Two things: notice that the crowd could just as easily have picked the headline rate and ignored the core. It has done that before. This time the pre-existing sentiment led the crowd to “bias confirmation.” Also, the standard 30-year mortgage rate fell to 6.29% last week. We can’t wait to see where it goes after the Fed next week.

And consider that the one big problem in core was sticky housing costs. This is partly a function of the official data lagging the private sector numbers (like Zillow) and all rentals lagging by definition.

We are not so sure the 50-bp crowd will just go quietly away.. We can refute the idea it must be 50 bp because recession is upon us. We have no evidence of recession now or looming, and no “crisis” to shove the Fed into panic mode.

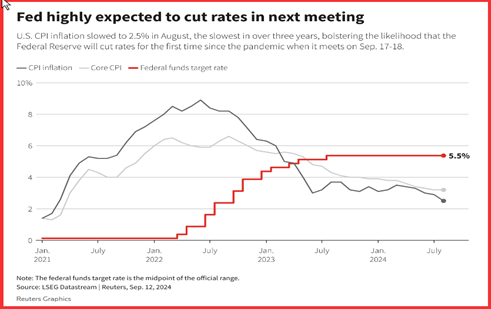

But setting the core CPI rise aside, headline CPI is nicely lower and even though the Fed looks at PCE and not CPI, it’s not inconceivable it could do 50 bp because the economy is so unresponsive/insensitive to interest rates, as Reuters wrote so well yesterday. Maybe it takes a mini-shock like 50 bp to wake up some entrepreneurial spirits, plus the housing market.

It’s a little funny that this morning a Bloomberg opinion says well, maybe 50 and the Fed can project everything is great and deserving of a boost. We too are inclined to wonder if 50 bp might not be possible—just. See the Reuters chart. It shows there is “room” for a bigger cut.

We give this less than a 50% probability for the September meeting next week but it could be something to keep in mind for the later two meetings this year—exactly as the betting shows (another 75 bp after September and with only two meetings left and no obvious need for an unscheduled meeting, one of them has to be 50 bp).

Traders are loathe to give up their big long euro positions and we keep seeing a dive and then a stubborn recovery. This seems to be a continuation of another same-old, same-old chapter in the long-standing anti-dollar bias. It’s somewhat the same in the dollar/yuan, which “should” never have fallen in the first place given the divergence in the two economies.

Since this is no longer a case of the overstated 50 bp rate cut, what is causing the dollar softness? Sentiment can be a fickle thing. It might even be a rise in risk appetite now that Trump has lost the presidential debate.

Political Tidbit: We thought Trump got some good blows early in the debate on Tuesday night, and sure enough, the die-harders are clinging to those few points. But the vast majority of the press and election bettors are all in one camp—Trump showed himself a lying jackass and Harris did exceptionally well, especially at getting under Trump’s skin.

Actually, she had to recover from the first few minutes when Trump was still sane. We were appalled that Harris (nor the moderators) did not call out Trump for saying in the first few minutes that it’s foreign exporters who pay tariffs. Of course, it’s not, and Harris is right to call tariffs a sales tax, but she didn’t defend that point. We’d bet ten dollars the majority of Americans missed that point entirely.

She did, however, make all the other critical points. We especially like her citing the Goldman view that recession will ensue in mid-year 2025 if Trump gets his policies. She also made the point very clearly that foreign leaders are laughing at Trump and his own military leaders say he is unfit for office, and he was the nitwit who started the withdrawal from Afghanistan and invited the Taliban to Camp David.

Harris “won” the debate according to the FT, WSJ, NYT, Washington Post, Reuters, Bloomberg, NY Magaizne, European banks (ING) and TV comedians. Winning the debate is not the same thing as winning the election, and let’s not forget that Clinton won the debate, too. But it could be a critical boost among the undecideds. We say that anyone who is still undecided must be as dumb as two bricks, but never mind.

Ahead of the debate around 4 pm, the Silver Bulletin had the polling at 48.9% Harris, 46.7% Trump, marking the end of early Harris post-convention euphoria. By late yesterday, the polling had 48.7% for Harris, 46.7% for Trump. Harris lost a few points!

The Trump style is sullen, defensive, angry, negative. The Harris style is calm, positive and forward looking. Does style matter? Yes, probably. Trump never once looked at Harris, which means something—fear? disdain? disrespect? He got sidetracked on the crowd size and notice of early rally leavers, and strayed off into people eating cats and dogs, which was both untrue and stupid. Everyone knows you can eat much better than Furby and Fido at the dumpster behind restaurants and you don’t have to skin the cat.

As an aside, some observers noted that Trump’s ear shows no sign of the sniper bullet wound. Some Trump supporters complain the moderators were biassed because Trump was the only one fact-checked, to which the response is that Trump was the only one on the stage telling lies. The most egregious—he had” nothing to do” with the Jan 5 insurrection.

Trump clung to the idea that he won the election and it’s only because of cheating and corruption that it was called for Biden. Trump’s lack of support for Ukraine and refusing to say he would not approve a national abortion ban were important, but we suspect the power of a pundit comment, that after Harris said Trump doesn’t talk about you, the viewing public, he proceeded to talk about himself, making the point.

Other points: after both Cheneys announced they would vote for Harris, Taylor Swift released on many social media platforms that she supports Harris and signed herself “childless cat lady.” It was an exceptionally well-written piece, too.

Before the debate, Fox asked both parties for another debate in October. By 10 am, both parties signaled they are willing, but by noon, Trump was retreating. He says he won but of course he knows he lost, horribly.

TV interviews show an alarming percentage of average folks did not watch the debate. In the 2020 election, some 84 million persons watched the first debate. We can’t yet find the count of TV watchers this time, although now we have streaming all over the place, the cable and airwave TV count may not be relevant.

One thing we want to know—how many people in Europe and elsewhere in the world watched the debate?

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

Japanese Yen rises following Tokyo CPI inflation

The Japanese Yen (JPY) gains ground against the US Dollar (USD) on Friday. The USD/JPY pair pulls back from its recent gains as the Japanese Yen (JPY) strengthens following the release of Tokyo Consumer Price Index (CPI) inflation data.

AUD/USD weakens to near 0.6200 amid thin trading

The AUD/USD pair remains on the defensive around 0.6215 during the early Asian session on Friday. The incoming Donald Trump administration is expected to boost growth and lift inflation, supporting the US Dollar (USD). The markets are likely to be quiet ahead of next week’s New Year holiday.

Gold price remains subdued despite increased geopolitical tensions

Gold edges lower amid thin trading following the Christmas holiday, trading near $2,630 during the Asian session on Friday. However, the safe-haven asset could find upward support as markets anticipate signals regarding the US economy under the incoming Trump administration and the Fed’s interest rate outlook for 2025.

Floki DAO floats liquidity provisioning for a Floki ETP in Europe

Floki DAO — the organization that manages the memecoin Floki — has proposed allocating a portion of its treasury to an asset manager in a bid to launch an exchange-traded product (ETP) in Europe, allowing institutional investors to gain exposure to the memecoin.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.