- Floki Inu price needs a trigger powerful enough to initiate a recovery.

- The news of the Bitfinex listing failed to be a bullish catalyst.

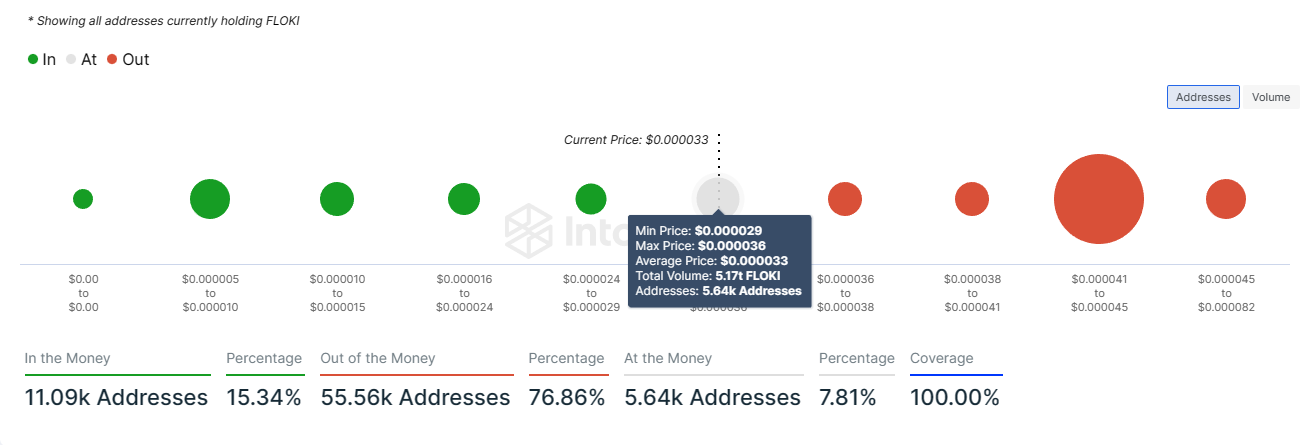

- 5.17 trillion FLOKI will only become profitable if the altcoin touches $0.00003346.

- Nearly 25% of the entire supply is still underwater, a climb back to March highs would make it profitable again.

Floki Inu price has witnessed one of the most volatile movements amongst some of the top altcoins and meme coins. The cryptocurrency swaying this aggressively is resulting in about half of the entire supply swinging between unrealized profits and losses.

Floki Inu price needs stability and a recovery

Floki Inu price has declined by more than 27% in the last couple of days following a 55% rally on April 24. The market was expecting a similar rally on May 3 as the cryptocurrency made its way on the crypto exchange Bitfinex, listing alongside the rest of the meme coins.

However, this was not the case as FLOKI, despite marking a 12% rise during the intraday trading hours, slid back down to trade at $0.00003346.

FLOKI/USD 1-day chart

As a result of this fluctuation, more than half of the entire circulating FLOKI supply is hanging between profits and losses. About 5.17 trillion FLOKI worth nearly $172 million bought between $0.00002900 and $0.00003600 can become profitable or plunge into losses depending on the broader market cues.

In addition to this, about 25% of the circulating supply is also underwater since the April 25 crash and would become profitable once FLOKI hits the March high of $0.00004500. Close to 2.4 trillion SHIB worth $80 million bought between $0.00003600 and $0.00004500 would bear profits to its 50,000 addresses once Floki Inu price marks 36% gains.

Floki Inu GIOM

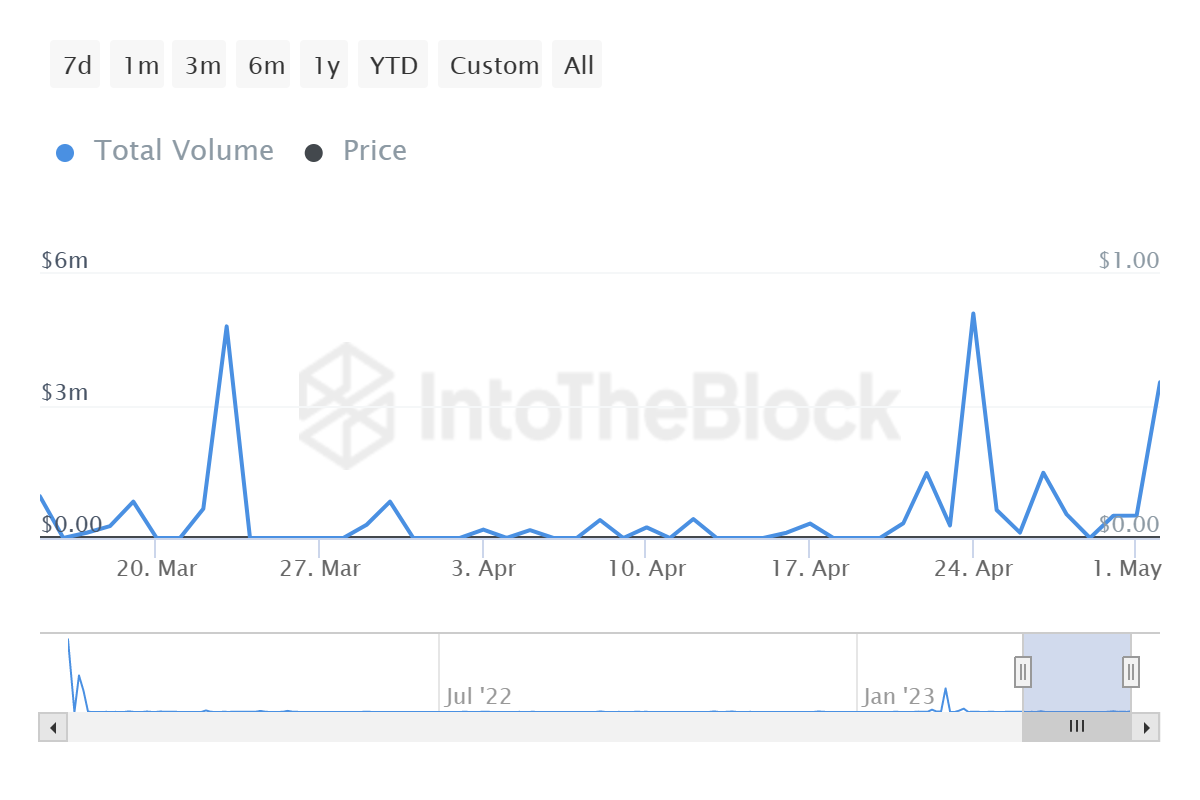

The volatile price action could bring about losses at any time given there is no support from the investors at the moment. Apart from the lack of participation on the network, the large transactions are also reacting only to extreme price rises or crashes.

Over the last two weeks, the most activity observed in transactions worth more than $100,000 was during the 55% rise of April 24 and on May 3 after the token was listed on Bitfinex.

Floki Inu large transactions

Thus Floki Inu price needs to find some stability and attempt to decouple itself from the “meme coin standard”.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ripple on-chain metrics show bullish signs amidst legal struggle with SEC, XRP eyes recovery

Ripple made a comeback above $0.48 on Tuesday and hovers above that level in Wednesday’s European session. Ripple on-chain metrics such as transaction volume and Network Realized Profit/Loss have turned bullish, supporting a recovery in the altcoin.

Bitcoin price falls amidst German government transfers, miners activity

Bitcoin (BTC) extends correction on Wednesday and hovers around $61,000 after finding resistance near the $64,000 level on Monday. Recent on-chain data indicates heightened selling activity from Bitcoin miners early in the week.

Crypto Today: Bitcoin erases gains from end of June, Ethereum declines while Ripple holds

Bitcoin wipes out gains from the last week of June and falls below $60,000 on Wednesday. Ethereum and top altcoins ranked by market capitalization erased gains as the inflation outlook worsened. Ripple holds on to recent gains and hovers above $0.48 on Wednesday.

Three reasons why altcoins could shake off losses this week

On-chain data from Santiment shows that altcoins are currently in the opportunity zone, or generating buy signals. The top three altcoins in the buy zone are Basic Attention Token (BAT), Chromia (CHR), and Highstreet (HIGH), per Santiment.

Bitcoin: BTC price correction could end in July, according to seasonal data

Bitcoin (BTC) price appears poised for a decline this week, influenced by slight outflows in US spot ETFs, selling activity among BTC miners, and a combined transfer of 4,690.28 BTC to centralized exchanges by the US and German governments.