USD/JPY Weekly Forecast: Fed timing is everything

- US May inflation at 5% has small impact on the dollar.

- Treasury rates fall as markets expect no Fed action.

- Unless the June FOMC changes course, summer consolidation is here.

- FXStreet Forecast Poll shows the lack of direction in USD/JPY

The competing forces acting on the USD/JPY are in balance.

American economic growth in the first quarter was 6.4%, Japan’s economy contracted 3.9%. Second quarter US GDP is running at 9.3%, according to the Atlanta Fed estimate. Japanese activity is forecast to shrink in this quarter. Consumer inflation in the US soared to 5% in May. Japanese consumer prices dropped 0.4% on the year in April.

Where is the balance and why isn’t the dollar running away from the yen?

The answer is straightforward. The Federal Reserve does not think the economy, specifically the labor market, is sufficiently recovered and will not curb its bond purchases. Treasury rates will remain ultra-soft.

Government bonds rates in the US have fallen markedly since the March 31 high even though inflation has almost doubled from 2.6% in March to 5% in May and the economic growth has accelerated.

The 10-year Treasury yield has fallen 29 basis points from 1.746% at the end of March to 1.457% at Friday's open.

With US interest rates falling and inflation rising, rate differentials have moved modestly towards the Japanese in the last two months.

This balance between higher expectations for US growth and US interest rates, and the immediate reality of slightly better Japanese return, has kept the USD/JPY in a narrow 108.50 -110.00 range for the past two months.

Until the Fed governors change their mind and approach the tapering of bond purchases, little will change.

It is illogical to sell the USD/JPY with the US economy expanding at more than 9%, but it is also illogical to buy the USD/JPY with the Federal Reserve insisting that rate accommodation will remain in place for the foreseeable future.

It could be a very lackadaisical summer.

Japanese statistics have improved modestly but had little market impact.

The Leading Economic Index, which tracks short and medium term trends, has now been above 2020 levels for most of the year. Gross Domestic Product (GDP) in the first quarter was revised higher, though remaining negative. The regionally based Eco Watchers Survey has improved in outlook while drifting lower in its current assessment. The Producer Price Index (PPI) for May was a bit higher than forecast and April’s result was revised up, which should help to dent Japan’s deflation.

In the US, inflation was the news with the Consumer Price Index (CPI) soaring to 5% in May, the fastest price expansion in 13 years.

Here also, market effect was limited. The Federal Reserve considers the current inflation trajectory transitory and will maintain its bond buying program at $120 billion per month.

Initial Jobless Claims fell to another pandemic low and the Job Openings and Labor Turnover Survey (JOLTS) showed a record 9.3 million positions on offer in April. Except for the somewhat puzzling weak hiring in April and May, all evidence points to a recovered labor market.

USD/JPY outlook

The major unknowns for the USD/JPY and the currency market in general are the pending updated GDP, fed funds and inflation projections from the Federal Reserve that are due at the conclusion of its two-day meeting on June 16. No policy changes are expected.

Of secondary interest is the Bank of Japan (BOJ) meeting on Friday. No policy alterations are forecast but there is a possibility that the governors may undertake further anti-deflation measures which could undermine the yen.

In the last set of Fed Projection Materials in March, the bank posited 2.4% PCE inflation and 2.2% core at the end of 2021, 6.5% GDP, a 4.5% unemployment rate and the fed funds at 0.1% through the end of 2023. All except the fed funds were improvements from the prior projections in December.

Inflation is running hotter than the Fed projections. Headline PCE was 3.6% in April and core was 3.1%. May’s figures will be issued on June 25 and they can be expected to rise.

The 12-month average for CPI was 1.92% in May and it will increase over the second half of the year.

Fed Chair Jerome Powell and other officials have maintained that price gains are temporary and there is no need for a policy adjustment. The new inflation projections will reflect that position. The numbers will be high enough to reflect reality but not so high as to excite rate speculation.

The Fed and Mr. Powell will chart a very careful course in order to keep the bond market and Treasury rates in check until the governors judge appropriate.

Until the Fed resumes its public discussion of the bond program, which of course means tapering purchases however the words are couched, the dollar will be unable to capitalize on US economic performance.

The USD/JPY will be restrained until the FOMC meeting and probably after. Consolidation Is the order of the day.

Markets know where US rates are headed. Timing in this case, is everything.

Japan statistics June 7–June 11

US statistics June 7–June 11

FXStreet

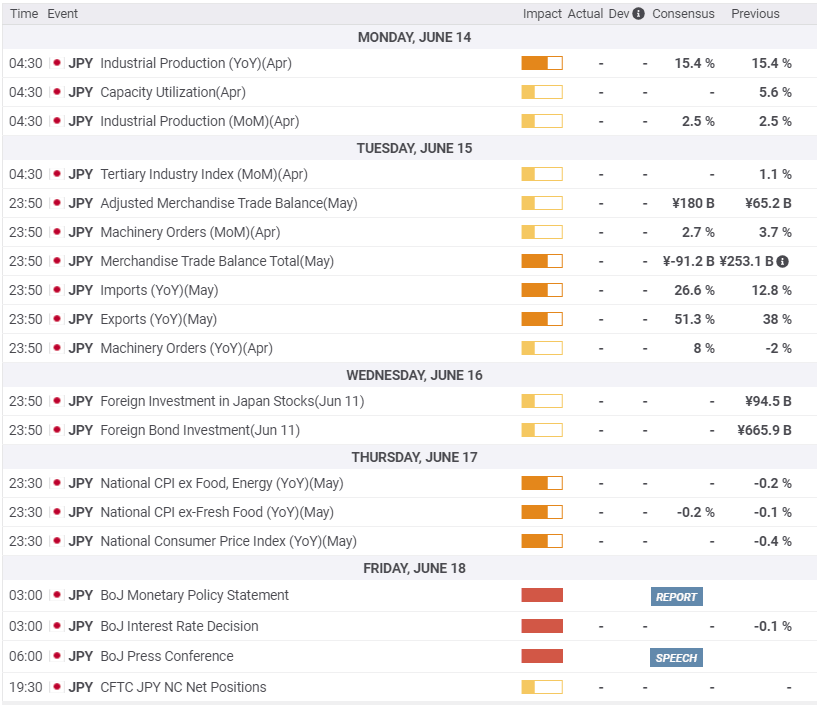

Japan statistics June 14–June 18

The Bank of Japan meeting on Friday will be overshadowed in market attention by the Wednesday Fed meeting. Nevertheless there is a reasonable chance the BOJ will undertake additional anti-deflationary measures. If it does so the extra liquidity will not have any practical effect on prices in Japan but it will add to yen weakness. National CPI for May on Thursday may give an indication of the BOJ's intent. The headline price index has been negative for seven straight months.

FXStreet

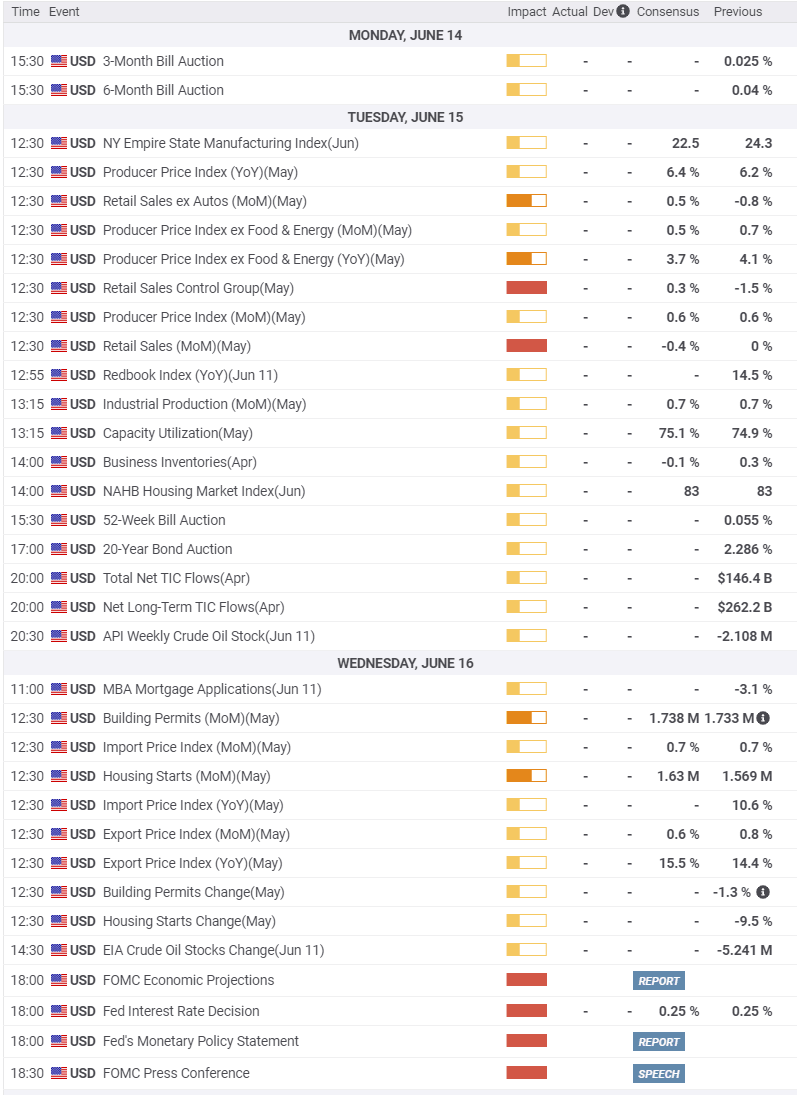

US statistics June 14–June 18

The Federal Reserve meeting on Tuesday and Wednesday dominates next week. No change is expected in policy or the bond program but the economic projections will be of utmost interest. Markets are looking for any clue to Fed rate timing. Inflation will be the central focus. The March version had PCE inflation at 2.4% and core at 2.2% at year end. The higher that projection moves, the closer a bond taper becomes. The Treasury market and US rates will react if the forecast warrants.

FXStreet

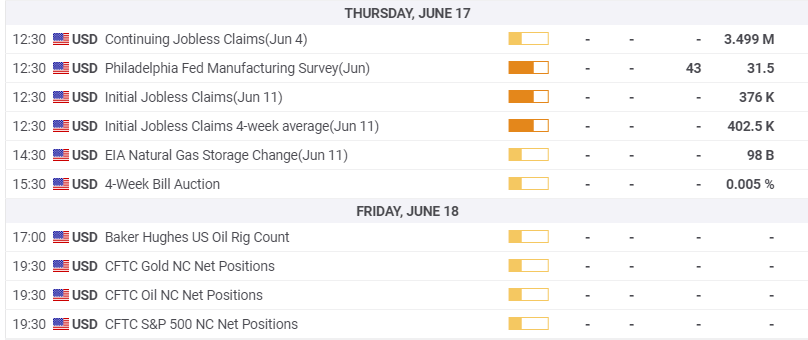

USD/JPY technical outlook

The USD/JPY's minor gain this week brings it to the higher side of its six-week range, just as the trading for most of May plumbed the lower side of its 108.50-110.00 spread. Neither fundamental or technical analysis provides much direction. Fundamentals are tied to the US Federal Reserve's temporizing policy position and the BOJ's lack of credible rate tools.

The MACD is neutral as is the Relative Strength Index (RSI) and True Range show scarce momentum. Given the limited ranges of the past few week's and the only occasional volatility that is expected.

Support lines have more participation and are stronger but the balance with resistance is as even as the fundamental drivers. The USD/JPY rebounded from the 21-day moving average at 109.36 on Friday for the only real technical involvement this week.

It is only the second week of June but the summer doldrums may have arrived.

Moving Averages: 21-day 109.36, 100-day 108.06, 200-day 106.28

Resistance: 110.00, 110.35, 110.70

Support: 109.35, 109.00, 108.50, 108.00

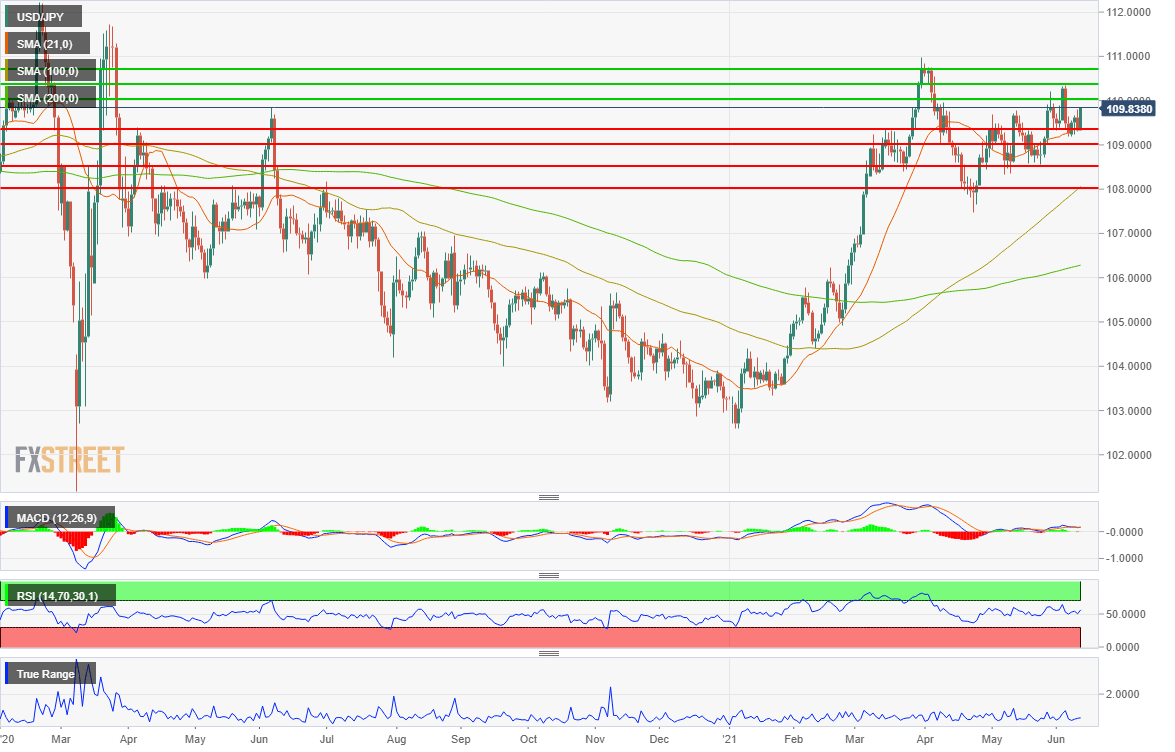

FXStreet Forecast Poll

The FXStreet Forecast Poll portrays the complete stasis of the USD/JPY with a 17 point range extending to the quarter. Markets await the next Federal Reserve move.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.