- Donald Trump and Kamala Harris diverge on key aspects of economic policy, the most important issue ahead of the presidential election.

- While the presidency is crucial, the control of the Congress and Senate is needed to enact far-reaching changes.

- Both Democrats and Republicans have a good track record in terms of economic performance.

The United States (US) is heading into a historic presidential election, and ahead of the event, polls show a tight vote intention between the Republican candidate Donald Trump and the Democratic candidate, Kamala Harris. Uncertainty about who will rule the world’s largest economy weighs on financial markets, and sentiment related to the outcome will likely lead the way for the next two weeks. Both candidates have explained their plans, presenting vastly different approaches to economic policy, the most important aspect for Americans when deciding who to vote.

US Government organisation

But before jumping into the potential outcome and how it could affect the future of the US economy, let’s look at the government organisation.

The US is a democracy whose political system was inspired by the French philosopher Montesquieu.

Featuring a division of power, the government is divided into three branches, which have the ability to control each other mutually:

- Congress, is in charge of legislating.

- President, in charge of executing.

- Supreme Court, which functions as the judicial branch.

As per the electoral system, the US is called a two-party system. That means that two parties dominate the political field in all three levels of government. These two parties are the Republican Party and the Democratic Party. Other parties, often generally termed “third parties”, in the US include the Green Party, Libertarians, the Constitution Party and the Natural Law Party, according to the official definition.

The Republican Party: Donald Trump

The Republican Party is often referred to as the GOP. This abbreviation stands for Grand Old Party. Generally speaking, it supports right-leaning ideologies of conservatism, social conservatism, and economic libertarianism. Republicans broadly advocate for traditional values, a low degree of government interference, and extensive support of the private sector. To sum up, a Republican victory would mean:

- Emphasis on individual freedom.

- Lower taxes for all.

- Enhanced military funding.

- Values private healthcare services and a low degree of government interference.

- Substantial border control and deportation of undocumented immigrants.

The Democratic Party: Kamala Harris

The Democratic Party, on the other hand, generally represents left-leaning, liberal and progressive ideological values, thus advocating for a strong government to regulate business and support US citizens. Democrats believe in a powerful government that can ensure welfare and equity for all. To sum up, a Democratic victory would mean:

- Emphasis on community.

- Higher taxes, especially for high-income earners.

- Reduced military funding.

- Values equal access to some form of government-supported healthcare.

- For residency of certain undocumented immigrants.

US election process

US citizens vote for president and vice president every four years during the general election.

Major political parties nominate presidential and vice presidential candidates at their party’s national convention.

Most states hold primaries 6-9 months before a presidential election. Primary voters choose their preferred candidate anonymously by casting secret ballots. The state where the primary is held takes the results of the vote into account to award delegates to the winners.

The candidates’ names will be listed on the general election ballot, yet no direct vote exists. Ultimately, American voters will choose delegates to meet at a final convention, the so-called Electoral College, to decide who will run the world’s largest economy. Over 50% of the delegates must vote for one candidate for him or her to be appointed as presidential candidate, and a simple majority vote is not enough.

And there is one more caveat: it is not just about who wins the presidential run, but also which party controls the House, and if it is possible. After the 2019 election, control of the House hangs in the balance: Republicans hold a slim majority of 220 seats against the 212 held by Democrats. There are three vacant seats, formerly held by one Republican and two Democrats.

Closely divided Houses have become more common in the last few years and have made passing major legislation more difficult, albeit not impossible. The ideal scenario for big policy changes would be having the same-party control of all three legislative actors – the House, the Senate, and the Presidency.

Last but not least, there are seven swing states, also known as battleground states. Swing states are defined as those in which either the Democratic or Republican candidate can win. The outcome of those will likely determine the result of the 2024 election.

The seven swing states are Pennsylvania, North Carolina, Georgia, Michigan, Arizona, Wisconsin and Nevada. Together, they account for 93 Electoral College votes. In these seven battleground states, neither Kamala Harris nor Donald Trump have a definitive lead, as polls are very tight.

Economic performance under Republican vs Democratic governments

Generally speaking, Republican governments tend to favor limited government regulation of the economy. Business interests are above all.

Democrats, on the other hand, believe in intervening in the economy to regulate business. Social interests are at the top of the list.

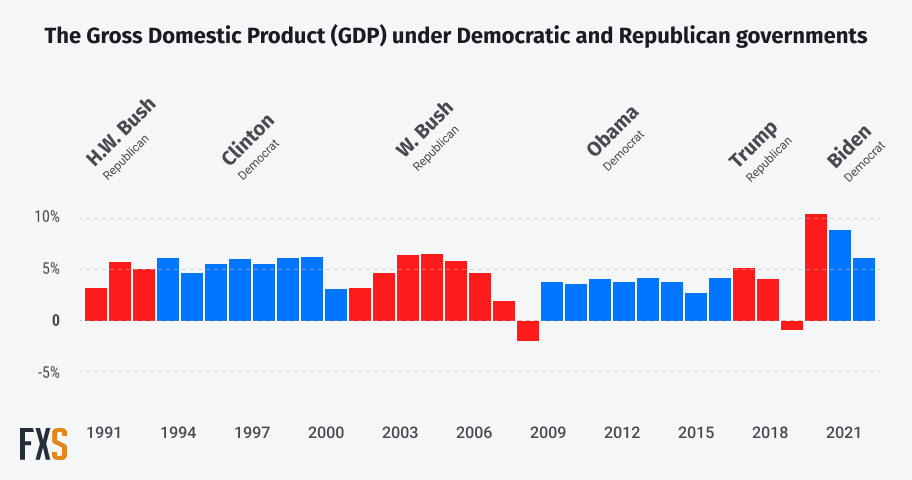

Historically, the US economy has grown faster, according to real Gross Domestic Product (GDP) measures, during Democratic presidencies. Additionally, the economy tends to produce more jobs, reduce unemployment, generate higher corporate profits and investment, and increase industrial production.

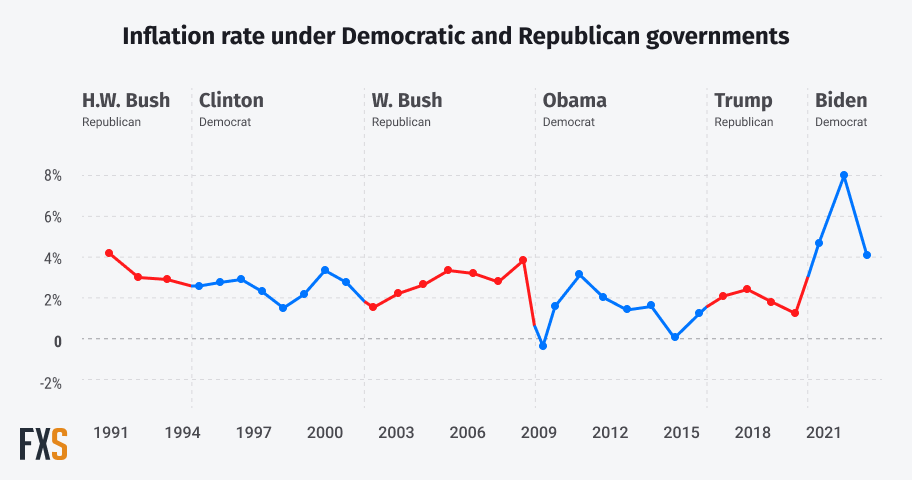

The reality, however, is that economic performance is affected not only by the US government but also by multiple international factors, such as wars, global economic performance, Oil prices, and many more.

Even further, the US government has run a budget deficit for decades, regardless of which party led the country. As a result, the role of the government in the economy has continued to increase.

The Democratic candidate, Vice President Kamala Harris, will likely continue with President Joe Biden’s agenda, which includes strong policies to maintain competition, preserve the environment, reduce the cost of living, support growth, racial equity, civil rights, and softer immigration laws. Her agenda also includes funding for small businesses.

Harris announced she plans fully forgivable $20,000 loans to Black entrepreneurs to start businesses, a $50,000 tax deduction for new small businesses and even proposed giving families a $6,000 tax credit for newborns in their first year of life and restoring a pandemic-era tax credit of $3,600 per child for middle and lower-class families.

These policies may increase the battered US debt but likely maintain the economy afloat. The Federal Reserve (Fed) will likely continue to trim interest rates as economic growth may remain sluggish but on track.

Former President Donald Trump, the Republican candidate, already claimed his government will be all about higher tariffs and lower taxes, which may make the US economy weaker and less competitive. Trump called tariffs “the most beautiful word in the dictionary” and said he’d use them to defend the US Dollar’s reserve currency status, mentioning up to 60% tariffs on Chinese products and 10% to 20% on other imports.

Tariffs are no joke, as this would increase prices for goods. The Fed may then have to interrupt interest rate cuts and, in the worst-case scenario, hike interest rates. That would result in what the country has already lived through these last few years: slowing growth, rising inflation, and higher unemployment.

A final note: the Committee for a Responsible Federal Budget noted that a Harris government will cost roughly $3.5 trillion. A Trump victory, on the other hand, will add to the country’s debt around $7.5 trillion.

Conclusion

The economy is a top concern for Americans in this year’s election. The US economy has performed well under both Trump and Biden’s administrations by almost all indicators such as growth or job creation, barring the Covid-19 pandemic shock.

While key aspects of economic policy diverge considerably between Trump and Harris (taxes, tariffs, spending, or immigration), the capacity of the government to implement far-reaching reforms will ultimately depend on who controls the House and the Senate.

Even in a scenario of full control of executive and legislative powers by the same party – currently unlikely, according to the polls – the US economy’s fortunes could be driven by external and unpredictable factors. In the end, the capacity of a president to exert decisive influence over the economy is more limited than what many voters perceive.

A Harris Democratic government seems to be the most benign in the current scenario regardless of political preference, as it will keep the US economy on the current path: easing inflation, lower financial costs, stable employment and modest growth. On the contrary, a Trump government grants tumultuous yet entertained times for financial markets.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds steady above 1.0800, looks to post weekly losses

EUR/USD trades marginally higher on the day above 1.0800 after the data from the US showed that Durable Goods Orders declined by 0.8% in September. Nevertheless, the pair remains on track to close the fourth consecutive week in negative territory.

GBP/USD extends recovery to 1.3000 area

GBP/USD extends its recovery and trades at around 1.3000 in the American session on Friday. The US Dollar struggles to gather strength as the market mood remains positive heading into the weekend, allowing the pair to hold its ground.

Gold fluctuates in narrow range below $2,750

Gold stays in a consolidation phase and fluctuates in a relatively tight range below $2,750 on Friday. US Treasury bond yields stabilize in the American session, making it difficult for XAU/USD to gather directional momentum.

Crypto Today: XRP, Bitcoin and Ethereum decline as Ripple files response to SEC appeal

XRP loses over 1.30% as Ripple's executive confirms the filing of an important document in the appeals process in the SEC lawsuit. Bitcoin corrects less than 1% and sustains above $67,500. Ethereum is down nearly 0.20%, holding above the key support level of $2,500.

US elections: The race to the White House tightens

Trump closes in on Harris’s lead in the polls. Neck and neck race spurs market jitters. Outcome still hinges on battleground states.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.