UK: Due in large part to the base effect, CPI is forecast down to 2.1% from 3.2%

Another handful of Fed speakers. As we saw yesterday, the latest stance is “not yet.”

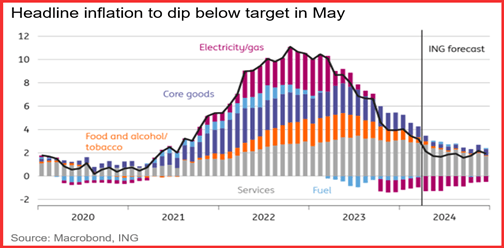

In the UK, tomorrow we get CPI. Due in large part to the base effect, CPI is forecast down to 2.1% from 3.2% and core, to 3.6% from 5.2%.

ING delivered a big report yesterday, saying inflation is nearly back to target and the data will “make or break a June rate cut from the Bank of England. Markets are pricing a 58% chance of that happening, at the time of writing.”

Headline is likely to fall from 2% to closer to the 2% target and nobody, including the BoE, expects perfection. The key factor is a 12% drop in household electricity/gas bills already underway that will subtract 1% from the headline. In addition, food and PPI are also down substantially.

ING writes: “The result is that headline inflation will, we think, dip below the Bank of England’s 2% target in May’s data due in June and stay there for most – if not all – of this year. Interestingly, the BoE itself expects headline CPI to end the year closer to 3%.... If we’re right, then that should be a recipe for several rate cuts this year. We expect at least three, which is slightly more than markets are pricing.”

One fly in the ointment--services inflation. The BoE is watching it closely and alas, this time it might be a gain. The BoE forecasts services down from 6.0% to 5.5%, with the consensus at 5.4% and ING’s forecast at 5.6%. “Policymakers have indicated that the data needs only come in roughly in line with forecasts to justify a near-term cut; it doesn’t require a material undershoot. BoE Governor Andrew Bailey, who was noticeably dovish in his recent press conference, doesn’t appear to need much more evidence to be comfortable with cutting rates.

“The bottom line is that if the data comes in with expectations, a June rate cut would quickly become the base case. But given the committee is visibly divided, a bigger upside surprise to services inflation this week would move the dial back towards August for the first rate cut. That’s been our long-held base case, and we'll review that after this week's data.” Well done for clarity.

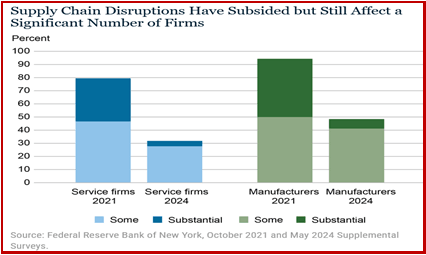

Tidbit: The New York Fed has been tracking supply chain constraints and devised several indices to track them.

Without the tiresome detail, here is the current reading: “… improvement has stalled. This trend is concerning as supplemental questions posed to businesses in the May survey indicate that supply disruptions remain significant for many firms in the region. Indeed, the recent lack of improvement in supply availability has occurred as inflation showed some stickiness.”

See the chart. Nearly one third of services and half of manufacturers continue to report supply problems.

What do companies do to offset? They raise prices, cut back operations (output), and/or reduce jobs and hours worked. We have to believe Main Fed sees this analysis.

Forecast:

We wrote yesterday that the key phrase is “maybe, but not yet.” Sure enough, we have range-trading pretty much everywhere, and while this can appear to be a stall, behind the curtain the pressure of uncertainty is growing. There’s only just so much anxiety traders can stomach before they act, rationally or not.

We can always get a Shock, like Nvidia failing to impress and the equity indices taking a nose-dive. With or without any influence from other markets, we expect traders to start covering dollar shorts ahead of the long US weekend. We need to see some of that today on “turnaround Tuesday.” If we don’t, the dollar recovery is postponed.

Tidbit: The Trump trial in New York is about to wrap up. The judge has postponed final arguments and postponed sending the jury to debate until after the Memorial Day holiday next Monday. Despite the best efforts of pro-Trump “news” outlets to magnify problem testimony from a sleazy witness, the case is pretty clearly in favor of the prosecution. Acquittal seems improbable but a hung jury is always a possibility. That’s if there is a secret Trumpie on the jury, or one very stupid juror, or the two lawyers on the jury are so obnoxious that they turn some jurors away from the seemingly obvious verdict. Now we wait. Remember that when the trial is over, the judge has jail in his back pocket for Trump violating the gag order.

Reasons for the Fed to cut rates

Avoid embarrassment from getting inflation wrong twice.

Normalize the yield curve.

Head off any recessionary tendencies.

Help housing via mortgage rates.

Help banks rollover commercial property loans.

Help the stock market.

Synchronize with the ECB (and Riksbank and SNB).

(Help the current White House).

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat