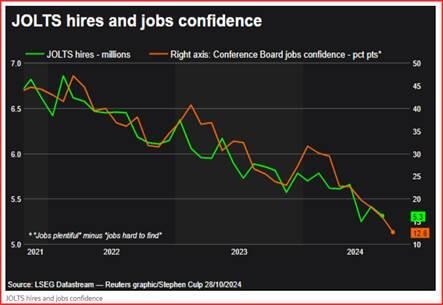

Today we get the JOLTs report, important as a bellwether for the labor market

Outlook

Today we get the JOLTs report, important as a bellwether for the labor market. See the chart from Reuters. We also get the trade balance, Aug house prices, and the Dallas Fed’s service sector for Oct. Tomorrow is important for eurozone GDP and the UK budget, which has to walk a tightrope of higher spending in some critical sectors but also higher debt (meaning higher bond issuance).

So far today the biggest news is an outcome from the Future Investment Initiative conference in Saudi Arabia. Bloomberg reports “Asked if they think there will be two more rate cuts this year, not a single executive in a panel that included the heads of Goldman Sachs Group Inc., Morgan Stanley, Standard Chartered Plc, Carlyle Group Inc., Apollo Global Management Inc. and State Street Corp., raised their hands.

“A majority agreed there might be one more reduction by the end of 2024.” The only reasons given in the Bloomberg story are the election and “embedded” inflation.

Election anxiety is the leader in the bond market. It’s so powerful that the Treasury announcement yesterday of less borrowing needed than earlier expected failed to dent yields. The Treasury will need to borrow $19 billion less than it estimated in July for a total of $546 billion in Q4.

By now most analysts agree that the yield surge is an election issue. Astute analyst Bianco links the rise in yields to the rise in Trump’s poll results. Trump tariffs = inflation. MishTalk refutes, correlating three specific high-end economic reports with each of three big recent yield surges.

We are not getting down in those weeds since a definitive answer is not possible, but do feel it’s important to note that a rise in yields implies a rise in the risk of the need for a rise in yields. This can be based on projections of giant deficits, or expectations of continuation of sticky inflation, regardless of the election. Or both. The prospect of a Trump win adds considerable weight to both issues.

Traditionally, the premium over inflation that is needed to attract and hold bond investors is based on inflation expectations. We don’t have a yardstick for presidential incompetence and mismanagement.

Inflation expectations can be estimated with no explicit regard for political developments, as we just saw in the NY Fed’s September Survey of Consumer Expectations. For one year out, the expectation is inflation unchanged at 3%. Never mind that the actual CPI inflation rate was 2.4%.

For three years out, the inflation expectation is 2.7%, higher than 2.5% in the previous survey. And for 5 years out, inflation is expected at 2.9%, from 2.8% the month before. It’s also higher than the 3-year number and a tiny 0.1% lower than the one year out.

We usually complain about the survey respondents not knowing enough about true conditions to deliver useful forecasts, let alone consistent ones, but then there is that thing named self-fulfilling prophecies. The Fed is all too aware of them. If people expect inflation not to fall to 2% plus a smidge, they will conduct themselves in such a way that inflation will not fall.

This is quite apart from the “real” world of supply chains, currency advantages or disadvantages, money supply growth, credit card limits, etc.

Then comes the question of whether the Fed looks at bond yields and reverse engineers the incorporated inflation risk. It doesn’t matter whether the risk is exaggerated or under-estimated—the price is the price. If the Fed really, truly believes inflation is whipped, it may cut in November just to make that point, and to flush out the inflation pessimists. Alternatively, the Fed may see evidence that the probability of recession is higher than we think and a cut is therefore preemptive.

But this is too fancy. The most likely Fed response to conditions, including the election, is to cut in Nov but hold back in December. This will deliver some volatility to both yields and the dollar, but in the end, leaves the US with a yield differential advantage.

Tidbit: Reuters reports a Nov 4-8 “leadership” meeting in China that will talk about $1.4 trillion in additional debt issuance to fund a stimulus program—“but it could be higher in the event of Trump Presidency.”

Tidbit: In Japan, the surprising loss by the ever-waning LDP causes what the western press calls a political stalemate. The yen fell to a 3-month high of 153.49 overnight. Supposedly a top issue is whether a new coalition government will pressure the BoJ to start tightening more, and to hell with central bank independence. This doesn’t ring true to us and Reuters does note that “Yuichiro Tamaki, head of the opposition Democratic Party for the People and possible 'kingmaker' in a new government, said the BOJ should avoid overhauling its ultra-loose monetary policy for now and focus on whether real wages turn positive.”

Forecast

There’s a lot here to support the dollar and very little to put a dent in it—except those pesky charts, which show the dollar rally very long in the tooth and deserving of a respite. We continue to detect consolidative impulses here and there—most notably in the pound. It’s not clear they have the muscle to break out, but it’s troubling to see trendlines flattening out and some indicators switching to buy. The advisory deduction is to cut the amount at stake.

Political Tidbit: A New Hampshire poll shows Trump well ahead, cheering supporters. But note that the poll starts with a question about allowing biological boys to compete in girls’ sports, a favorite of the dingbat radical left. In the 2016 election, it was trans boys using girls’ bathrooms. Now it’s sports. We think immigration and the economy are the top issues, but these “social” issues are right up there and may be decisive to some at the last minute, triggering anger on the way into the voting booth.

Meanwhile, Trump voters who think he will drain the swamp are blissfully refusing to see that “With business ties to foreign governments and holdings in industries overseen by federal regulators, Donald Trump would likely be the most conflicted president in U.S. history,” as the NYT puts it.

On the bright side, some 44 million have already done early voting, a record. Early voters historically are women and we know why they are turning out.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat