USD/JPY Weekly Forecast: Look to your 2021 profits

- USD/JPY loses 111.00 on Monday and 110.00 on Thursday.

- Treasury yields fall, 10-year return drops below 1.3% on Thursday.

- US economic statistics put the USD/JPY at risk as recovery concerns rise.

- The FXStreet Forecast Poll predicts little profit-taking risk to USD/JPY.

The US economic recovery remains on track, just try scheduling a kitchen renovation and contractor before Christmas. Even in the hospitality sector, restaurants, hotels and travel, June employment saw the largest employment increase in 18 months. People are working and they are spending.

Yet the USD/JPY is lower on the week, stocks fell on Thursday and Treasury yields have been sliding since the Fed meeting on June 16. The expectations for a powerful US rebound have been so overstated that a more realistic view was probably inevitable.

Will the sustained weakness in hiring abate once the supplemental federal unemployment expires in September, easing the labor shortage that is stymying full recovery? Services and manufacturing employment indexes contracted in June and initial jobless claims rose in the latest week. Or will consumer demand fade in the fall as millions of workers lose their immediate income?

Japan’s data gave scant evidence that the island economy is improving. Labor Cash Earnings and Overall Household spending in May were slightly ahead of forecasts but with rising COVID rates they are less than relevant. Japan has already declared an emergency in Tokyo due to the fast-spreading strain, but Japan’s vaccination rate is one of the lowest in the developed world.

After a year-and-a-half of COVID, the US is finally losing the last restrictions, but how will the new Delta variant, less dangerous but more communicable, affect the recovery? Federal Reserve Chair Jerome Powell and the June Projection Materials acknowledged the good economy, and a bond taper is clearly the next policy move, but there is no evident urgency in official comments. Chair Powell’s observations in his news conference did nothing to advance the timetable. There is one more FOMC meeting in late July before the bank’s annual Jackson Hole symposium at the end of August, which is expected to be a platform for explaining the logic and timing of a policy change.

A reduction in the $120 billion bond purchase program, which seemed so close in May and June, has been put off into an interminable future.

The Treasury yield curve has considerably flattened in July but the reduction in long-term rates removes the premium that had been installed in anticipation of a pending taper, it is not a judgement on the condition of the US economy.

The 10-year yield dropped 16 basis points to close at 1.288% on Thursday, its first finish below 1.3% since February 18.

10-year Treasury yield

CNBC

The 30-year yield dropped below 2% on Wednesday, the first since February 11 and closed at 1.91% on Thursday.

In contrast, the 2-year return has fallen just 8 basis points from its 0.27% high on June 25 to its 0.192% close on Thursday.

2-year Treasury yield

CNBC

The dollar performance this week is a reminder that foreign exchange values are established in pairs.

American economic statistics have been somewhat equivocal this month, primarily in the labor market, but the dollar has lost little of the edge established since the June Federal Open Market Committee (FOMC) meeting.

American growth and pandemic prospects are, with the possible exception of the UK, the happiest in the world and that is reflected in the dollar’s position.

The Fed forecasts of 7% growth and 3.4% headline inflation are the envy of central banks everywhere. Except for the Bank of Canada which has reduced its monthly bond purchases by one billion Canadian dollars, a move possible only because the Fed is still pumping $120 billion into the US economy, the projection of two rate increases in 2023 is a most optimistic official pronouncement.

USD/JPY outlook

The dollar needs good US statistics, particularly in the job market, and rising or at least stable Treasury yields, to improve.

Given the precipitous drop in long-term interest rates the dollar’s resiliency is testimony to the relative position of the US economy versus its currency competitors. The US is still in better shape than all of its trading partners, even the UK will not fully lift its COVID restrictions for another ten days.

Headline inflation data is expected to confirm the Fed’s temporary thesis with a slight drop in June’s annual rate but there will be no market reaction.

Retail Sales on Friday is another story. The US economy is consumer driven and after May’s larger-than-expected drop in consumption a healthy rebound in June is needed for reassurance. If that is not forthcoming the speculation that the recovery is slowing will grow, Treasury rates could fall and the dollar will likely drift lower.

Japanese economic data in the week ahead, Industrial Production for May, will provide no new information.

The Bank of Japan’s (BOJ) meeting and policy affirmation on Thursday could offer further liquidity support to the economy, perhaps through more stock purchases, but the pointlessness of BOJ efforts will not change.

The USD/JPY has had a good year. The dollar is 7.1% higher since January 4 and 1.9% to the good since April 23. The 23.6% Fibonacci line of the January to June run at 109.47 is just beneath Thursday’s low at 109.53, hardly a coincidence.

If US statistics do not offer confidence in the recovery the temptation to take profits on the six-month run could become overwhelming.

Japan statistics July 5–July 9

CNBC

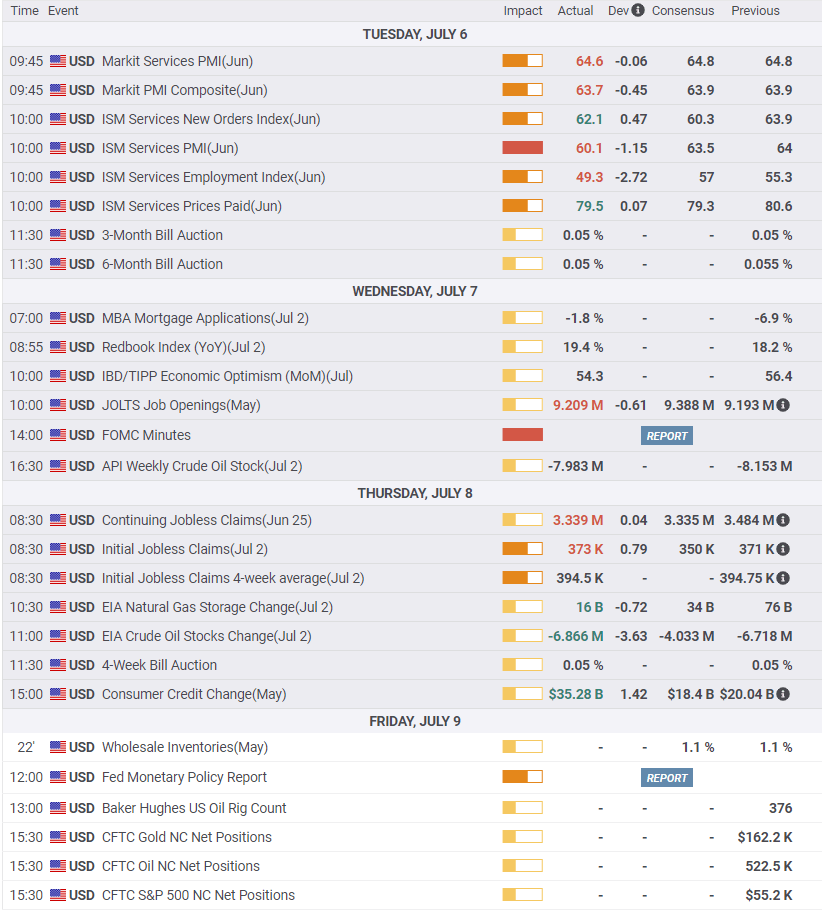

US statistics July 5–July 9

FXStreet

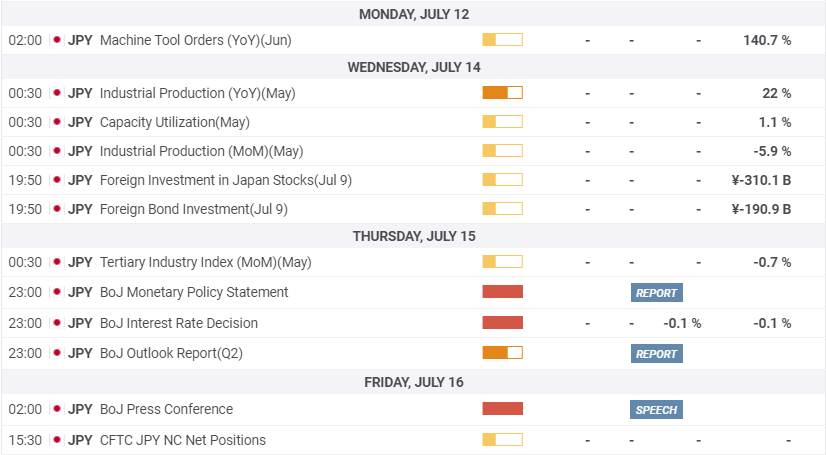

Japan statistics July12–July 16

FXStreet

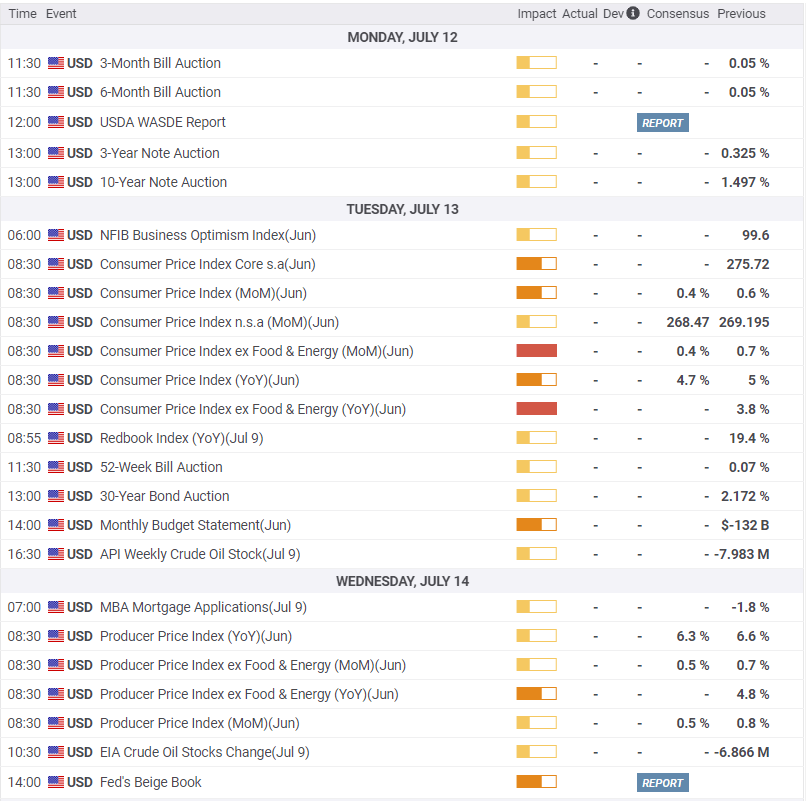

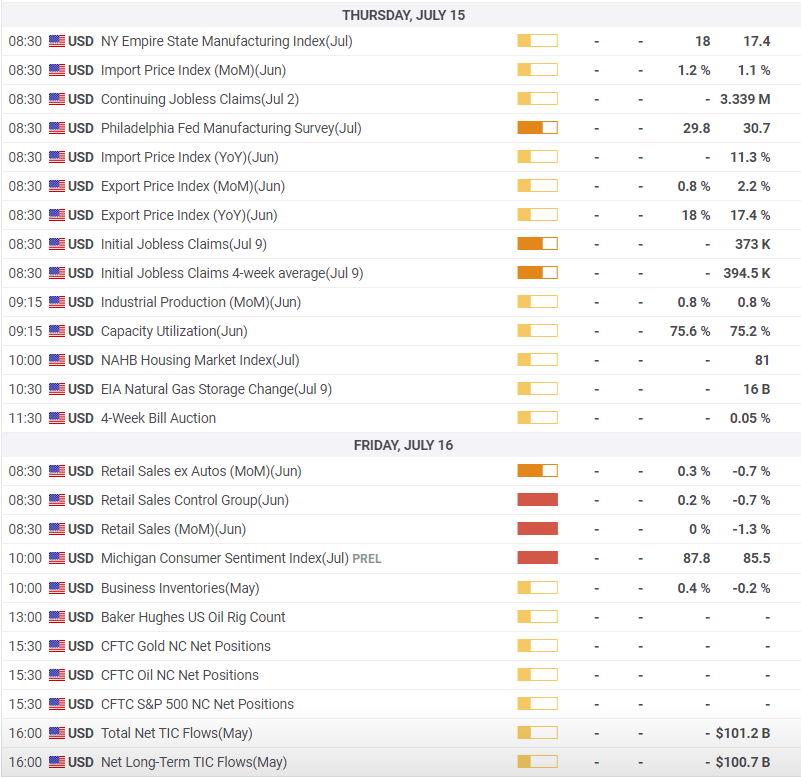

US statistics July 12–July 16

USD/JPY technical outlook

The dominant technical consideration is the latent profit potential of the USD/JPY ascent in the first half of the year. At 110.00 and above almost all of the 7.1% gain from January 4 to July 1 is unrealized. Thursday's drop referenced the 23.8% Fibonacci line then rebounded, but the deeper retrenchment to 38.2% at 108.20 awaits trader attention.

Momentum indicators have moved to the negative despite the Friday rebound. The MACD is now advising a sale though the Relative Strength Index (RSI) is nearly neutral at 50. True Range has considerable downward momentum, understandably since the USD/JPYdeclined in three of four sessions (it was flat on Wednesday) and has lost a figure on the week.

Moving averages (MA) are split with the 21-day at 110.55 forming a minor resistance line between 110.35 and 110.70. Support is more prevalent than resistance and has seen more trading but it is arrayed against potentially powerful profit motives.

Resistance: 110.35, 110.70, 111.00, 111.55

Support: 109.80, 109.25, 109.00, 108.75, 108.50, 108.00

FXStreet Forecast Poll

The FXStreet Forecast Poll predicts condolidation ahead but no large profit-taking declines.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.

%20ytech%201-637614362311916504.png&w=1536&q=95)

%20tech%202-637614362446294245.png&w=1536&q=95)