USD/JPY

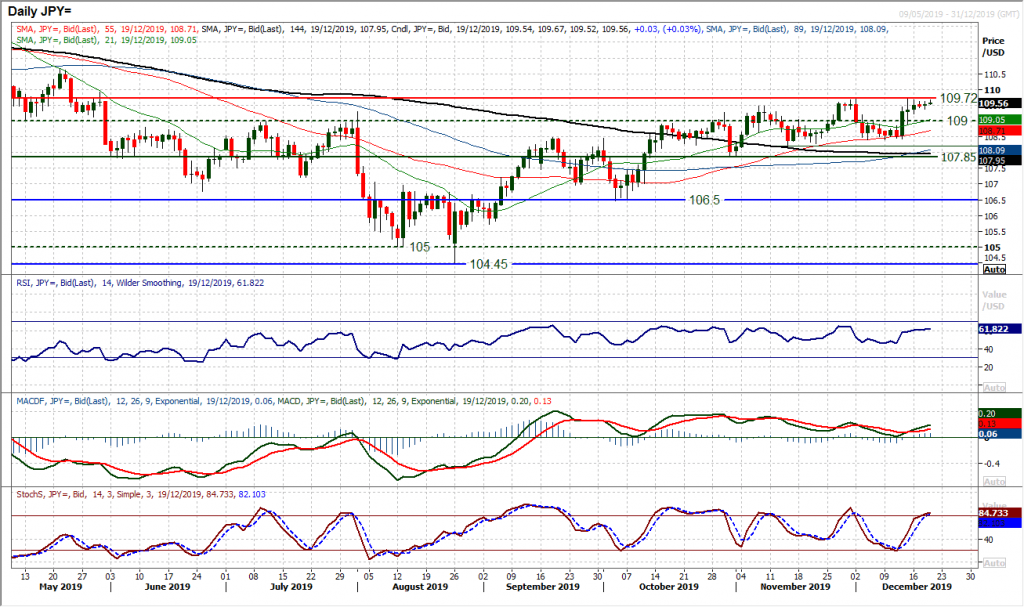

We are broadly positive on Dollar/Yen as the succession of higher lows continues. However, it is a real slog for the bulls to find any traction in the move higher. We have long noted that breaking consistently above 109.00 resistance would suggest the bulls gaining control and once more we have seen the market closing consistently above 109.00 in the past week. However, resistance at 109.70 has restricted the bulls again and in the past few sessions, the positive candles have started to turn more mixed, hinting at a lack of conviction. There is still upside potential in the momentum indicators. The RSI is around 60 and tends to falter around 65 on the bull runs, whilst the MACD lines have only just crossed higher and Stochastics still also have room to go. However, as has so often been seen in previous weeks, the breakouts quickly lose traction and are met with a retracement. Buying into weakness is therefore the strategy. The latest higher low is at 108.40 whilst the rising 55 day moving average is at 108.70 and is a good basis of support now. A retreat that finds support around 109.00 would be a good opportunity. A breakout above 109.70 would find resistance sitting at 109.90, whilst 110.65 is key.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0850 area as mood sours

EUR/USD stays under bearish pressure and trades deep in negative territory near 1.0850 on Tuesday. The US Dollar benefits from safe haven flows and weighs on the pair as investors adopt a cautious stance ahead of this week's key earnings reports and data releases.

GBP/USD closes in on 1.2900 on US Dollar recovery

GBP/USD is on the defensive toward 1.2900, struggling to find a foothold on Tuesday. The US Dollar holds steady following Monday's pullback amid a negative shift seen in risk sentiment, not allowing the pair to regain its traction.

Gold recovers above $2,400 as US yields retreat

Gold stages a rebound and trades above $2,400 on Tuesday after closing the fourth consecutive trading day in negative territory on Monday. The pullback seen in US Treasury bond yields help XAU/USD cling to modest daily gains despite the US Dollar's resilience.

Bitcoin price struggles around $67,000 as US Government transfers, Mt. Gox funds movement weigh

Bitcoin struggles around the $67,000 mark and declines by 1.7% at the time of writing on Tuesday at around $66,350. BTC spot ETFs saw significant inflows of $530.20 million on Monday.

Big tech rebound ahead of earnings, Oil slips

/stock-market-graph-gm532464153-55981218_XtraSmall.jpg)

Tesla and Google are due to report earnings today after the bell, and their results could shift the wind in either direction. Despite almost doubling its stock price between April and July, Tesla sees appetite for its cars and its market share under pressure.