USD/JPY Outlook: Seems vulnerable near two-month low, bears could pause ahead of FOMC minutes

- USD/JPY drops to over a two-month low and is pressured by a combination of factors.

- Dovish Fed expectations and declining US bond yields continue to weigh on the USD.

- Narrowing the US-Japan rate differential and bets of a BoJ policy shift boost the JPY.

- Traders now look to the crucial FOMC meeting minutes for some meaningful impetus.

The USD/JPY pair remains under heavy selling pressure for the fourth successive day on Tuesday – also marking the fifth day of a negative move in the previous six – and dives to over a two-month low heading into the European session. With the latest leg down, spot prices have retreated over 450 pips from the 152.00 neighbourhood, or the YTD peak touched earlier this month, and seem vulnerable to depreciate further amid the prevalent selling bias surrounding the US Dollar (USD).

The incoming disappointing US macro data pointed to a slowing jobs market and easing inflationary pressures, eliminating any surviving bets of further rate increases and fuelling speculation about a series of rate cuts in 2024. In fact, the rate-sensitive 2-year US government bond yield remains below the current 5.25%-to-5.50% Fed funds target, suggesting that the momentum in Favor of policy easing is building. Furthermore, the CME’s Fedwatch tool points to a roughly 30% chance that the Fed will start cutting rates as soon as March 2024 and a nearly 100 bps of cumulative rate cuts by the year-end. The dovish outlook, in turn, drags the USD Index (DXY), which tracks the Greenback against a basket of currencies, to its lowest level since August 31 and supports prospects for a further depreciating move for the USD/JPY pair.

A further decline in the US Treasury bond yields, meanwhile, results in the narrowing of the US-Japan rate differential. This, along with speculations that the Bank of Japan (BoJ) will almost certainly end its negative interest rate policy by early next year, might continue to boost the Japanese Yen (JPY) and validate the near-term bearish outlook for the USD/JPY pair. Investors, however, remain uncertain over the timing when the Fed could begin easing its monetary policy. Moreover, Fed officials have not ruled out the possibility that more rate hikes could be needed should a change in economic data require it. In fact, Richmond Fed President Thomas Barkin said on Monday that inflation is likely to remain stubborn and force the central bank to keep interest rates higher for longer than investors currently anticipate.

Hence, investors will closely scrutinise the FOMC meeting minutes, due for release later during the US session this Tuesday, to get a fresh insight into policymakers' views on whether the US central bank should raise interest rates again. This will play a key role in influencing the near-term USD price dynamics and provide a fresh directional impetus to the USD/JPY pair. In the meantime, a generally positive risk tone, which tends to undermine the safe-haven JPY, assists spot prices to rebound around 50 pips from the the daily swing low, around the 147.25 region. Nevertheless, the aforementioned fundamental backdrop seems tilted firmly in favour of bearish traders. This, in turn, suggests that any subsequent recovery is more likely to be seen as a selling opportunity and runs the risk of fizzling out rather quickly.

Technical Outlook

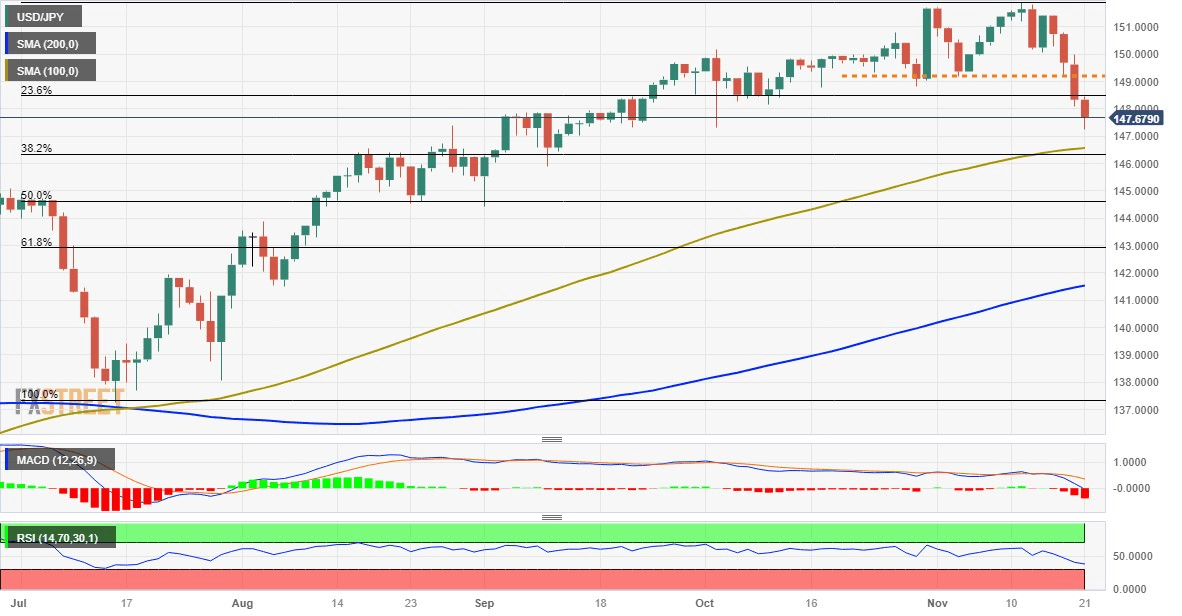

From a technical perspective, the overnight slide below the 149.20-149.15 area and the 148.80-148.70 horizontal support confirms a breakdown through the neckline of a bearish double-top pattern formed ahead of the 152.00 mark. Furthermore, oscillators on the daily chart have been gaining strong negative traction and are still far from being in the oversold territory. This, along with acceptance below the 23.6% Fibonacci retracement level of the July-November rally, further adds credence to the negative outlook for the USD/JPY pair. Hence, some follow-through weakness below the 147.00 mark, towards the 100-day Simple Moving Average (SMA) around mid-146.00s, looks like a distinct possibility. This is closely followed by the 38.2% Fibo. level, around the 146.20-146.15 region, which if broken decisively will set the stage for deeper losses.

On the flip side, the 148.00 round figure now seems to act as an immediate hurdle ahead of the 23.6% Fibo. level, around the 148.35 region. A sustained strength beyond might trigger a short-covering rally and allow the USD/JPY pair to reclaim the 149.00 mark. Any further move up, however, is more likely to attract fresh sellers and remain capped near the 149.25 region. The latter should act as a key pivotal point, which if cleared could negate the negative outlook and shift the near-term bias back in favour of bullish traders.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.