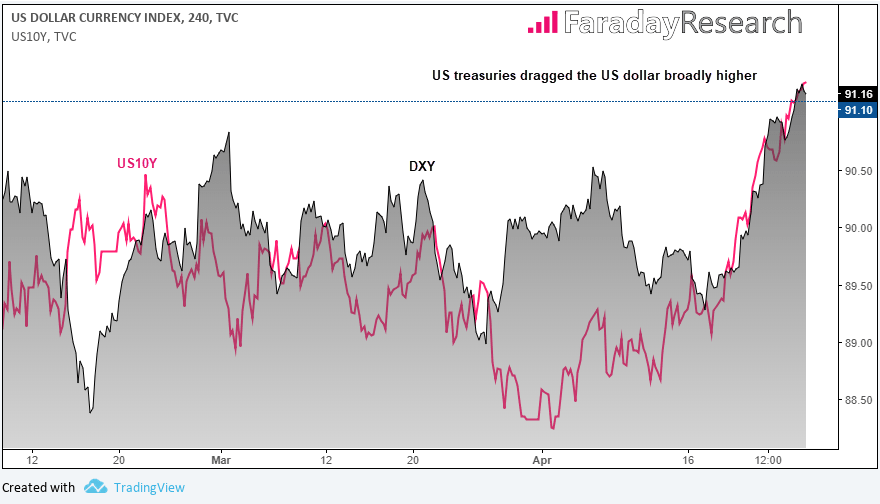

The threat of inflation and Fed hikes has pushed US yields higher and, for now at least, we’ve seen the return of the positive correlation with the US dollar. In doing so USDCHF has broken out from between a rock and a hard place, EURUSD and AUDUSD broke their long-term bullish trendlines and, not wanting to miss out NZDUSD threw itself from the top of a tall building. Well, now USDJPY wants in on the action.

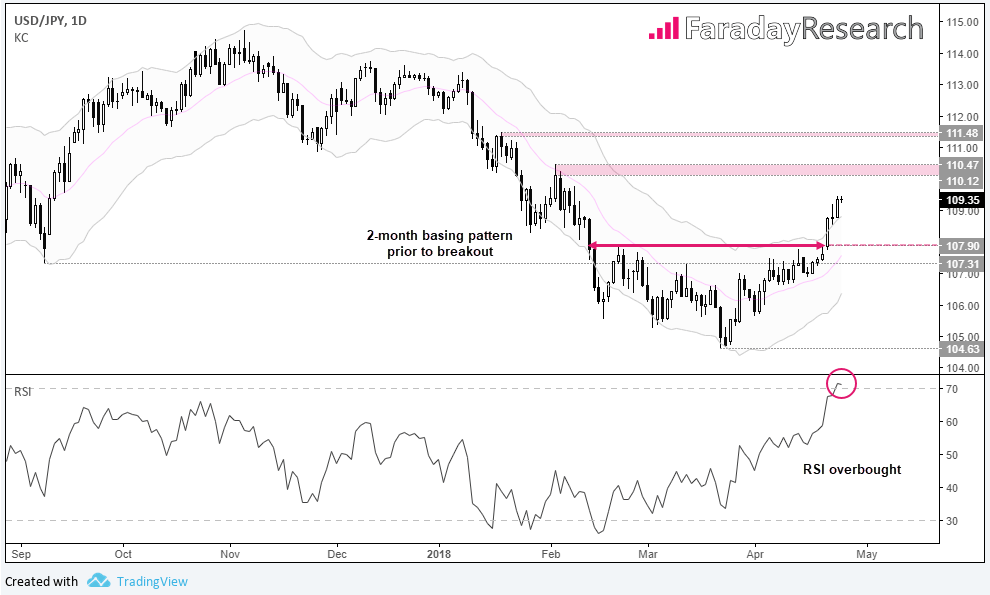

It was the US 10yr push for 3% which finally saw USDJPY perk up and break above 108 on Monday. With a 1% range it was its most volatile session in four weeks, made more compelling by the fact it broke key resistance and blew out of a 2-month basing pattern.

Ultimately, we remain bullish on USDJPY but Monday’s parabolic break above 108 has pushed USDJPY above the upper Keltner band for a fourth session (so far). If this is to be met with signs of exhaustion, the potential for a retracement grows. But it’s interesting to note that yesterday’s range expansion closed above Tuesday’s Doji which is likely enticing to bullish intraday traders. But if you prefer to enter on the daily timeframe, we suggest you question whether the reward is worth the risk given how extended the move is.

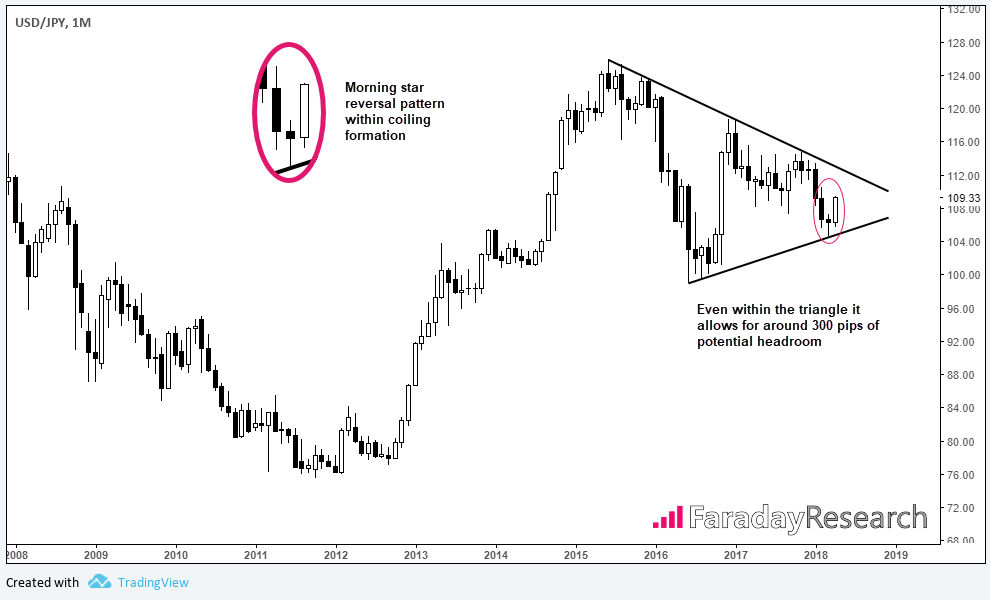

The 110.12/47 highs make for a likely target given they are a key structural level. And if we are to see a break of 110.47 (February’s high) JPY would then be trading above a monthly morning star reversal pattern.

The monthly chart is coiling and, even if any upside break were capped by the upper trendline there’s still potential for 250-280 pips headroom. For now we’ll step aside as the BOJ meeting is tomorrow and, even though odds of a change of policy are minimal, they have been known to throw in a surprise or two over the years. But if following the event the technical picture allows, perhaps we can try to capitalize on a bullish trade.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0850 area as mood sours

EUR/USD stays under bearish pressure and trades deep in negative territory near 1.0850 on Tuesday. The US Dollar benefits from safe haven flows and weighs on the pair as investors adopt a cautious stance ahead of this week's key earnings reports and data releases.

GBP/USD closes in on 1.2900 on US Dollar recovery

GBP/USD is on the defensive toward 1.2900, struggling to find a foothold on Tuesday. The US Dollar holds steady following Monday's pullback amid a negative shift seen in risk sentiment, not allowing the pair to regain its traction.

Gold reconquers $2,400, lacks directional momentum

Gold stages a rebound and trades above $2,400 on Tuesday after closing the fourth consecutive trading day in negative territory on Monday. The pullback seen in US Treasury bond yields help XAU/USD cling to modest daily gains despite the US Dollar's resilience.

Bitcoin price struggles around $67,000 as US Government transfers, Mt. Gox funds movement weigh

Bitcoin struggles around the $67,000 mark and declines by 1.7% at the time of writing on Tuesday at around $66,350. BTC spot ETFs saw significant inflows of $530.20 million on Monday.

Big tech rebound ahead of earnings, Oil slips

/stock-market-graph-gm532464153-55981218_XtraSmall.jpg)

Tesla and Google are due to report earnings today after the bell, and their results could shift the wind in either direction. Despite almost doubling its stock price between April and July, Tesla sees appetite for its cars and its market share under pressure.