US Core Personal Consumption Expenditure Price Index June Preview: Bad will not be bad enough

- June PCE and Core PCE inflation likely to outstrip predictions.

- CPI and Core CPI were 0.5% over forecasts.

- Inflation pressures from labor market and supply chain dislocations unabated.

- Federal Reserve retains accommodative policy while acknowledging price increases.

- Markets likely to pass on inflation figures after the Fed decisions.

Inflation is rampant. Consumers, politicians, and economists have noticed. Even the Federal Reserve has concerns, though not enough to modify the easy money policy that is abetting the increases.

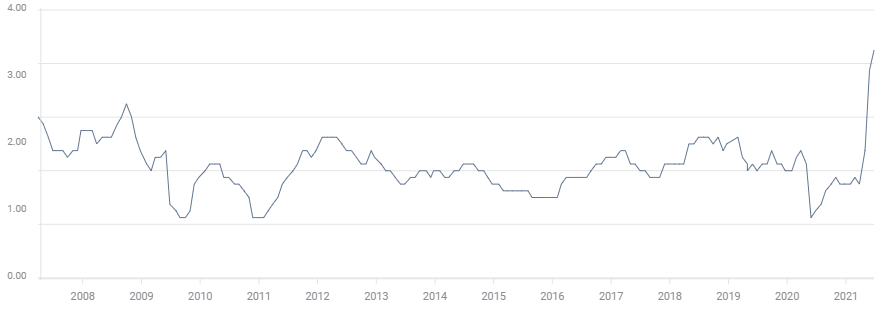

The Fed’s chosen price gauge, the Core Personal Consumption Expenditure Price Index, core PCE for short, reached a three decade high at 3.4% in June,

Federal Reserve Chair Jerome Powell asserted the central bank position that the inflation surge this year is due to temporary factors at his press conference yesterday after the FOMC decision to leave rates and the bond purchase program untouched. But he admitted that price increases have been stronger than the Fed expected and may last longer than anticipated.

How much longer can the governors avoid action? Next year is an election year. Raging inflation is political dynamite and Chair Jerome Powell’s term is up in February 2021.

The annual Core PCE Price Index is expected to rise to 3.7% in June from 3.4% in May. On the month, price gains are estimated to be 0.6% in June after May's 0.5% increase. Headline PCE rose 0.4% in May and the yearly rate was 3.9%.

Core PCE

PCE and CPI

The Consumer Price Index (CPI) is the elder cousin of PCE. Their statistical methods are similar. The chief differences lie in the basket of items used to assess price changes.

When prices rise consumers often switch purchases to lower cost goods, think store brands rather than name brands. This substitution is included in PCE but not in CPI. Historically, PCE has produced a lower overall inflation rate than CPI.

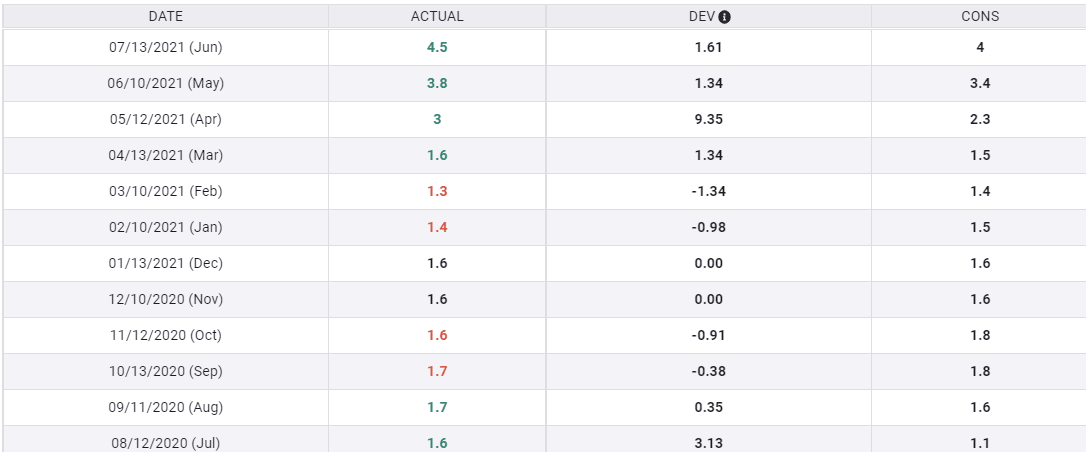

Core CPI

Core CPI rose to 4.5% in June from 3.8%, for the highest price gains since November 1991. The inflation measured by this gauge has more than tripled from January’s 1.4%.

For the last three months, April, May and June, the actual annual rate has averaged over 0.5% more than the consensus estimate. In the previous quarter the difference between the estimates and result was 0.1%, with two out of three forecasts higher than the actual figure.

The discrepancy between the core PCE estimate and the released figures over the last six months is just 0.08%. The Consumer Price Index from the Department of Labor is issued two weeks before the PCE measure from the Bureau of Economic Analysis. The delay gives economists time to rework their PCE forecast in light of the new information.

Conclusion: Inflation and Fed action

Accelerating inflation has Fed and market attention. Mr. Powell was questioned more extensively on this topic and the possible Fed response than any other at Wednesday’s new conference.

Labor and supply shortages have not abated and Mr. Powell acknowledged that they may continue for longer than the central bank had anticipated.

Congress will at some point pass another enormous deficit package adding more monetary fuel to the economy.

The Fed has been successful at thwarting the higher Treasury rates that would be the normal effect of this inflationary surge. The yield on the benchmark 10-year bond has fallen more than 25 basis points since the June 16 FOMC. The dollar has strengthened modestly as the US remains the best bet for a robust economic recovery.

Market reaction to the June PCE figures, historic as they may be, will be limited, the Fed has seen to that. But the central bank’s position that inflation is a temporary phenomenon will be tested in the next few months. The prognosis is doubtful.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.