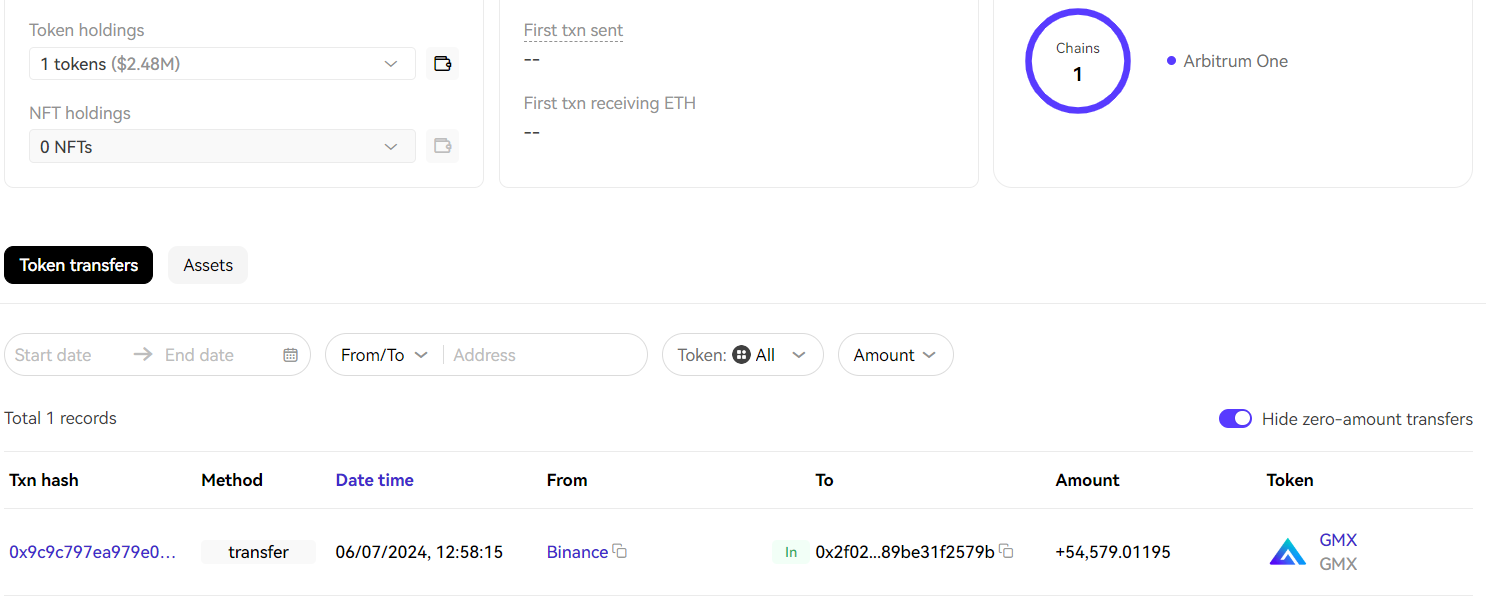

TheDataNerd also posted that one whale withdrew nearly 55,000 GMX worth roughly $2.47 million.

Source: TheDataNerd Twitter

Additionally, the top 50 GMX whale holders have grown their stack exponentially in 2024, showing the big-picture outlook and the confidence these investors have.

Top 50 Holders Accumulation chart

With whales showcasing their interest, GMX price has shot up more than 20% in the past two days. But technical analysis suggests there might be another opportunity to accumulate GMX in the coming days before it takes off for good.

Also read: Ethereum's price suffers slight decline amid Hong Kong's plan to allow staking in ETH ETFs

GMX price likely to dip before skyrocketing

GMX price is hovering above the $39.68 support level but is facing rejection at $42.80, which is the midpoint of the 66% crash witnessed between March 13 and April 13. Going forward, investors can expect the DEX token to crash nearly 8% and revisit the $39.68 to $35.98 accumulation zone.

Depending on the interest from sidelined buyers, GMX could see a quick bounce that kickstarts its massive ascent. If this move flips $42.80, it would open the doors to the $56.05 hurdle, roughly 30% away.

But the bulls' target would ideally be the sell-side liquidity resting above the set of equal highs formed at $64.93. This move would constitute a 63% gain, measured from the $39.68 level.

GMX/USDT 1-day chart

Regardless of the whales’ involvement, a crash in Bitcoin (BTC) price could trigger a correction for GMX as well. In such a case, a breakdown of $35.98 would produce a lower low and invalidate the bullish thesis.

This development could open the path for GMX to crash 16% before finding a stable support level at $30.13.

Also read: Dogecoin whales could end DOGE’s muted volatility

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Meme coin popularity sends Solana's economic value to new all-time high

Solana block space profitability reached a new all-time high of over $91 million on Monday, the same day that Pump.fun's cumulative revenue surpassed the $50 million mark. The attention towards meme coins in the current bull cycle has partly fueled the growth.

Circle acquires first stablecoin license under MiCA laws

Circle revealed it has become the first global stablecoin issuer to be granted with the Electronic Money Institution license under Markets in Crypto Assets laws in the EU. Following the announcement, Circle can now issue USDC and EURC stablecoins across Europe.

Ethereum's expected July rise threatened by outflows and whale exchange deposit

Global Ethereum ETF outflows threaten expectations of successful spot ETH ETF launch. ICO whale and US government hint at ETH sale after recent transfers. Ethereum's historical July returns could attract bulls as spot ETH ETF launch draws closer.

Solana meme coins rally with double-digit gains, Keith Gill sued for securities fraud

Keith Gill, the trader behind the alleged GameStop stock pump and dump has been slammed with a class action lawsuit. The plaintiff accuses Gill of orchestrating a pump-and-dump scheme and failed to disclose his purchase and sale of GameStop options.

Bitcoin: BTC price correction could end in July, according to seasonal data

Bitcoin (BTC) price appears poised for a decline this week, influenced by slight outflows in US spot ETFs, selling activity among BTC miners, and a combined transfer of 4,690.28 BTC to centralized exchanges by the US and German governments.