USD/JPY Weekly Forecast: The Omicron identity

- Omicron panic on Friday November 26 set the week’s stage.

- Currency and Treasury markets waiting for proof the variant is dangerous.

- US NFP weakens Treasury yields and the dollar as payrolls miss forecast.

- The FXStreet Forecast Poll predicts a technical rebound.

Last Friday’s reaction to the discovery of the new Omicron variant set the stage for this week’s trading. The Japanese yen’s long standing safe-haven status drove the USD/JPY down 2%, by far the largest US dollar loss for the day. A collapse in US Treasury yields undermined the greenback in all major pairs except the USD/CAD which was aided by a 12.8% plunge in West Texas Intermediate. The US 10-year Treasury yield lost 16 basis points on the day, closing at 1.482%.

Markets remained wary all week as Omicron case reports began to trickle in from various countries and US states, even though there were no indications of heightened danger or vaccine avoidance from the new strain. Preliminary observations from the doctor in South Africa who identified the first mutated virus noted the cases she had seen were all mild without complications.

Monday’s close at 113.66 was the high for the week and the Tuesday drop to 112.52 was the lowest trade since October 11. Wednesday’s close below 113.00 support at 112.81 did not generate an attempt at the weakly defended passage to 112.25.

Markets are waiting for information on the new variant. Virus mutations are a matter of course, and the normal evolution is toward higher transmission and lower lethality.

The Treasury market yield panic was not mitigated by Federal Reserve Chair Jerome Powell’s twin comments that it might be time to retire the ‘transitory’ description of inflation and that an advancement in the pace of the taper might be in order at the December 15 Federal Open Market Committee (FOMC) meeting.

The US Nonfarm Payroll report on Friday missed its headline forecast of 550,000 new jobs producing just 210,000, but in other respects it illustrated how far the labor market has come this year.

Unemployment fell to 4.5% and underemployment dropped to 7.8%, both far better than predicted, and the lowest of the pandemic. The labor participation rate climbed to 61.8% its highest since March 2020.

Purchasing Managers’ Indexes (PMI) for the manufacturing and service sectors were strong. Overall PMI in service set an all-time record at 69.1. The New Orders Index was unchanged at 69.7, another record and much better than the 64 projection. Initial Jobless Claim rose to 222,000 in the latest week from 194,000 prior, indicating that the labor market continues to heal.

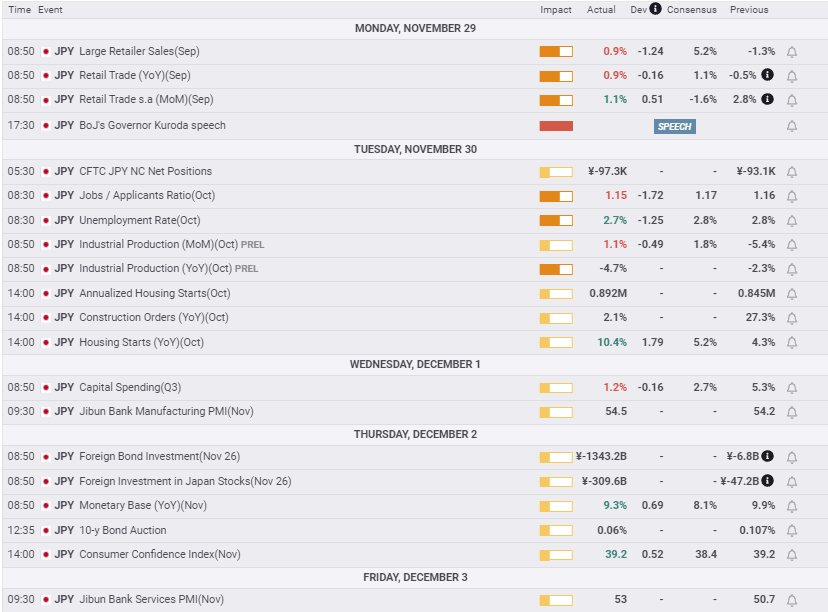

Japanese economic information was mixed with little market impact. Retail Trade (sales) was slightly weaker than forecast for the year in September, though purchases at large stores were just 0.9%, less than a fifth of the 5.2% estimate. Industrial Production in October was weaker than predicted and the annual change was -4.7%, its worst reading since January.

USD/JPY outlook

Last week’s panic reaction to the Omicron advent is the fulcrum for the USD/JPY and markets in general. At question are the objective considerations about the health danger and contagion of the strain but also how governments will respond.

If the new virus is less difficult but more transmissible, governments may still opt for restrictions and closures that will inhibit the global recovery. The plunge in oil prices and their limited return is a clear indication that commodity markets view new lockdowns as a distinct possibility.

Credit markets take the same jaundiced view, that central banks, as governments, will respond to any new problem as they answered the previous ones.

If the Omicron strain shows to be little different in outcome, it will take time for markets to accept that conclusion. Governments around the world are not likely to downplay the new variant but to use it as a pressure to supplement current economic and social restrictions.

In this week’s trading, the USD/JPY barely moved from its panic close last Friday at 113.13. Omicron is an unresolved issue. Given the weakness of support in the USD/JPY below 113.000 and the possibility that new economic restrictions will be forthcoming in many countries, the bias in the USD/JPY is lower.

If there is widespread notice that Omicron is not a threat, the USD/JPY will quickly regain the initiative.

Economic data in Japan and the United States in the week ahead will be background to the Omicron saga.

In Japan, Labor Cash Earnings and Overall Household Spending for October will open fourth quarter consumer information. Spending is expected to fall for the third month in a row. The Eco Watchers Survey, which tracks regional economic trends, is forecast to show a decline in current outlook and stability for the immediate future. The Producer Price Index is predicted to jump 0.5% to 8.5% in November.

In the US, CPI for November on Friday will be the main event. The overall rates is expected to rise to 6.8% from 6.2% and core to reach 4.9% from 4.6%. These results will reinforce the Fed's taper prospects, regardless of Omicron developments.

Japan statistics November 29–December 3

US statistics November 29–December 3

FXStreet

Japan statistics December 6–December 10

FXStreet

US statistics December 6–Decemebr 10

USD/JPY technical outlook

The MACD (Moving Average Convergence Divergence) cross last Friday and the widening divergence since then is a sell signal. Interestingly, the Relative Strength Index is only weakly negative for the USD/JPY. Except for the initial move last Friday, there is no momentum lower. This is clearly shown in the True Range which has sharply decreasing momentum since the move on November 26 and finished at the low point for the week. These indicators are mixed, reflecting the non-technical nature of the Friday swoon inthe USD/JPY.

The 21-day moving average (MA) at 113.92 offered no support to the USD/JPY in its plunge last Friday and the 50-day MA at 113.40 performed the same in Tuesday's descent. These average will likely perform quite differently if the USD/JPY reverses as both abut substantial resistance lines. The 100-day MA at 111.64 is part of support at 111.60.

Resistance lines will be more difficult to negotiate due their recent vintage and their greater trading volume. The support gap between 112.80 and 112.23 is a draw for any market that moves below 113.00.

Resistance:113.20, 113.65, 114.00, 114.40, 114.85

Support: 12.80, 112.23, 112.00, 111.60, 111.40

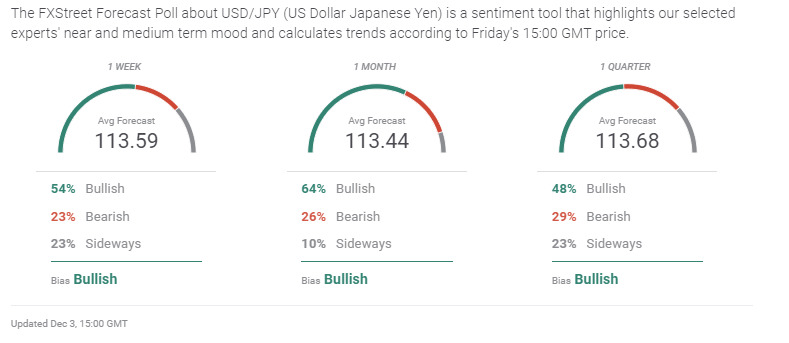

FXStreet Forecast Poll

The FXStreet Forecast Poll takes the technical view that a fundamentally bid USD/JPY will recover from any weakness. This ignores the ramifications of a potentially revived pandemic.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.