XAU/USD

Gold price rose during early trading on Wednesday, after being stuck within a narrow congestion in past three days.

Fresh strength hit the highest in almost two weeks, though the wider picture shows the price moving within larger range ($2368/$2286) for the past couple of weeks.

Traders look for fresh direction signals, with Fed monetary policy and geopolitical situation being metal’s key drivers.

Markets await release of the minutes of FOMC last meeting (due later today) to get more information about Fed’s next steps, after the central bank’s Chairman Jerome Powell said on Tuesday that the US was in disinflationary path, but Fed needs more data before starts cutting rates.

The data from the US labor sector are also in focus, with ADP report from private sector due today and more significant NFP release on Friday.

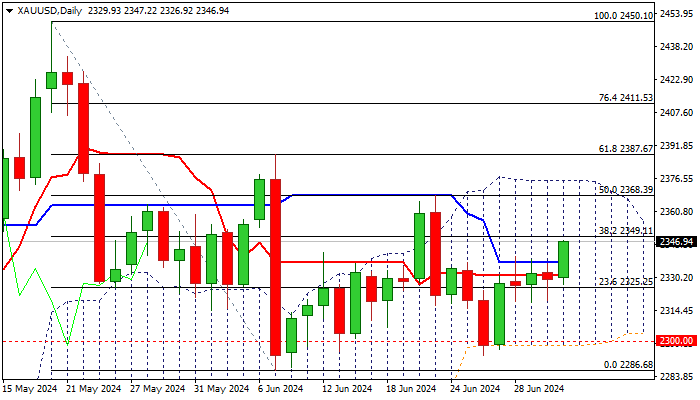

Technical picture turned firmly bullish on lower timeframes and improved on daily chart, although no clear direction to be expected while the price action stays within current range (also defined by the boundaries of daily Ichimoku cloud).

This signals that traders could play the range as long as short-term action is in sideways mode, with violation of any of range boundaries $2368/75 (50% retracement of $2450/$2286 / daily cloud top) at the upside or $2300/$2286 (psychological / daily cloud base / June 7 low) at the downside, to generate initial direction signal.

Res: 2350; 2368; 2375; 2387.

Sup: 2325; 2319; 2300; 2286.

Interested in XAU/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD climbs back above 1.0750 ahead of ADP, Fed Minutes

EUR/USD has regained lost ground above 1.0750 in the European session on Wednesday. The pair draws support from the renewed US Dollar weakness, in the aftermath of the dovish Fed Chair Powell's comments. Eyes turn to US ADP data, Fed Minutes.

GBP/USD retakes 1.2700, looks to US data/Fed minutes

GBP/USD is battling 1.2700 in European trading on Wednesday, attempting a modest bounce. Traders appear reluctant and prefer to wait on the sidelines ahead of the FOMC minutes while the UK elections on Thursday also keep them on the edge. US ADP data eyed as well.

Gold jumps toward $2,350, with eyes on key US events

Gold price is closing in on $2,350 in the European trading hours on Wednesday, staging a rebound amid a fresh leg down in the US Dollar. Gold price capitalizes on dovish Fed Chair Powell's remarks on Tuesday, which added to the September rate cut expectations. US ADP data and Fed Minutes on tap.

Bitcoin price struggles around $61,000 as German government transfers, miners activity weigh

U.S. spot Bitcoin ETFs registered slight outflows on Tuesday. The German Government transferred another 832.7 BTC, valued at $52 million, on Tuesday.

ADP Employment Change Preview: US private sector expected to add 160K new jobs in June

The United States ADP Research Institute will release its monthly report on private sector job creation for June. The announcement is expected to show that the country’s private sector added 160K new positions in June after adding 152K in May.