- The Fed President says that cryptocurrencies are nothing but speculative markets.

- BTC/USD breaks above the price barrier at the 23.6% Fib retracement level.

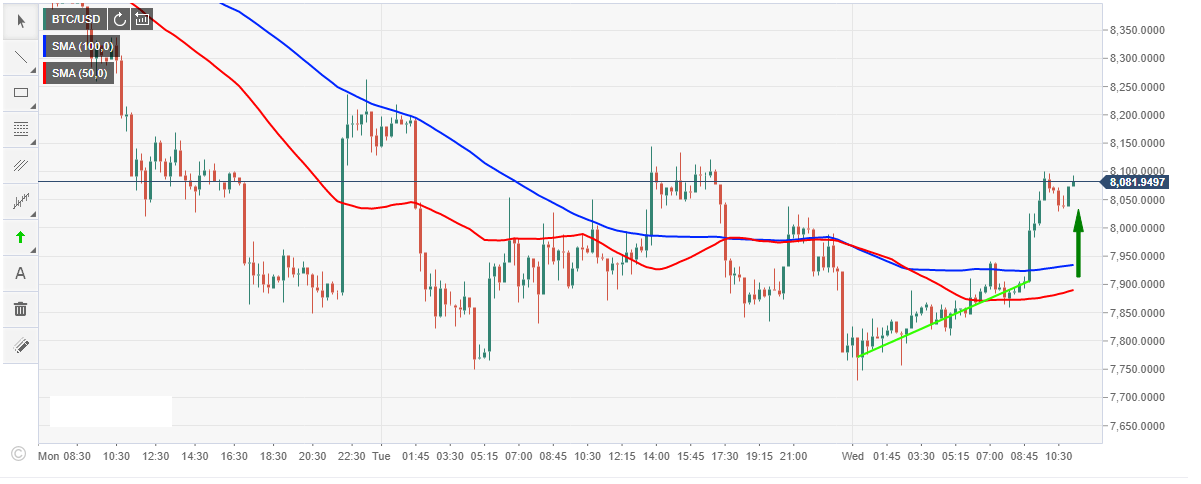

Bitcoin price has sharply ascended to trade above the pivotal $8,000 level. There is a growing buying pressure on the intraday 15 minutes timeframe chart. The upside gains seem to have been capped under $8,088, however, $8,100 seems to be within reach.

The largest cryptocurrencies are appreciating in price despite the pessimistic comments from various leaders. The Atlanta Fed President Raphael has been reported saying that cryptocurrencies “are speculative markets. They are not currency. If you have money you really need, do not put it in these markets.’’ Read more here.

Still, on the same pessimistic line, the SNB's Maechler says she does not believe cryptocurrencies will be broadly accepted as conventional currencies.

Technical Analysis

Bitcoin price has broken above the earlier stated barrier at the 23.6% Fib retracement level with the previous swing high of $9,012 and $7,340. The level is now acting as the immediate support at $8,035. If BTC/USD continues to retrace higher the next major resistance will be encountered at the 38.2% Fib retracement level above $8,200. At the moment, the price is correcting higher and a bullish trend is forming $8,081. The immediate support level is at $7,876 level. A break below this level could open the door towards the major support level at $7,770.

BTC/USD 15 minutes intraday chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP holds steady above $0.47 as Ripple President breaks silence on Real USD stablecoin

Ripple President Monica Long recently appeared on The Block Podcasts and addressed XRP trader concerns about the stablecoin’s launch. The payment remittance firm’s stablecoin is called Real USD (RLUSD) and is slated for launch in 2024.

Bitcoin Weekly Forecast: BTC price correction could end in July, according to seasonal data

Bitcoin price appears poised for a decline this week, influenced by slight outflows in US spot ETFs, selling activity among BTC miners, and a combined transfer of 4,690.28 BTC to centralized exchanges by the US and German governments.

TON and Telegram narrative may be overvalued according to new research

Toncoin, Telegram narrative may be overestimated according to analysts at Blockworks Research. The social media messaging app has a relatively low number of daily active users, and no EVM compatibility.

Dogecoin price poised for 13% rally after finding support on a key level

Dogecoin price has stabilized around $0.118, aligning with the 200-week Exponential Moving Average (EMA), while on-chain data reveals a rising trend in DOGE's development activity, reflecting optimistic sentiment among investors.

Bitcoin: BTC price correction could end in July, according to seasonal data

Bitcoin (BTC) price appears poised for a decline this week, influenced by slight outflows in US spot ETFs, selling activity among BTC miners, and a combined transfer of 4,690.28 BTC to centralized exchanges by the US and German governments.