- ZRX is ready to recover from the recent sell-off.

- The bulls may reach $0.50 with no hassle.

0x is an open-source protocol that supports the peer-to-peer exchange of tokens on the Ethereum blockchain. The users of the protocol can stake its native token ZRX to earn rewards in ETH. Currently, ZRX is the 51st-largest digital asset with the current market capitalization of $319 million and an average daily trading volume of $48 million, in line with the current values. The token is most actively traded on Coinbase Pro and Binance.

ZRX/USD: The technical picture

ZRX/USD bottomed at $0.138 on March 13, as the global cryptocurrency market was hit by COVID-19 consequences and massive anti-risk sentiments across the board. On August 17, the token topped at $0.97 before the downside correction pushed it back to $0.40. At the time of writing, the ZRX/USD is changing hands at $0.44, mostly unchanged in the last 24 hours. Despite the retreat from the recent highs, the token is still yielding nearly 170% of annual return on investments.

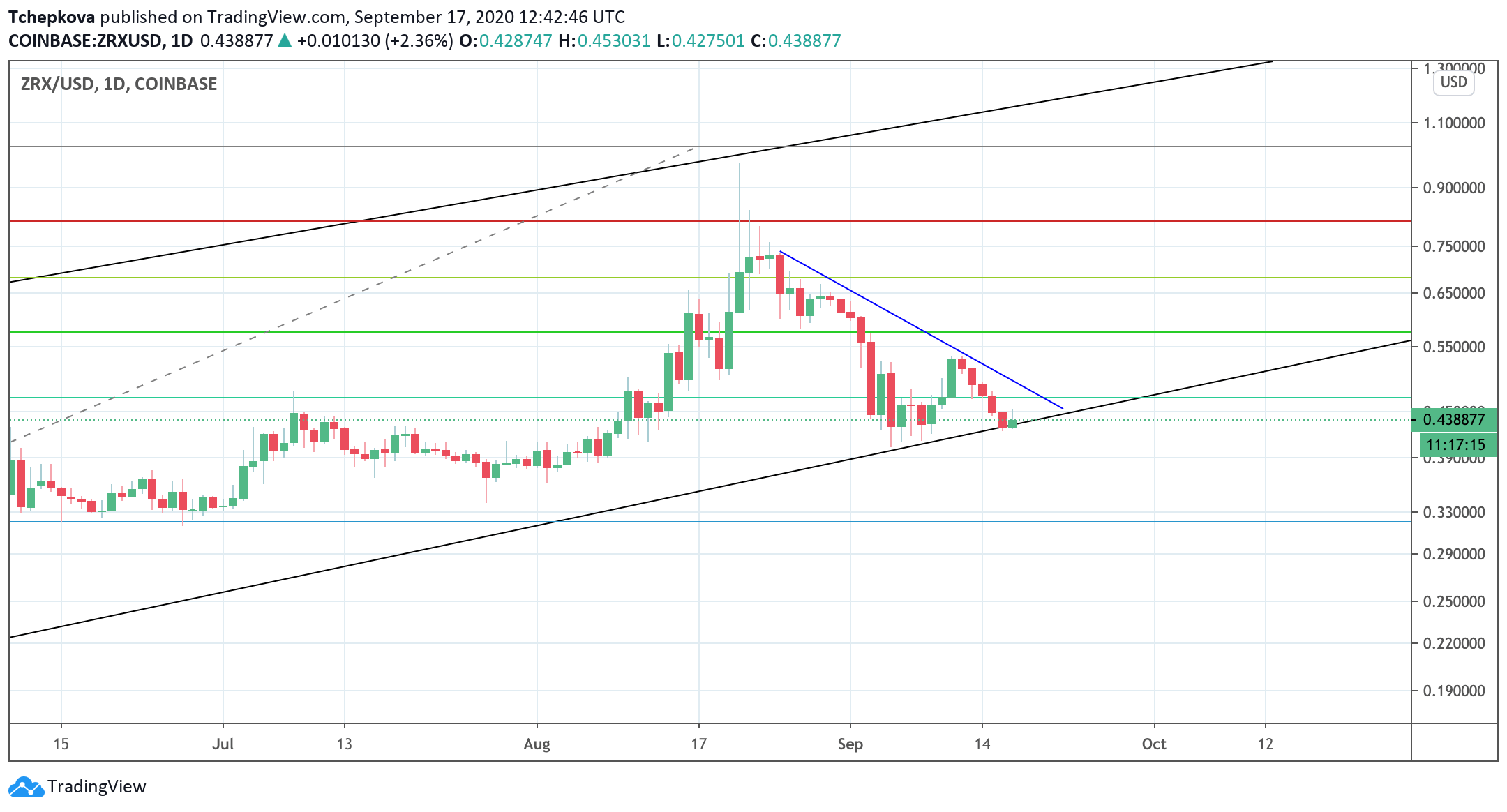

ZRX/USD daily chart

On a daily chart, the price broke a sequence of five bearish days in a row and reversed from the long-term channel support (currently at $0.42). The price tested this barrier on numerous occasions recently but failed to engineer a decisive breakthrough. If the history is repeated, the price may extend the recovery towards the initial resistance created by the short-term downside trendline that coincides with the psychological $0.50. Once it is out of the way, the upside is likely to gain traction with the next focus on $0.575 (50% Fibo for the upside move from March lows).

On the downside, a sustainable move below $0.42 will invalidate the immediate bullish outlook and bring $0.40 in focus. If it is broken, the sell-off may continue all the way down it $0.32 (78% Fibo for the above-mentioned move).

XRX market positioning

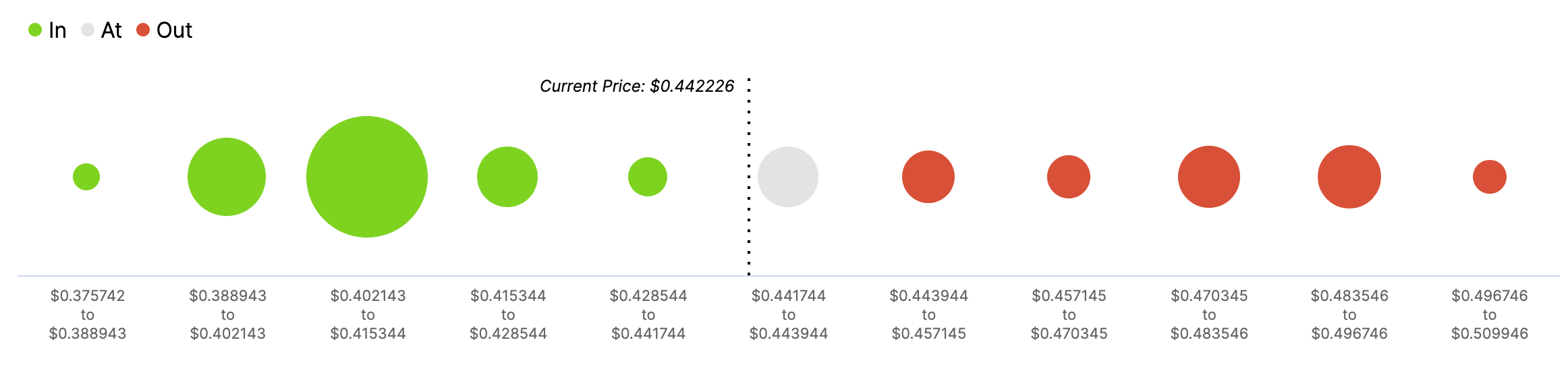

Source: Intotheblock

0x market positioning data confirms the bullish outlook as we have no solid supply walls all the way up to $0.50. At the same time, nearly 5 million addresses with 92 million ZRX tokens stand ready to defend their breakeven point in the range of $0.42-$0.40. This impressive army of potential buyers has the power to stop the sell-off and trigger a sharp recovery towards the above-mentioned bullish target.

At the same time, the holders' distribution data shows that 0x whales are buying tokens as the number of wallets holding over 1 million coins increased from 36 on September 8 to 40 on September 15. As the chart below shows, the price tends to go along with the whales' activity, meaning that the current divergence between the price and the holders' distribution metrics is likely to result in bullish momentum.

0x holders distribution

Source: Santiment

To conclude, 0x (ZRX) may use the channel support as a jumping-off ground for a healthy recovery with the first aim at $0.50 and $0.57. The market positioning data confirms the bullish outlook, as there are no significant supply areas along the line. On the other hand, a sustainable move below $0.42-$0.40 will invalidate the bullish setup and open up the way to $0.32.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Celebrity meme coins controversy continues amid Pump.fun revenue dominance

Pump.fun outperformed the Ethereum blockchain on Tuesday after raking in $1.99 million. Following this achievement, a meme coin based on actress Sydney Sweeney was the subject of controversy after its developers dumped their bags on investors.

PEPE's on-chain metrics indicate potential rally after weeks of silence

PEPE has struggled to see any significant price move after reaching an all-time high in May. Increased adoption rate and low MVRV ratio indicate a bullish run may be on the horizon. A single PEPE outflow from Binance worth $14.7 million gives credence to signs of bullish expectation.

Ethereum has failed to overcome key resistance despite bullish sentiment surrounding ETH ETF

Ethereum (ETH) is down more than 1.4% on Tuesday following another ETH sale from the Ethereum Foundation. Meanwhile, crypto exchange Gemini's recent report reveals that ETH ETF could see about $5 billion in net inflows within six months of launch.

Crypto community blasts Polkadot following report of treasury spending

Polkadot reports $87 million of treasury spending during H1. Crypto community members expressed harsh feelings toward the DOT team's high spending. DOT is up more than 2% in the past 24 hours but risks correction following the report.

Bitcoin: BTC price correction could end in July, according to seasonal data

Bitcoin (BTC) price appears poised for a decline this week, influenced by slight outflows in US spot ETFs, selling activity among BTC miners, and a combined transfer of 4,690.28 BTC to centralized exchanges by the US and German governments.

[15.47.38, 17 Sep, 2020]-637359441124776283.png)