UK markets: Election preview

With one week to go before the UK general election on 4th July, the Bank of England has warned about the risks to UK asset prices, albeit not from the UK election. The BOE warned on Thursday that French and US elections could pose a risk to UK financial markets due to the policies that the winning candidates could put in place, which may include protectionist trade policies. The Bank published its Financial Policy Report on Thursday, and while it said that the risks to the UK financial system were broadly unchanged from Q1, it said that global political uncertainty had increased, and this could trigger higher borrowing costs and global fragmentation, both of which could be negative for UK asset prices.

Interestingly, compared to the French and US election, the UK elections do not appear to be having the same impact on volatility or geopolitical concerns. The last leaders debate before the general election on Wednesday night ended in a draw, with both candidates accusing the other of not telling the truth over their plans for future policy. Based on the Bank of England’s report, the biggest risk from this election is that the party who wins power over spends, which causes bond markets to revolt and bond yields to move higher. However, we argue that the bond market is wary of spendthrift fiscal plans, and if the winning party looks like they are pushing the boundaries of fiscal prudence, the market will punish them, as it did Liz Truss. The same is true if Marine Le Pen’s party wins in France, financial markets and the threat of rapidly rising bond yields, should be there to keep them on a sustainable spending path.

Ahead of the election, the latest opinion polls have shown very little movement. According to the latest YouGov/ Sunday Times poll on voting intentions from the end of last week, support for Labour has decreased to 36%, the Conservatives, are still expected to win 20% of the vote. Reform UK is still expected to win 18% of the vote, while the Liberal Democrats are expected to win 13% of the vote, a touch lower than the week prior. However, comments from Nigel Farage, the leader of Reform, earlier this week, which tacitly seemed to support Russia over Ukraine, may have cost Reform some votes, which could boost the Tories. Also, the election seems to be Labour’s election to lose, yet Kier Starmer is not winning his debates with Rishi Sunak. Does this mean that the election could be closer than some think? The latest polls for this week will be worth watching closely in case this is a closer election than what is currently price in. While we think that a hung parliament is unlikely, if this does look like a possibility in the coming days, then we could see some volatility in UK asset prices.

Three charts to watch in the run up to the election

Leading up to this election, there has been remarkable calm in UK asset prices, which have been driven by global trends. The pound, which tended to take the brunt of political risk in the aftermath of the Brexit vote and Liz Truss’s premiership, is still attracting inflows. CFTC data shows speculative interest in GBP long positions is close to its highest level of the year so far, even if long positions were trimmed slightly last week. This is helping the pound to outperform in the run up to this election, as you can see below.

Chart 1: GBP/USD and EUR/USD normalized to see how they move together

Source: XTB and Bloomberg

As you can see in this chart, the pound and the euro have been tracking each other, but the pound has outperformed the euro, suggesting that there is a greater political risk premium attached to the euro than to the pound in the lead up elections in France and the UK.

One month volatility for the FTSE 100 is also at relatively low levels. This suggests that the market is not concerned about the outcome of the election on July 4th.

Bond markets are also worth watching closely this week and next. We have been tracking 10-year bond yields in the US, France and the UK. As you can see, French bond yields are rising at a much faster rate than in the US and the UK (this chart has been normalized to show how the bond yields move together, not their absolute value). This suggests two things: 1, French election risk is far higher than election risk in the UK, and to a lesser extent to the November elections in the US. 2, The messages from both the Labour party and the Conservative party about their plans for taxes and public spending, are not worrying the bond market for now. Thus, from a bond market perspective, the French election is a far riskier outcome than next week’s UK election.

Chart 2. UK, US and French 10-Year sovereign bond yields, normalized to show how they move together

Source: XTB and Bloomberg

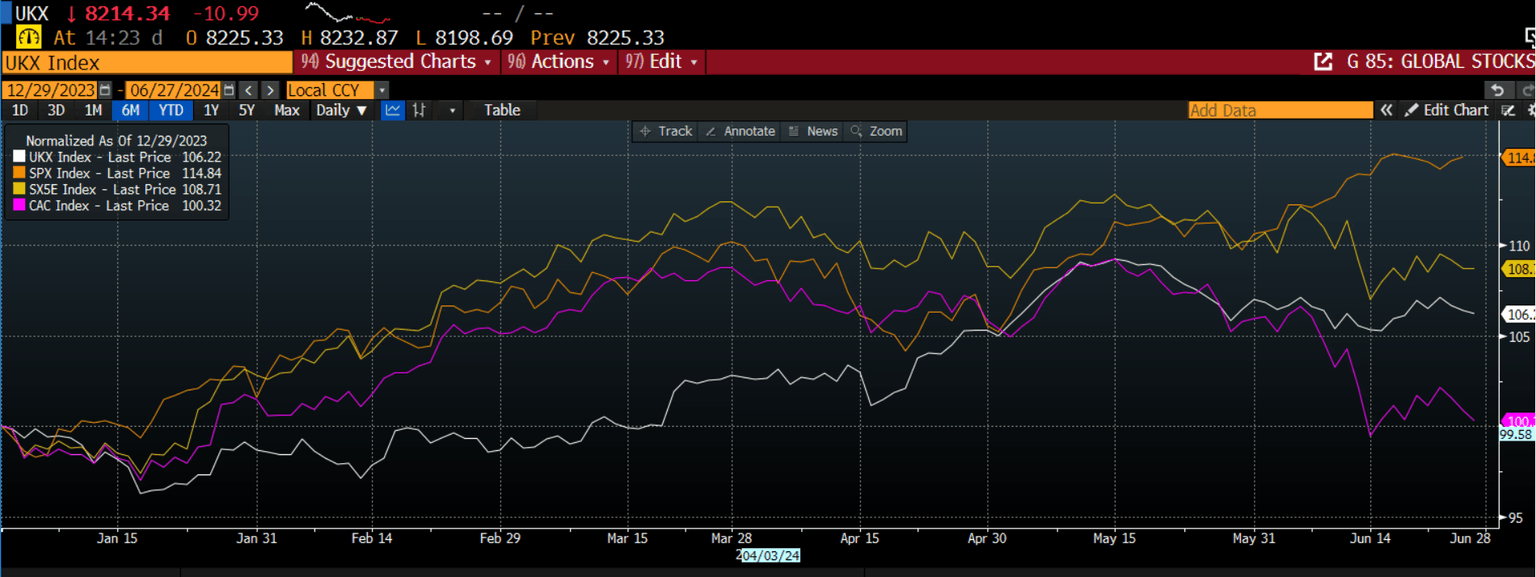

Lastly, stock indices have been mixed in recent weeks and as we move to the second half of the year. The FTSE 100 has underperformed the S&P 500 and the Eurostoxx 50 index, however, it has outperformed the French Cac Index, which has been under intense pressure since the start of the month and is lower by 7% in June. In contrast, the UK’s FTSE 100 index is down by 1% in the past month, which suggests that there is a lower political risk premium in the UK index compared to the French index.

Chart 3: S&P 500, Eurostoxx 50, FTSE 100 and the Cac 40, normalized to show how they move together

Source: XTB and Bloomberg

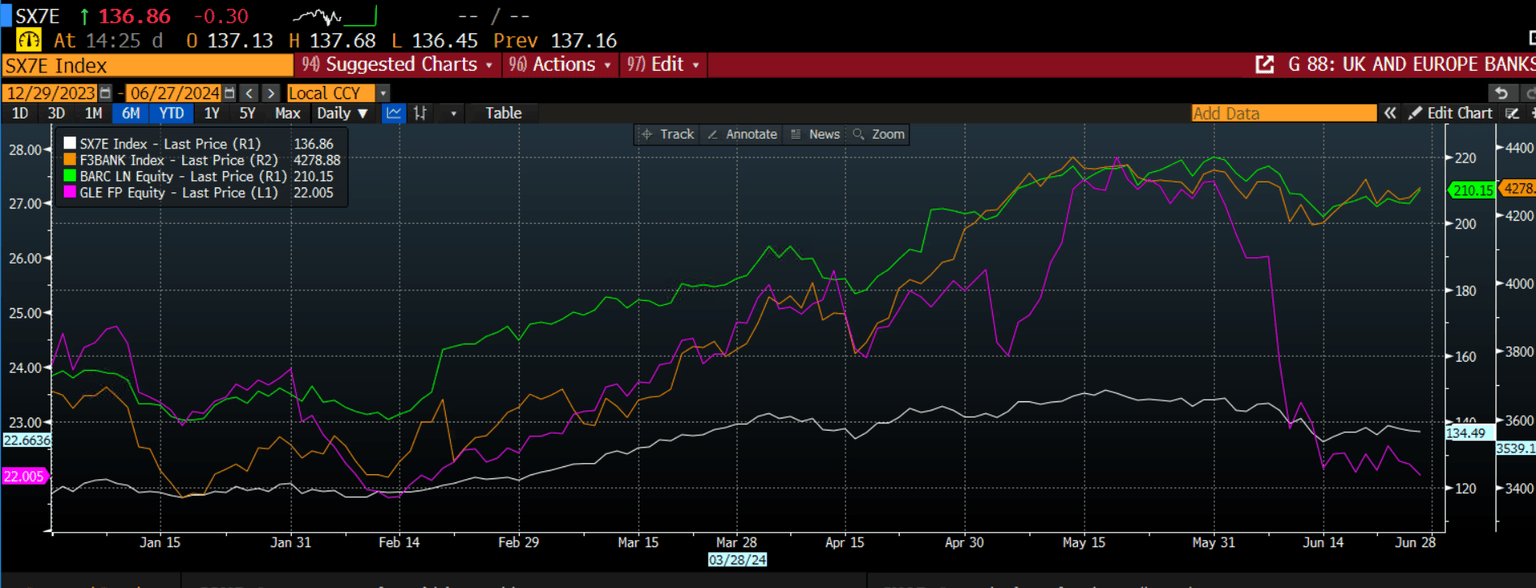

The economic health of a nation is often reflected in the banking sector, the chart below shows the Eurostoxx banking index and the FTSE 350 banking index, along with Barclays share price and the share price of Société Generale. The FTSE 350 banking index and Barclays have massively outperformed the Eurostoxx banking index and Soc Gen’s share prices this year, particularly since May. This is a further sign of the lower risk premium for UK banks. Since the French election is weighing on French bond yields, this is putting pressure on French banking stocks, as French banks are large holders of domestic debt. The same pressure is not facing the UK banking sector and it is not dealing with a political risk premium that is eroding the value of French banks. This is another sign that the global financial markets are not worried about the outcome of the UK election next week.

Chart 4: Eurostoxx index and Soc Gen, FTSE 350 banking index and Barclays, normalised to show how they move together

Source: XTB and Bloomberg

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.