- The institutionalization of Bitcoin and other cryptocurrencies is what the market needs for a reversal.

- Mike Novogratz predicts Bitcoin will reverse the trend and hit $8,000.

- Ripple’s is currently on the verge of a bullish break above the bullish flag pattern.

- Ethereum sideways trading is gaining traction.

Bitcoin, Ripple’s XRP and Ethereum lead from behind as the market trends lower. The retreat comes after cryptocurrencies made an attempt to leave the dark ‘crypt’. However, Bitcoin upside was limited at $3,700, XRP at $0.32 while Ethereum was capped at $128.

Galaxy Digital founder, Mike Novogratz recently told Bloomberg that he expects Bitcoin to correct towards $8,000. He added that the infrastructure that will enable institutional investment in the industry is steadily falling in place. Novogratz believes that the institutionalization of Bitcoin and other cryptocurrencies is what the market needs for a reversal.

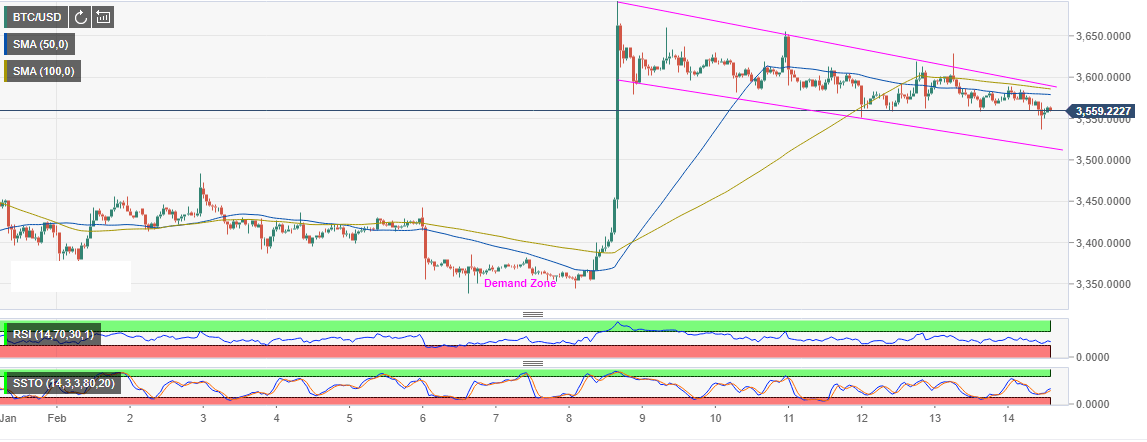

Bitcoin price overview

Bitcoin is trending lower 0.27% today. The asset has been on a steady decline mode since last week’s high at $3,700. Presently, Bitcoin is trading at $3,567 after a slight recovery from the immediate support at $3,550. As discussed in the price analysis, Bitcoin delayed bullish flag pattern breakout will open the door for gains towards $3,700. Meanwhile, it is important that the bulls keep the price above $3,550 to avoid declines that could breach $3,500 and spiral towards $3,400.

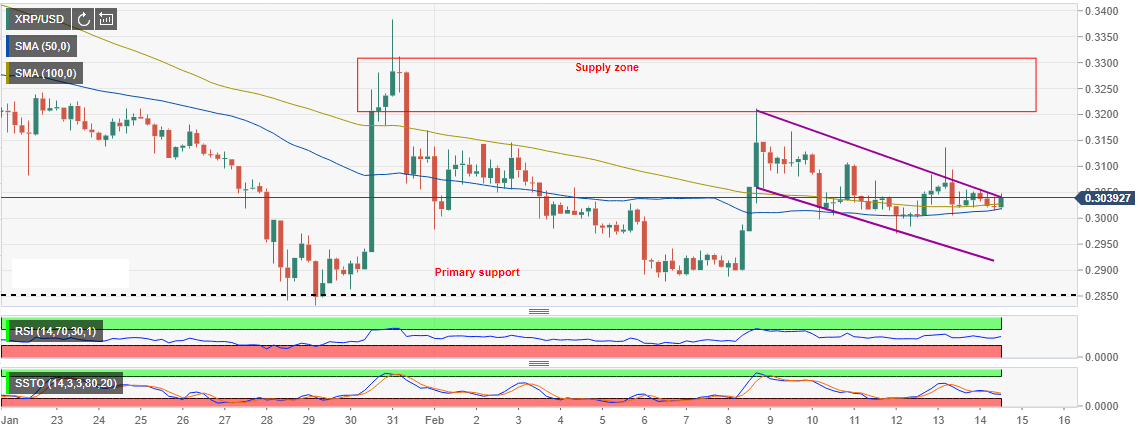

Ripple’s XRP price overview

Ripple’s is currently on the verge of a bullish break above the bullish flag pattern we mentioned yesterday. The asset is valued at $0.3040 while supported by the 4-hour 50-day Simple Moving Average (SMA). Correcting above $0.31 (initial resistance) will see price ignite more gains heading to $0.32 (critical level) and eventually test $0.33 (medium-term resistance).

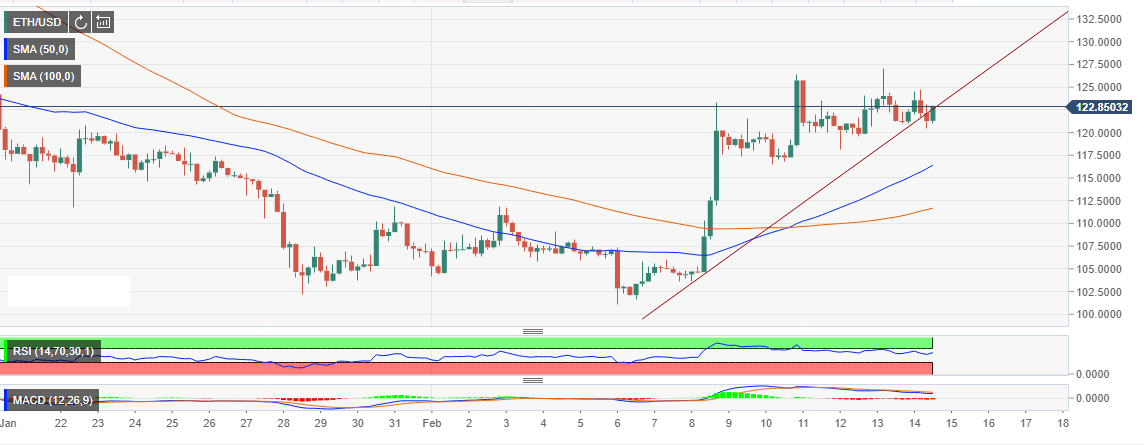

Ethereum price analysis

Ethereum sideways trading is gaining traction after failing to break above $128 in the recent rally. ETH/USD corrected from $102 and reclaimed support at $120 before pushing for gains towards $130. However, there has been a recoil to the south with Ethereum touching $116 support. At the moment, the crypto has recovered to $112.59 with the immediate resistance seen at $125. A break above $125 must occur for Ether buyers to gain more strength towards $130 critical level.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto Today: Bitcoin gets less interest from traders, Ethereum ETF could attract $5 billion inflows

Bitcoin market sees a decline in volatility per on-chain data from Crypto Quant. Bitcoin ETFs saw a net inflow of $129 million on July 1; on-chain analysts predict a relief rally in BTC.

Ripple escrow timelocks expired on Monday, one billion XRP unlocked as altcoin ranges above $0.47

Ripple (XRP) escrow unlocked 1 billion tokens on Monday as part of the planned unlock until January 2025. XRP hovers around $0.48 early on Tuesday, adding more than 1% to its value on the day.

Bitcoin holds above $61,000 as Daily Active Addresses is highest since mid-April

US spot Bitcoin ETFs registered slight inflows on Monday. On-chain data shows that BTC's daily active addresses increased, signaling greater blockchain usage. German Government transferred 1,500 BTC, valued at $94.7 million, out of its wallet on Monday.

Chainlink poised for a rally as whales buy the dips

Chainlink’s price bounced from the weekly support level at $13.15 and extends recovery on Tuesday. On-chain data shows that whales have accumulated 2.08 million LINK in the past seven days.

Bitcoin: BTC price correction could end in July, according to seasonal data

Bitcoin (BTC) price appears poised for a decline this week, influenced by slight outflows in US spot ETFs, selling activity among BTC miners, and a combined transfer of 4,690.28 BTC to centralized exchanges by the US and German governments.