US Q3 GDP Preview: Gold stays fragile barring a negative surprise

- US economy is widely expected to lose momentum in Q3.

- Fed policymakers are unlikely to change their tapering outlook.

- Gold bears look to retain control following the failed attempt to hold above $1,800.

The US Bureau of Economic Analysis (BEA) will release the first estimate of the third quarter Gross Domestic Product (GDP) growth on Thursday, October 28. Markets expect the US economy to expand by 2.5% on a yearly basis after growing by 6.7% in the second quarter.

The negative impact of the coronavirus Delta variant on consumer activity and ongoing supply chain issues in the manufacturing sector are likely to be reflected by the GDP reading. The PMI surveys and retail sales reports in the last couple of months, however, offered some positive surprises, diminishing the possibility of a weaker-than-expected growth figure.

The main question will be whether the GDP data by itself can alter the US Federal Reserve’s policy outlook.

The Fed’s most recent Summary of Economic Projections showed that policymakers have revised the 2021 full-year growth forecast down to 5.9% from 7%. Nevertheless, the number of policymakers who see a lift-off in the policy rate from zero in 2022 rose to nine from seven. More importantly, the FOMC’s policy statement revealed that policymakers saw it appropriate for the Fed to start reducing asset purchases before the end of the year. Despite the disappointing September jobs report, which showed that Nonfarm Payrolls rose by only 194,000, FOMC officials continued to voice their support for tapering to start as early as November.

Although FOMC Chairman Jerome Powell said that they will need to watch carefully to see whether the economy is evolving within their expectations, he reiterated that it was time to taper when he spoke at a virtual event on October 22.

In summary, policymakers are already anticipating a loss of momentum in the economic activity toward the end of the year and they are unlikely to change their view after the Q3 GDP data. After all, supply chain issues are expected to remain temporary and coronavirus vaccinations are helping consumer activity remain relatively healthy despite occasional spikes witnessed in the number of positive cases.

Rising US Treasury bond yields have been supporting the greenback since the Fed’s hawkish tilt became apparent in September. A GDP print near market consensus could allow the dollar to continue to outperform its rivals. A reading above 3% could trigger strong USD-buying while a big GDP miss could force investors to assess their pricing of the Fed’s policy outlook.

Gold technical outlook

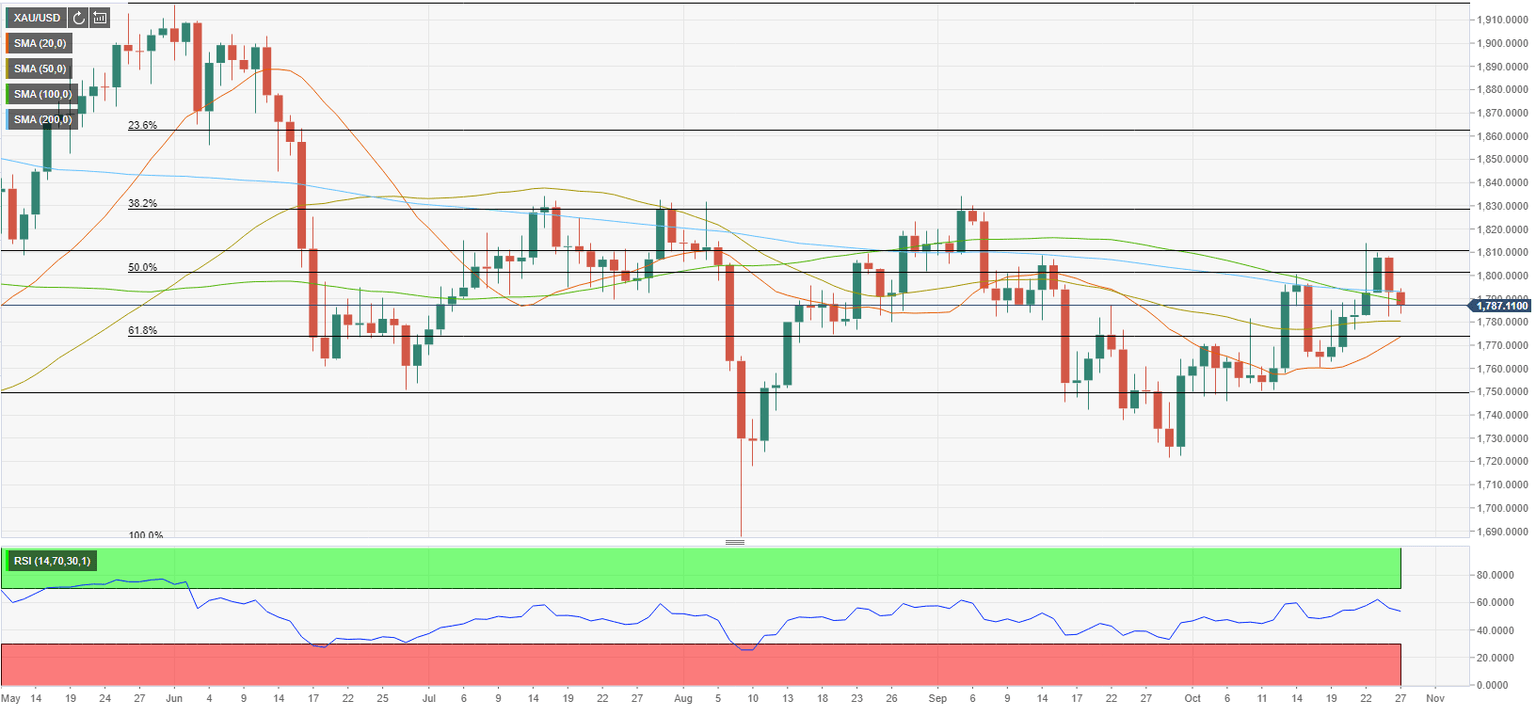

Gold managed to build on last week’s gains and climbed to the $1,810 area at the start of the week. However, the renewed USD strength forced XAU/USD to turn south on Tuesday and the pair is currently trading in a relatively tight range between the 100-day and 200-day SMAs.

In case the GDP report provides a boost to the greenback, the initial support is located at $1,780 (50-day SMA) before $1,770 (former resistance, Fibonacci 61.8% retracement of the April-June uptrend). In case the latter support fails, sellers could turn their attention to $1,750 as the next target.

Meanwhile, the Relative Strength Index (RSI) indicator on the daily chart retreated to 50 area, confirming the view that buyers are struggling to dominate gold’s action.

On the upside, $1,790 (200-day SMA) aligns as initial resistance if the dollar faces selling pressure. The $1,800 (psychological level) and $1,810 (static level) levels are likely to act as next hurdles.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.