US Dollar Forecast: Focus shifts to US data and Fedspeak

- US Dollar Index (DXY) drops for second straight week.

- Softer-than-expected US CPI-fuels rate cut bets for September.

- Retail Sales, FedSpeak emerge as salient events next week.

The corrective decline broke below the 200-day SMA

The selling pressure in the FX world continued to punish the Greenback this week, sending the USD Index (DXY) back to the 104.00 region, or multi-week lows, against the backdrop of the strong pick-up in expectations surrounding the timing of the start of the Federal Reserve’s (Fed) easing cycle.

In addition, the pronounced retracement of the US Dollar (USD) also breached the always-relevant 200-day SMA (104.44), hinting at the idea that further weakness may be in store for the currency in the next few days.

Is the Fed’s policy divergence dwindling?

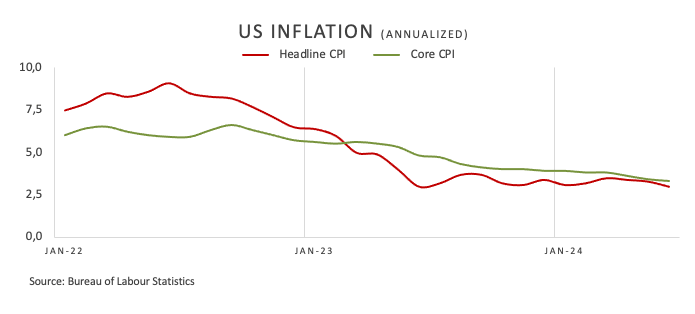

The acute decline in the index over the past week exclusively followed investors’ repricing of the timing of an interest rate cut by the Fed. This scenario strongly emerged after US inflation figures measured by the Consumer Price Index (CPI) fell short of consensus in June, rising by 3.0% over the last 12 months and by 3.3% when excluding food and energy costs, the so-called Core CPI. The higher-than-expected Producer Price Index published on Friday, however, did nothing but raise an eyebrow among investors.

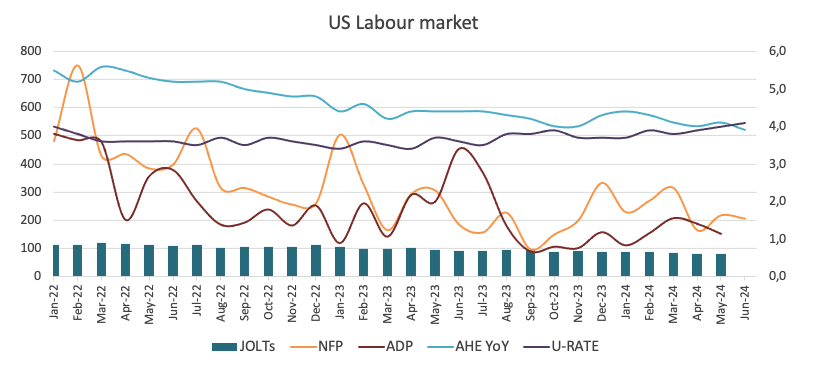

If we add the recent cracks in the US labour market, which kept suggesting further cooling, the picture pointing to a weaker US Dollar does nothing but strengthen on the short-term horizon.

In the meantime, the euro area, Japan, and the United Kingdom face an acceleration of disinflationary pressures. The European Central Bank (ECB) reduced its rates by 25 bps early in June and is largely anticipated to keep rates on hold at its July 18 meeting.

Additionally, the Swiss National Bank (SNB) surprised markets with another 25 bps cut on June 20, while the Bank of England (BoE) maintained a dovish stance at its gathering last month. Similarly, the Bank of Japan (BoJ) conveyed a dovish message on June 14. An exception is the Reserve Bank of Australia (RBA), which is projected to begin its easing cycle in the second half of 2025.

So… one, two or three interest rate cuts?

The increasing market speculation about an earlier start to the Fed's easing cycle was underpinned by “good data”. In light of the re-emergence of the downtrend in domestic inflation, along with a recent slowdown in key areas such as the labour market and the services sector, market participants now dare to anticipate a third interest rate cut by the Fed to occur in the latter part of the year. This prospect, however, contrasts sharply with the Committee’s projection of just one interest rate reduction, likely to occur at the December 18 meeting.

According to the FedWatch Tool by CME Group, there is approximately a 94% chance of rate cuts at the September 18 meeting and around 97% of lower rates in November, while a rate cut in December is almost fully priced in.

US yields validated the steep correction in the Dollar

The US money market kind of “accompanied” the Dollar’s strong pullback, as yields in the short end of the curve retreated to levels last seen in early March vs. multi-week lows in the belly of the curve and monthly lows in the long end.

The Fed remains cautious in light of rising rate cut bets

Another indication of increasing disinflationary pressures in the US emerged shortly after Chair Jerome Powell, in his semi-annual testimonies, expressed some confidence that inflation is headed lower but was not yet prepared to say he was sufficiently confident it would sustainably decrease to 2%.

Regarding the US CPI data, St. Louis Fed President Alberto Musalem commented that consumer price data is moving in the right direction, noting that inflation data shows a slowdown and aligns with price-sensitive consumers. He also expressed confidence that current monetary policy is appropriate and argued that he is monitoring the data to see if inflation continues to moderate towards the 2% target. Meanwhile, San Francisco Fed President Mary Daly anticipated further easing in price pressure and the labour market, which she believes would justify interest rate cuts.

Upcoming key events

Next on tap on the US calendar will be the release of Retail Sales for the month of June (July 16) and July’s Philly Fed Manufacturing Index (July 18). In addition, as usual, Fedspeak should keep investors entertained.

Techs on the US Dollar Index

The DXY broke below the key 200-day SMA of 104.44.

The continuation of the bearish trend could prompt the US Dollar Index to revisit the June low of 103.99 (June 4) prior to the weekly low of 103.88 (April 9), and the March low of 102.35 (March 8). Further south aligns the December bottom of 100.61 (December 28), before the psychological contention of 100.00.

In case buying interest returns to the market, DXY is expected to meet its initial upside barrier at the June top of 106.13 (June 26), just below the 2024 peak of 106.51 (April 16). Once it clears this region, the Index could embark on a potential move to the November high of 107.11 (November 1) ahead of the 2023 top of 107.34 (October 3).

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.32% | -0.56% | -0.60% | -0.04% | -0.42% | -0.43% | -0.20% | |

| EUR | 0.32% | -0.24% | -0.24% | 0.27% | -0.12% | -0.13% | 0.09% | |

| GBP | 0.56% | 0.24% | 0.00% | 0.51% | 0.12% | 0.11% | 0.34% | |

| JPY | 0.60% | 0.24% | 0.00% | 0.49% | 0.15% | 0.13% | 0.36% | |

| CAD | 0.04% | -0.27% | -0.51% | -0.49% | -0.38% | -0.40% | -0.18% | |

| AUD | 0.42% | 0.12% | -0.12% | -0.15% | 0.38% | -0.01% | 0.21% | |

| NZD | 0.43% | 0.13% | -0.11% | -0.13% | 0.40% | 0.01% | 0.24% | |

| CHF | 0.20% | -0.09% | -0.34% | -0.36% | 0.18% | -0.21% | -0.24% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.