Outlook: Today we get the September personal consumption expenditures price index, the University of Michigan sentiment index, and pending home sales. As well as a flood of opinion about the Fed’s decision and comments next Wednesday. This is one of the information overload times. For what it’s worth, Bloomberg sees 65 bp next week but 50 bp in Dec and two 25 bp hikes next year. But see the last entry below.

So far the dollar pushback against the recent pullback is holding the line, but against some important headwinds. Those include the nicely falling 10-year Gilt (3.53% from over 4.5% during the worst of the Truss mess)–sterling is weaker than it should be. In the emerging market space, the dollar is still abnormally weak against the peso, whose chart is about as confusing as a chart can get. This is evidently a function of really good and unexpected trade data, despite higher inflation, and some real confidence in a vigilant central bank. The yen is a bit dippy in the absence of even any talk about BoJ intervention but nerves are a little frayed. In a word, the FX market is minestrone soup so far today.

One wonders whether or when the US midterm elections (Nov 8) will affect FX. For one thing, Trump is expected to announce candidacy for the 2024 presidential election immediately after the midterms. For another, turnout so far is extraordinarily big, hinting the Dems may win (against the historical odds) but if not, you have to wonder if the dollar sells off on a Republican win. They are the ones who want to abandon Ukraine, slash social welfare programs, and ban gay marriage as well as women’s health self-determination. The world is watching.

Last time, mismanagement and bad conduct by the former president contributed to risk-off but failed to harm the dollar despite the US being the source of the sentiment. It may be different this time.

Markets are a bit befuddled by yesterday’s events, from US GDP surpassing expectations to Lagarde saying rate hikes are “substantially” done, implying a lower ending rate next year but gumming up the financial system with ending long-term free loans to banks and talks to begin this quarter on starting QT. This is good in the sense of a return to normalcy but it’s not at all clear the European banks can handle it all.

The U.S. economy grew at a 2.6% annual rate in the third quarter after 0.6% in Q2. This is real meaning after inflation, and seasonally adjusted, although that was probably quite a chore considering the turmoil of the past two years. The consumer held up well and exports contributed, too, despite residential investment down at a 26.4% annual rate. This time the Atlanta Fed overshot by only a little–it had 3.1%.

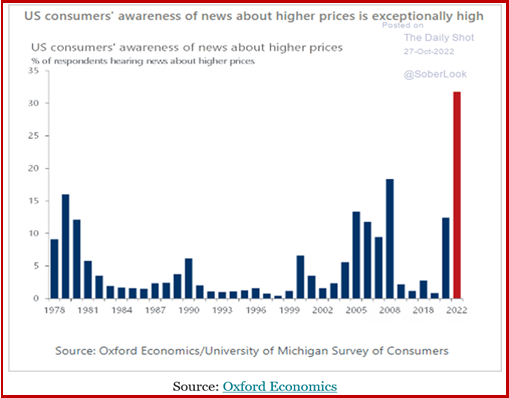

You can read all night about how this is the last gasp before the recession–or the recession, assuming we get it, will be short and small. In other words, opinion is all over the place. Most analysts point out that the consumer is holding up well because employment is holding up well. When that changes and unemployment rises, watch out. We’re not so sure that rising interest rates are going to suffice to damage such a tight labor market. And with inflation awareness red-hot (see below), the consumer may well pull back, and not by a little.

Bottom line, it’s a confusing state of affairs and even though we expected decent growth, it still surprised. But before we start believing in a soft landing, remember the bogey-man in the closet–Lag. At some point inflation is going to chew up spending as well as consumer sentiment, even as labor holds up okay. Probably.

About the ECB Decision: Raising rates by 75 bp put an end to the talk of recession trumping inflation, for a while anyway. The hike takes the main benchmark from 0.75% to 1.5%, the most since 2009. The bigger event was the ECB taking away the punchbowl in the form of the terms of the “targeted longer-term lending program” (TLTRO). The program basically made $2.1 trillion available to banks for as little as -1%, meaning the central banks were paying the commercial banks to take loans and turn around and redeposit the money, or some of it, for a tiny return. As of Oct 24, the overnight deposit rate was 0.658%, which mixes a long -term borrowing (apple) with a short-term return (orange). Starting Nov 23, the rates will be adjusted to be consistent with the new market rates. Reuters unblushingly names it the end of a subsidy–in a headline. As for closing out the ECB’s massive purchases of government bonds, talks will begin in December.

Net-net, the ECB decisions were perceived as dovish and expectations for the ending rate next year has fallen from 2.75% to 2.35-2.45%. Remember, the US is expected to get 4.5% or more.

Tidbit: The Swiss National Bank borrowed over $11 billion from the Fed this week. Credit Suisse announced it wasn’t them–it borrowed nothing from the SNB for liquidity purposes during its recent troubles. So it was somebody else.

Friday Insight: Why the Fed will hike 75 bp in Dec as well as Nov, in a single chart:

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains near 1.0300 after US PMI data

EUR/USD trades in positive territory at around 1.0300 on Friday. The pair breathes a sigh of relief as the US Dollar rally stalls, even as markets stay cautious amid geopolitical risks and Trump's tariff plans. US ISM PMI improved to 49.3 in December, beating expectations.

GBP/USD holds around 1.2400 as the mood improves

GBP/USD preserves its recovery momentum and trades around 1.2400 in the American session on Friday. A broad pullback in the US Dollar allows the pair to find some respite after losing over 1% on Thursday. A better mood limits US Dollar gains.

Gold retreats below $2,650 in quiet end to the week

Gold shed some ground on Friday after rising more than 1% on Thursday. The benchmark 10-year US Treasury bond yield trimmed pre-opening losses and stands at around 4.57%, undermining demand for the bright metal. Market players await next week's first-tier data.

Stellar bulls aim for double-digit rally ahead

Stellar extends its gains, trading above $0.45 on Friday after rallying more than 32% this week. On-chain data indicates further rally as XLM’s Open Interest and Total Value Locked rise. Additionally, the technical outlook suggests a rally continuation projection of further 40% gains.

Week ahead – US NFP to test the markets, Eurozone CPI data also in focus

King Dollar flexes its muscles ahead of Friday’s NFP. Eurozone flash CPI numbers awaited as euro bleeds. Canada’s jobs data to impact bets of a January BoC cut. Australia’s CPI and Japan’s wages also on tap.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.