What happens to the economy if the stock market gets the willies?

Outlook:

We get US housing data all week, including starts and permits tomorrow and existing home sales on Friday, all likely to show robust growth. Today is the Empire State and Thursday is the usual jobless claims. Wednesday brings the Fed minutes. The Empire State August survey is expected to rise to 19.0 from 17.2 the month before and the National Association of Home Builders housing market index will likely hold at the same 72.

We doubt there is anything much here to impress markets. The Dems hold their nomination convention starting tonight and the Republicans do it next week, both meetings not something the financial markets care much about, although the Disrupter-in-Chief is no doubt looking for something to grab headlines from the Dems, perhaps some new attack on China.

We also get the TICS report on capital flows, but it’s unreadable (no doubt on purpose) and therefore never moves markets even when it should or might. Earnings might be more interesting this week than usual, including Home Depot, Walmart, Kohl’s and BJ’s, all beneficiaries of the current situation.

One tidbit we might note—in a country where some 20% of households say they don’t have enough money to feed their children, other households are spending money, including those government checks, on home remodeling, hence high hopes for Home Depot earnings. In a Real Crisis, you would expect consumers to save that money, and while savings are indeed higher, the recovery in retail sales shows either the US consumer is deeply stupid or has boundless optimism or perhaps believes the government will come through in the end.

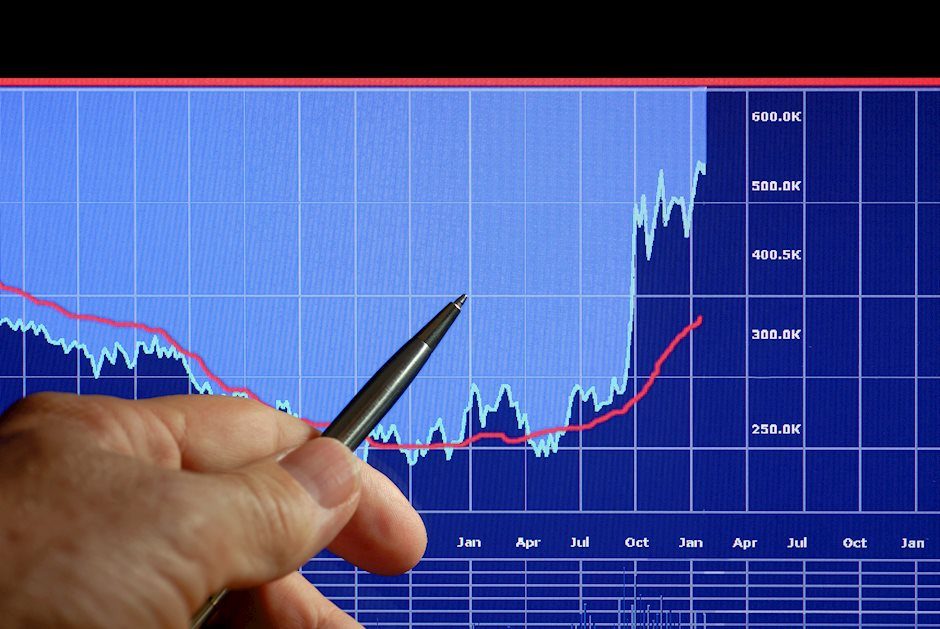

These two things might be connected: the stock market persists in not only hanging on but building new highs and at the same time, retail sales recovered (if with a different composition). We should probably ask what happens to the economy if the stock market gets the willies.

We suspect the euro is going to thrive and put in new highs, at least for a while, as we await some mover and shaker, unless Trump’s next disruption engenders risk-off.

US Politics: The battle over the post office is getting hotter by the minute. House Speaker Pelosi recalled the House from vacation to deal with it. To be fair, the letter from the postal service to the states about not being able to process mail-in votes properly was devised and sent out before the Trump guy got the top job. In other words, the post office was already in deep trouble before Trump got his grubby hands on it.

Postal service is mandated in the Constitution (thank you, Benjamin Franklin) and was never intended to be a self-sufficient business, that that doesn’t stop the Republicans. When this nonsense first began decades ago, it was a joke that maybe the Army should be a self-sufficient business, too (i.e., the US could rent it out as mercenaries).

Ironically, the postal service could be run as a business—the UK did it with the Royal Mail in 2013—if Congress would stop imposing ridiculous regulations and limitations, which have indeed made it almost comically inefficient. Still, making it even less efficient is just plain stupid, unless you have a hidden agenda, like suppressing the vote. Even some Republicans are offended by this particular Trumpian assault on institutions, even though suppressing the vote generally benefits the Plubs. One leader showing up well is Mitt Romney, who also voted to impeach. Golly, one guy with principles.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat