- DashCopay wallet app wallet is specifically designed for both Android and iOS devices.

- Dash will now be integration on AloGateway platform which makes at least 100,000 transactions per day.

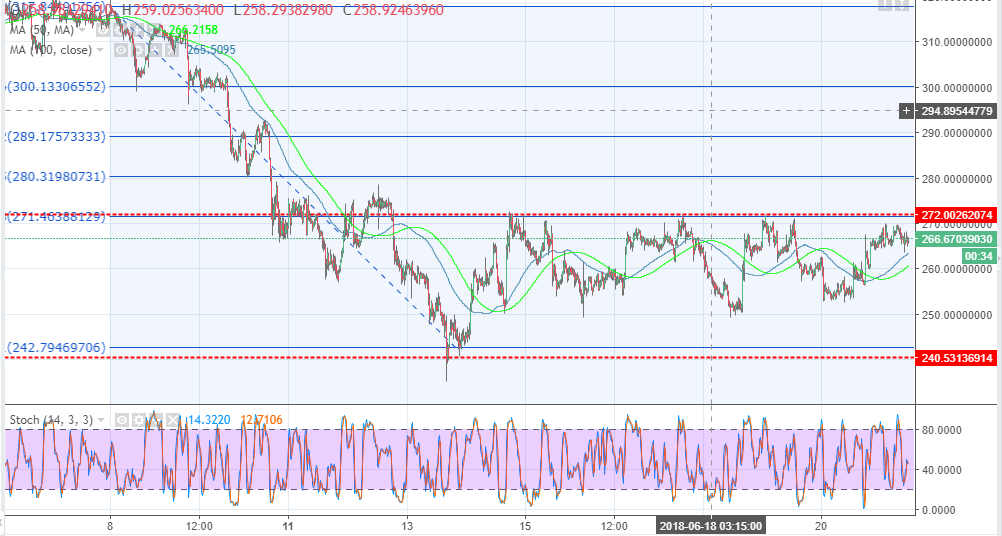

- DASH/USD is currently stuck within ranging channel with the resistance at $272.0 and supported at $240.5.

Dash is cryptocurrency that has been transforming outlook since its inception. It was launched in 2014 as XCoin but because of the privacy features it rebranded to Darkcoin but in it change again to Dash to allow it to be a global payment processing system. The Dash team is one of the most active in the space. Dash has today announced the release of its much-awaited DashCopay wallet for iOS and Android. The wallet is going to have some of the best features including ability to set a local currency and create share or join shared wallets using multi-signature among others. The wallet is still in the beta stage, but further developments are in progress leading to the official launch.

AloGateway, a global payment processing platform yesterday made an announcement that it was partnering with Dash, which is also referred to as ‘Digital Cash.” The reason for this partnership is to aid AloGateway in its expansion into the Asian market. Dash will now be added to the platform which is said to be making over 100,000 transactions in a single day. The CEO of AloGateway said while commeting on why Dash among other currencies:

“We had a number of reasons for choosing Dash as one of first digital assets we offer on our platform. First, Dash has among the lowest fees and fastest transactions of any blockchain network. Dash also has an active community, particularly in parts of Asia and Europe where we are seeing a lot of potential for growth.”

Dash price analysis

Dash price has been walloping in selling pressure just like other virtual currencies in the market. The cryptocurrency is currently stuck within ranging channel with the resistance at $272.0 and supported at $240.5. DASH/USD is changing hands at $266, besides it is facing acute resistance at $270. The upper limit of the ranging channel also coincides with the resistance from the 61.8% Fib retracement level with the last high leg at $317.7 and a low of $242.7. Dash price is battling for a support at $265, but the short-term support at $260 will continue to hold in the medium term.

DASH/USD 15’ chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Celebrity meme coins controversy continues amid Pump.fun revenue dominance

Pump.fun outperformed the Ethereum blockchain on Tuesday after raking in $1.99 million. Following this achievement, a meme coin based on actress Sydney Sweeney was the subject of controversy after its developers dumped their bags on investors.

PEPE's on-chain metrics indicate potential rally after weeks of silence

PEPE has struggled to see any significant price move after reaching an all-time high in May. Increased adoption rate and low MVRV ratio indicate a bullish run may be on the horizon. A single PEPE outflow from Binance worth $14.7 million gives credence to signs of bullish expectation.

Ethereum has failed to overcome key resistance despite bullish sentiment surrounding ETH ETF

Ethereum (ETH) is down more than 1.4% on Tuesday following another ETH sale from the Ethereum Foundation. Meanwhile, crypto exchange Gemini's recent report reveals that ETH ETF could see about $5 billion in net inflows within six months of launch.

Crypto community blasts Polkadot following report of treasury spending

Polkadot reports $87 million of treasury spending during H1. Crypto community members expressed harsh feelings toward the DOT team's high spending. DOT is up more than 2% in the past 24 hours but risks correction following the report.

Bitcoin: BTC price correction could end in July, according to seasonal data

Bitcoin (BTC) price appears poised for a decline this week, influenced by slight outflows in US spot ETFs, selling activity among BTC miners, and a combined transfer of 4,690.28 BTC to centralized exchanges by the US and German governments.