XAU/USD

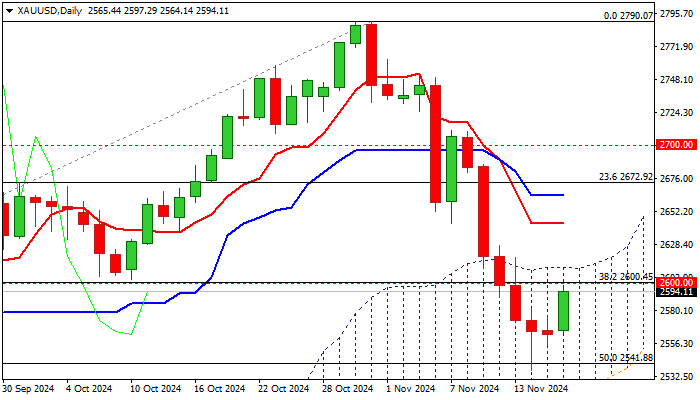

Bears are taking a breather after two-week pullback (down 6.5%) from new record high found footstep at $2540 zone (contained by rising 100DMA).

Gold price bounced from new two-month low on Monday after pullback faced strong headwinds from Fibo 50% of $2293/$2790 upleg and nearby daily Ichimoku cloud base, boosted by a pause in dollar’s recent strong rally.

Fresh gains eye initial pivots at $2600/11, former strong supports, reverted to solid resistances (broken Fibo 38.2% / psychological / daily cloud base), violation of which is needed to generate initial reversal signal and shift near term focus to the upside.

Recovery after the biggest weekly loss in more than three years (gold price was down 4.5% last week, strongly deflated by signals of Fed’s less aggressive stance on interest rates cuts ) still requires more information about the US central bank’s near-term rate trajectory, to generate clearer direction signal.

Sustained break above $2600 to ease downside pressure, however, rise through next technical barriers at $2633 (Fibo 38.2% of $2790/$2536 pullback / 10DMA) and extension through $2663 (50% retracement / daily Kijun-sen) to validate signal.

Also, deteriorating geopolitical situation on US’s green light for potential missile attacks deeply into Russian territory and their subsequent response that may lead into immeasurable escalation of the war in Ukraine, could be very supportive to safe-haven gold.

Res: 2600; 2611; 2643; 2663.

Sup: 2564; 2536; 2524; 2500.

Interested in XAU/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD holds steady above 1.0550 on modest USD weakness

EUR/USD struggles to gather recovery momentum but clings to modest daily gains above 1.0550 in the second half of the day on Monday. Although the US Dollar corrects lower following the previous week's rally, the cautious market mood makes it hard for the pair to push higher.

GBP/USD stabilizes above 1.2600 following previous week's drop

GBP/USD defends minor bids above 1.2600 in the American session on Monday, while the negative shift seen in risk sentiment caps the pair's upside. The Bank of England Monetary Policy Hearings and UK inflation data this week could influence Pound Sterling's valuation.

Gold benefits from escalating geopolitical tensions, rises above $2,600

After suffering large losses in the previous week, Gold gathers recovery momentum and trades in positive territory above $2,600 on Monday. In the absence of high-tier data releases, escalating geopolitical tensions help XAU/USD hold its ground.

Bonk holds near record-high as traders cheer hefty token burn

Bonk (BONK) price extends its gains on Monday after surging more than 100% last week and reaching a new all-time high on Sunday. This rally was fueled by the announcement on Friday that BONK would burn 1 trillion tokens by Christmas.

The week ahead: Powell stumps the US stock rally as Bitcoin surges, as we wait Nvidia earnings, UK CPI

The mood music is shifting for the Trump trade. Stocks fell sharply at the end of last week, led by big tech. The S&P 500 was down by more than 2% last week, its weakest performance in 2 months, while the Nasdaq was lower by 3%. The market has now given back half of the post-Trump election win gains.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.