- BTC/USD had a week of consolidation amid negative news.

- The ongoing US government shutdown puts a Bitcoin ETF approval on ice.

- The technical picture is balanced for Bitcoin and experts are also mixed.

Cryptocurrencies suffered a mini "flash crash" early in the week. The move sent BTC/USD to a low point of $3,433 but the granddaddy of digital coins bounced back to range quite quickly. Similar moves were seen in Ethereum and in Ripple. It seems that stop-loss orders were flushed and weak hands were gotten rid of.

The rest of the week was stable, which is surprising amid the negativity. JP Morgan analysts said that cryptos' value is "unproven" and that BTC/USD could go as low as $1,260. They favor other assets even in case of a deep financial crisis. Gold and the US Dollar are more liquid and easier to access and to transact.

The global bank has made investments into the blockchain technology but its boss Jamie Dimon has been outspoken against Bitcoin.

Another downbeat development comes from the high profile Bitcoin Exchange Trade Fund (ETF) request by the CBOE in collaboration with VanEck and SolidX. They withdrew the requested rule change that has been delayed over and over again.

The move is due to the government shutdown which paralyzes the Securities and Exchange Commission (SEC). While they may reapply, yet another delay in bringing cryptos to the masses has weighed on prices in the past.

This time, markets are shrugging it off and this is a sign of resilience. The ongoing shutdown means that the topic is off the agenda for quite a while.

What will be the next driver of Bitcoin? More adoption is the answer. The new year may bring innovation in this field.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

BTC/USD Technical Analysis

Bitcoin is trading in a narrow range capped by $3,620 and supported by $3,510. Both lines have been tested in recent days. Momentum and the RSI are not going anywhere fast.

The 50-day Simple Moving Average awaits at $3,660 and is the initial upside target out of this range. The swing high of $3,800 recorded in mid-January. $3,980 provided support to BTC/USD when it was trading on the higher ground early in the new year. $4,100 was the high point of 2019 so far.

Support below $3,510 is at $3,433, the mini-flash crash point. Further down, $3,210 was a swing low in early December. $3,125 is the cycle low recorded in mid-December.

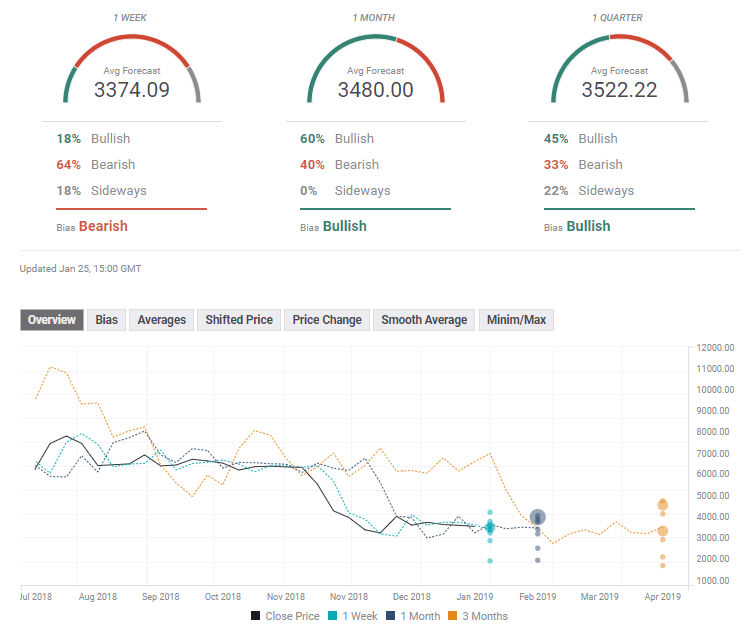

The Forecast Poll of experts shows a bearish tendency in the short term but a bullish one afterward. The targets have not been materially changed in the past week.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Celebrity meme coins controversy continues amid Pump.fun revenue dominance

Pump.fun outperformed the Ethereum blockchain on Tuesday after raking in $1.99 million. Following this achievement, a meme coin based on actress Sydney Sweeney was the subject of controversy after its developers dumped their bags on investors.

PEPE's on-chain metrics indicate potential rally after weeks of silence

PEPE has struggled to see any significant price move after reaching an all-time high in May. Increased adoption rate and low MVRV ratio indicate a bullish run may be on the horizon. A single PEPE outflow from Binance worth $14.7 million gives credence to signs of bullish expectation.

Ethereum has failed to overcome key resistance despite bullish sentiment surrounding ETH ETF

Ethereum (ETH) is down more than 1.4% on Tuesday following another ETH sale from the Ethereum Foundation. Meanwhile, crypto exchange Gemini's recent report reveals that ETH ETF could see about $5 billion in net inflows within six months of launch.

Crypto community blasts Polkadot following report of treasury spending

Polkadot reports $87 million of treasury spending during H1. Crypto community members expressed harsh feelings toward the DOT team's high spending. DOT is up more than 2% in the past 24 hours but risks correction following the report.

Bitcoin: BTC price correction could end in July, according to seasonal data

Bitcoin (BTC) price appears poised for a decline this week, influenced by slight outflows in US spot ETFs, selling activity among BTC miners, and a combined transfer of 4,690.28 BTC to centralized exchanges by the US and German governments.

-636840140237840399.png)