Trump wants rates lower but the Fed may not be able to deliver

Outlook

The critical factor today is not relative economic performance but rather bond yield differentials and the somewhat peculiar re-emergence of bond vigilantes in the US. As we have been seeing since the Fed issued its “hawkish cut,” higher for longer has pushed yields north and taken the dollar with them.

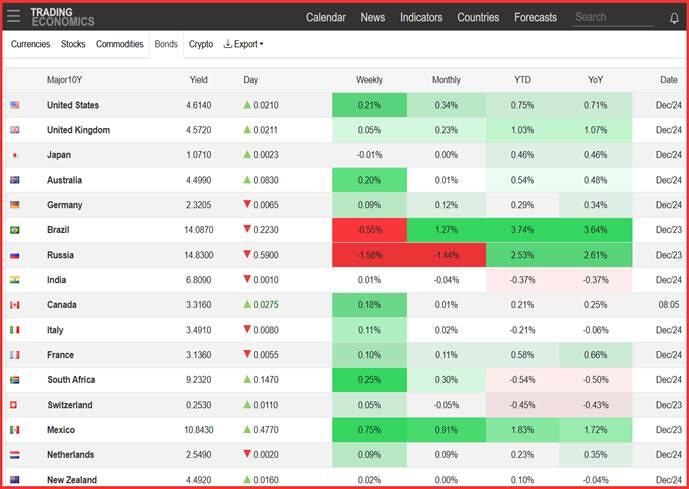

Not to be rude, but the Reserve Bank of Australia minutes overnight were already out of the date. The RBA said it was getting closer to cutting rates, but needs data to support slowing inflation. Now that the Fed has established its stance, the RBA and other central banks that want to cut may have to think again about the effect on their currencies. See the useful table from Trading Economics.

When the Fed is cutting rates—and saying so in the form of the dot-plot and other forecasts—longer-term rates should fall, too. Instead, we see the US 2-year and 10-year on the rise. Analysts have been shy about calling this situation a case of bond vigilantism, but that’s almost certainly what it is.

The term is credited to the excellent Ed Yardeni and dates back to the 1980’s. Then the central issue was expected inflation, and it remains the central issue today, goaded by higher GDP growth than anyone had expected. The Atlanta Fed, for one, has 3.1% for Q4.

This is the not-so-hidden deduction of the bond gang about Trump’s policies. The tariffs alone are inflationary. Departing millions of workers is inflationary, although we tend to think this is another Mexican border wall. A recent WSJ article indicates Trump and the incoming border czar are already talking it down.

Tax cuts are inflationary if they promote higher spending, although nobody much cares about the price of yachts.

A second factor and not to be neglected is the expected rise in the federal deficit that will come with tax cuts, even if we didn’t also expect higher spending.

Remember that last week, Pimco said it was reducing its US bond holdings in favor of the UK, Canada and Australia—a tangible protest against the Fed failing to acknowledge economic conditions, chiefly inflation, and fiscal irresponsibility.

This is not good for the Fed’s reputation, and could become the cause célèbre that drives Trump to get rid of Powell and/or other changes to the Fed. We also face the possibility that by the March FOMC, we will see how much has been rhetoric and how much is real, and the Fed may well be gutsy and revise the rate cut schedule as we see the preemptive price rises. Trump wants rates lower but the Fed may not be able to deliver.

The old forecast of the 10-year to 4.65% is now seen as too low. Something over 5% is more likely. And remember the ECR Research mention of rate hikes instead of cuts. The probability may still be less than 50%, but it’s not zero.

Forecast: The euro/dollar is probably going to be stuck in the mud today, tomorrow and Thursday on the market thinning out and/or closing for the holiday.

See the 60-minute mini-chart. From the high before the Fed announcement last week to the low (1.0343), the euro has retraced almost exactly the Fib 62%. Fibonacci retracements are superstitious hooey but many, many are believers and self-fulfilling prophecies abound. Yesterday we got a drop to an intermediate low but the narrowing of the B band indicates the drop in participation and/or a loss of conviction.

The range is about 1.0427-1.0383. As noted yesterday, you never know when a surprise might come along and punch you in the face. Complacency at year-end is not wise. Remember that in 2020 we got a big change on the first day of the new year.

Political Tidbit: In the spirit of fairness, we seek some useful things the Trump presidency might bring. There are only a few and they don’t outweigh the negatives, but here goes, anyway.

First, the macho BS is obnoxious and rude to allies like our neighbor Canada and to Europe, but might come in handy when it comes to getting hostages back and dealing with Russia/Iran/N. Korea. Is it possible he can end the Ukraine war?

Then there’s the loopy anti-scientific evidence Kennedy, but he wants to remove chemicals, including pesticides and preservatives, from food, and halt drug advertising on TV. Yes, please.

Also, it’s possible that the efficiency initiative could work, at least a little. The public has long been annoyed by waste and regulatory overkill. Everybody has a story. Ours is the handicap ramps on remote Adirondack forest rainwater measurement huts. The $2 trillion target is ridiculous and on a par with building the border wall and making Mexico pay for it, but a few billion should be do-able.

Out on the fringe lies the tiny possibility that the ruined Republican party will re-build itself as the party seeking fiscal rectitude. They can’t let the Dems take their one big policy claim, even if it was Dem Clinton and only Clinton that ever actually reduced the deficit.

Tamping down “wokeness,” especially at elite colleges and universities, is a good idea. Nobody knows how to get this done but it has damaged the Dems for many elections. In a similar vein, the non-college educated men who overwhelmingly voted for Trump will discover he does nothing for them. This means the Dems will win the mid-terms and Trump will be a lame duck for the second half of his administration.

A NYT editorial says “He is overwhelmingly strong in some areas and ruinously deficient in others.” We can focus on the strong stuff every once in a while.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat