US Dollar Weekly Forecast: ‘Trump trade’ craze captivates bulls

- The US Dollar Index reaches its eighth weekly gain in a row.

- Investors keep their bullish view on the so-called ‘Trump trade’.

- The US Dollar Index hit two-year peaks past the 108.00 mark.

The US Dollar (USD) has not only kept its winning streak alive for yet another week, but it has also managed to hit levels not seen in over two years beyond the 108.00 hurdle when tracked by the US Dollar Index (DXY).

That said, the index extended its positive streak this week, which remained uninterrupted since late September.

The ongoing rally has been driven by robust US economic data and was re-energised by the “Trump trade” as well as by the Federal Reserve’s (Fed) renewed cautious stance as it carefully evaluates its next steps on interest rates.

Uncertainty around the Trump administration: A double-edged sword?

Aside from some unexpected names coming and going, President-elect Donald Trump has yet to announce any major moves. Investors seem to have accepted this calm for now, leaving little room for unpleasant surprises in key appointments.

Meanwhile, market sentiment across the crypto space, the US Dollar, equities and corporate sector is anything but subdued. The optimism surrounding Trump’s potential second term is fuelled by expectations of corporate tax cuts and deregulation, driving strong gains in equities — particularly in financials, energy and industrials.

Initially, Trump’s likely loosening of fiscal policies, combined with the probable introduction of tariffs on European and Chinese imports could reignite inflationary pressure. This would have a direct and immediate impact on the Fed’s monetary policy stance.

In response, the Fed might pause — or even halt — the current easing cycle, keeping rates at a sufficiently restrictive level. This could strengthen the Greenback while potentially starting to dampen economic activity.

As we approach the final month of the year, the combination of a potential “Santa Rally” and the anticipation of Trump’s policies suggests the outlook for a stronger US Dollar remains intact and unblemished.

Cautious Fed, confident Dollar

Another key factor fuelling the Dollar’s sharp rally is the Fed and its renewed cautious approach. This was evident in Chair Jerome Powell’s recent remarks, where he reiterated that the central bank is in no rush to lower interest rates further.

Powell’s stance is supported by persistently high US inflation figures. While most Committee members still expect consumer prices to move toward the 2% target, the path may be bumpier than initially anticipated.

The same cautious outlook applies to the labour market: it is cooling, but at an almost glacial pace — much slower than many had hoped. FOMC Governor Michelle Bowman, a well-known hawk, echoed Powell’s prudent position, expressing discomfort with the idea of cutting interest rates while inflation remains above target.

As the Fed shifts its focus from controlling inflation to monitoring the job market more closely, the overall health of the US economy has become a critical factor in shaping future policy decisions.

In October, the Nonfarm Payrolls (NFP) report showed a modest gain of just 12,000 jobs, while the Unemployment Rate held steady at 4.1%. Although the ADP report outperformed expectations, weekly jobless claims suggest the labour market remains robust, even if it is gradually cooling.

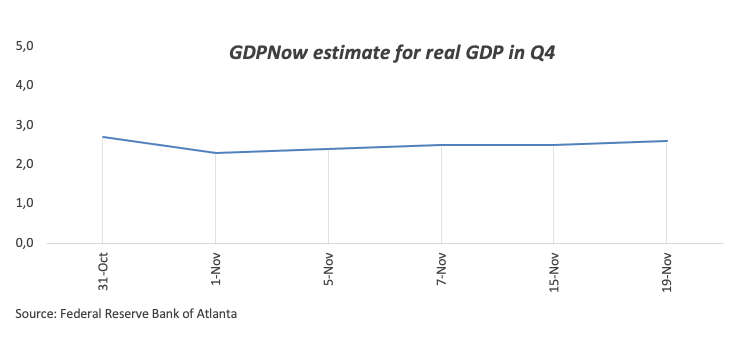

Strong GDP figures have also eased fears of an imminent recession. At this point, neither a hard landing nor a soft landing seems likely.

Compared to its G10 peers, the US economy continues to outperform, which could help the US Dollar maintain its strength over the medium to long term.

Rate changes across the globe: Who’s hiking, who’s cutting

The Eurozone, Japan, Switzerland and the UK are all grappling with deflationary pressure and increasingly unpredictable economic trends.

In response, the European Central Bank (ECB) cut interest rates by 25 basis points on October 17 but offered little clarity on its next steps, adhering to its familiar “data-dependent” approach. Similarly, the Swiss National Bank (SNB) trimmed rates by 25 basis points on September 26.

The Bank of England (BoE) also reduced its policy rate earlier this month, lowering it to 4.75%. However, the BoE is proceeding cautiously, as it expects the new budget to boost both growth and inflation. This makes aggressive rate cuts unlikely in the short term, although the central bank anticipates inflation will stabilise by the end of 2025.

In Australia, the Reserve Bank of Australia (RBA) kept rates unchanged at its November 5 meeting, maintaining its typically cautious stance. Markets now expect a potential rate cut by May 2025.

Meanwhile, in Japan, the Bank of Japan (BoJ) held firm on its accommodative policy at its October 31 meeting. While markets anticipate a modest 45-basis-point tightening over the next 12 months, the BoJ remains committed to its ultra-loose approach for now.

What’s up next week?

Next week will be shorter due to the Thanksgiving Day holiday on November 28.

On the US docket, the key event will be the release of the FOMC Minutes from the November 7 meeting, accompanied by data releases on the real economy and limited activity from Fed speakers.

Techs on the US Dollar Index

The US Dollar Index (DXY) continues its steady climb, with the next major target being the recent cycle high just above the 108.00 level on November 22. Beyond that, it aims for the November 2022 top of 113.14 (November 3).

On the downside, any pullback would first encounter support at the critical 200-day SMA, currently at 103.96, followed by the November low of 103.37 (November 5). Further declines could test the 55-day and 100-day SMAs at 103.30 and 103.16, respectively. A deeper retreat might even bring the index closer to its 2024 bottom of 100.15, recorded on September 27.

The Relative Strength Index (RSI) remains in overbought territory, sitting just above the 72 yardstick, signalling the potential for a short-term correction. At the same time, the Average Directional Index (ADX) has gained momentum, climbing above 50, which underscores the strength of the current uptrend.

Economic Indicator

FOMC Minutes

FOMC stands for The Federal Open Market Committee that organizes 8 meetings in a year and reviews economic and financial conditions, determines the appropriate stance of monetary policy and assesses the risks to its long-run goals of price stability and sustainable economic growth. FOMC Minutes are released by the Board of Governors of the Federal Reserve and are a clear guide to the future US interest rate policy.

Read more.Next release: Tue Nov 26, 2024 19:00

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve

Minutes of the Federal Open Market Committee (FOMC) is usually published three weeks after the day of the policy decision. Investors look for clues regarding the policy outlook in this publication alongside the vote split. A bullish tone is likely to provide a boost to the greenback while a dovish stance is seen as USD-negative. It needs to be noted that the market reaction to FOMC Minutes could be delayed as news outlets don’t have access to the publication before the release, unlike the FOMC’s Policy Statement.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.58% | 0.53% | 0.15% | 0.04% | 0.22% | 0.55% | 0.84% | |

| EUR | -0.58% | -0.05% | -0.42% | -0.54% | -0.36% | -0.03% | 0.25% | |

| GBP | -0.53% | 0.05% | -0.37% | -0.49% | -0.31% | 0.01% | 0.30% | |

| JPY | -0.15% | 0.42% | 0.37% | -0.11% | 0.07% | 0.38% | 0.68% | |

| CAD | -0.04% | 0.54% | 0.49% | 0.11% | 0.17% | 0.50% | 0.79% | |

| AUD | -0.22% | 0.36% | 0.31% | -0.07% | -0.17% | 0.33% | 0.61% | |

| NZD | -0.55% | 0.03% | -0.01% | -0.38% | -0.50% | -0.33% | 0.28% | |

| CHF | -0.84% | -0.25% | -0.30% | -0.68% | -0.79% | -0.61% | -0.28% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.