XAU/USD

Gold price rose further on Friday morning and pressuring important technical barriers ahead of release of key US NFP report.

The metal rose around 1.7% for the week so far, benefiting from weaker dollar on soft US macroeconomic data, which point to a slowing US economy and boost bets for possible Fed rate cut in September.

Economists expect that the US economy have added 191Knew jobs in June, compared to 272K increase previous month, with weaker than expected June NFP figure to add to recent signals and further lift metal’s price.

Conversely, above consensus June numbers would signal resilience of the labor market and fade expectations for rate cut which would make the yellow metal less attractive.

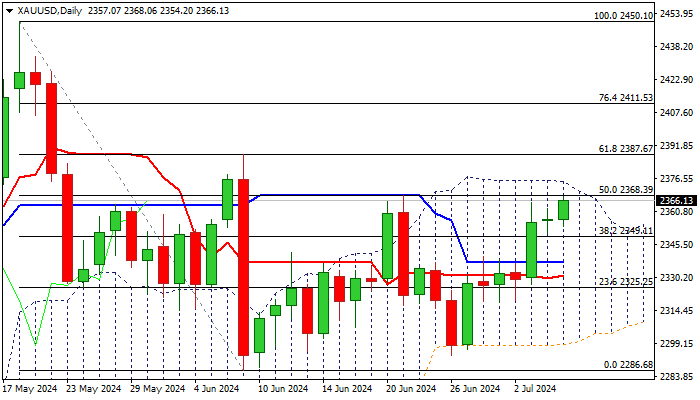

Technical studies remain overall bullish on daily chart, but strong obstacles at $2368/71 (50% retracement of $2450/$2286 / daily cloud top) need to be cleared to signal continuation of recovery from the higher base at $2290 zone and expose targets at $2387/$2400 (Fibo 61.8% / psychological).

Initial support lays at $2349 (broken Fibo 38.2%) followed by $2337/30 pivots (converging daily Kijun/ Tenkan-sen), loss of which will be bearish.

Res: 2371; 2378; 2387; 2400.

Sup: 2329; 2337; 2330; 2319.

Interested in XAU/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD retreats from daily highs, holds above 1.0800

EUR/USD loses traction but holds above 1.0800 after touching its highest level in three weeks above 1.0840. Nonfarm Payrolls in the US rose more than expected in June but downward revisions to May and April don't allow the USD to gather strength.

GBP/USD struggles to hold above 1.2800 after US jobs data

GBP/USD spiked above 1.2800 with the immediate reaction to the mixed US jobs report but retreated below this level. Nonfarm Payrolls in the US rose 206,000 in June. The Unemployment Rate ticked up to 4.1% and annual wage inflation declined to 3.9%.

Gold approaches $2,380 on robust NFP data

Gold intensifies the bullish stance for the day, rising to the vicinity of the $2,380 region following the publication of the US labour market report for the month of June. The benchmark 10-year US Treasury bond yield stays deep in the red near 4.3%, helping XAU/USD push higher.

Crypto Today: Bitcoin, Ethereum and Ripple lose key support levels, extend declines on Friday

Crypto market lost nearly 6% in market capitalization, down to $2.121 trillion. Bitcoin (BTC), Ethereum (ETH) and Ripple (XRP) erased recent gains from 2024.

French Elections Preview: Euro to “sell the fact” on a hung parliament scenario Premium

Investors expect Frances's second round of parliamentary elections to end with a hung parliament. Keeping extremists out of power is priced in and could result in profit-taking on Euro gains.