US Dollar Weekly Forecast: Investors now look to PCE

- The USD Index (DXY) extended its weekly decline below 104.00.

- Investors appear to have fully priced in a rate cut in June.

- Markets are expected to refocus on the PCE data.

- A bearish outlook awaits below the 200-day SMA.

The persistent selling interest put the Greenback under extra pressure throughout the week, forcing the US Dollar (USD) to accelerate its losses and break below the key support at 104.00.

The negative performance of the Greenback also came in contrast to the persevering move higher in US yields across different maturities, all against the backdrop of steady bets for a potential interest rate cut by the Federal Reserve (Fed) in June.

On the latter, CME Group's FedWatch Tool sees the probability of the first interest rate cut by the Fed at the June 12 event around 52% vs. nearly 15% a month ago.

The prospects of the start of the Fed’s easing cycle was further strengthened following another solid print from weekly Initial Claims – showing that the labour market could cooling albeit at a slower pace than the Fed anticipated.

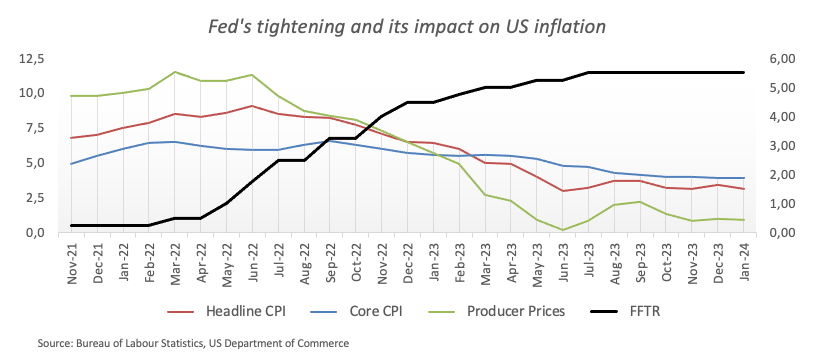

At the same time it follows the latest higher-than-estimated US inflation figures measured by the US Consumer Price Index (CPI) and the Producer Price Index (PPI) seen in the previous week.

On the US data front, the week was dominated by the release of the FOMC Minutes, which delivered a hawkish tilt and showed that the central bank is in no rush to start trimming its interest rates. From the Minutes, the majority of Fed officials highlighted the dangers associated with reducing interest rates too hastily, with a subset expressing concerns about the possibility of inflationary progress halting. These officials indicated that demand might be stronger than previously evaluated, and several also acknowledged potential risks stemming from looser financial conditions.

In the macro scenario, bets around the timing of the potential first interest rate cut by the Fed continued to dictate the sentiment among market participants. A parallel between the Fed and its major peers (excluding the Bank of Japan) can also be highlighted as both the European Central Bank (ECB) and the Bank of England (BoE) are also predicted to delay policy rate cuts until after the summer.

In the meantime, the increasing likeliness of a “soft landing” in the US economy, coupled with the still tight labour market and persistent uncertainty surrounding inflation are also predicted to prop up the view of later-than-expected rate cuts by the Fed.

Also contributing to the view of a later-than-anticipated interest rate cut, President of the Richmond Federal Reserve Thomas Barkin underlined earlier in the week the fact that the United States is still far from achieving a seamless economic transition. While recognizing advancements made in tackling inflationary issues, the main focus now lies on the timeline for their resolution.

DXY technical outlook

The continuation of the bearish tone faces the next key contention zone at the 200-day SMA at 103.72. If sellers maintain control, the loss of this region should shift the Dollar’s outlook to bearish, opening the door to a potential slide towards the temporary 55-day SMA at 103.16 ahead of the weekly low of 102.77 set on January 24. A deeper pullback could see the index embark on a potential visit to the December low of 100.61 (December 28) before the psychological 100.00 barrier and the 2023 low of 99.57 (July 14).

Bullish attempts, on the flip side, should meet the initial barrier at the 2024 high at 104.97 (February 14). Once this area is cleared, there is a minor hurdle at the weekly peak of 106.00 (November 10) ahead of the November top of 107.11 (November 1).

Economic Indicator

United States Personal Consumption Expenditures - Price Index (YoY)

The Personal Consumption Expenditures (PCE), released by the US Bureau of Economic Analysis on a monthly basis, measures the changes in the prices of goods and services purchased by consumers in the United States (US). The YoY reading compares prices in the reference month to a year earlier. Price changes may cause consumers to switch from buying one good to another and the PCE Deflator can account for such substitutions. This makes it the preferred measure of inflation for the Federal Reserve. Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.US Dollar price this week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.38% | -0.54% | 0.18% | -0.43% | 0.18% | -1.01% | -0.01% | |

| EUR | 0.38% | -0.16% | 0.56% | -0.05% | 0.55% | -0.62% | 0.37% | |

| GBP | 0.53% | 0.16% | 0.72% | 0.11% | 0.71% | -0.45% | 0.52% | |

| CAD | -0.18% | -0.56% | -0.72% | -0.61% | 0.00% | -1.18% | -0.20% | |

| AUD | 0.43% | 0.04% | -0.11% | 0.60% | 0.61% | -0.56% | 0.42% | |

| JPY | -0.17% | -0.56% | -0.69% | 0.00% | -0.61% | -1.18% | -0.19% | |

| NZD | 0.98% | 0.60% | 0.45% | 1.16% | 0.55% | 1.14% | 0.97% | |

| CHF | 0.02% | -0.37% | -0.53% | 0.20% | -0.42% | 0.19% | -0.98% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.