Today it’s September Existing Home Sales and the Beige Book

Outlook

Today it’s Sept existing home sales, the Beige Book, and G7 and G20 meeting on the sidelines of the IMF annual meeting. We can expect a flood of forecasts and analysis from the World Economic Outlook. We also get comments from at least two Feds, plus that 10-year Treasury auction.

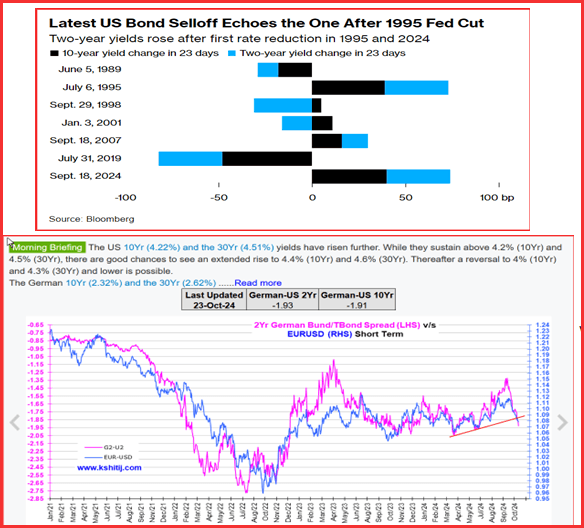

The 10-year yield is up about 25 bp in only one week, a rare occurrence. We get a 10-year auction today, too. Bloomberg summed it up nicely late yesterday: “Treasuries Plunge Like It’s 1995 as Traders See Soft Landing. Two-year yields have jumped 34 basis points since Fed meeting. Resilient economy limits room for rate cuts as election looms.”

Bloomberg notes 2-year yields are up 34 bp since the Sept 18 Fed policy meeting. “Yields rose similarly in 1995, when the Fed — led by Greenspan — managed to cool the economy without causing a recession. In prior rate cutting cycles going back to 1989, two-year yields on average fell 15 basis points one month after the Fed started slashing rates.” See the chart.

The second chart shows the strong correlation of the 2-year differential with the EUR/USD.

We have been surprised at how the growth rates, including the Atlanta GDPNow numbers, seemed to fail to impress. No longer. “Interest swaps show traders are expecting the Fed to lower rates by 128 basis points through September 2025, compared with 195 basis points priced in about a month ago.” It’s even starting to affect the CME FedWatch tool (Fed meeting now 15 days away). Those betting on a 25 bp cut shifted from 93.7% a week ago down to 87.6% today.

Separately, the ECB is arguing out loud about whether it’s okay to keep cutting rates to below the desired terminal rate in order to goose economies. We say the issue is not interest rates but rather a culture that lacks entrepreneurial spirit.

About the Yen: The dollar/yen has returned to 152.88, the highest since July 3 and very nearly at the 62% retracement line of the big move down from then to the low at 139.58 on Sept 16. This is another one of the yen’s remarkable moves bolstered in part by an absence of words and action by the BoJ and MoF. Some analysts say we should be holding our breath for strong comments and/or intervention—but not until after the election this weekend that will bolster the new PM—or not.

About the Canadian Dollar: The BoC meets today and the majority seeing a 50 bp rate cut is losing adherents. Canada has already cut three times vs. the Fed having done just 50 bp, if in one fell swoop. Can Canada disengage so much from the US, or to put it another way, can Canada lead? We suspect it will be a cut of only 25 bp, and that would lift the CAD.

Forecast

You can’t forecast the dollar without first forecasting the yields. Nobody knows how far yields can go but it does seem a limit must be nearby. Kshitij writes today that the 10-year will likely go to 4.4% (from 4.22% now) and then back to 4%. This implies the delayed dollar correction to the downside is going to take some more time. At a guess, it can easily reach to well after the election, now two weeks away but the outcome not known for another 3-10 days after that. If Trump, no retreat to 4% (and buy more gold).

US Political: The WSJ has a front-page story about the sharks placing new trades ahead of a Trump wins, without naming target names (except generic “domestic manufacturing, infrastructure spending, and prices of certain materials and commodities.”)

One CIO says he is “betting the dollar will strengthen and the U.S. yield curve will steepen, meaning long-term rates will go up more than short-term ones. He is wagering that inflation breakevens—essentially, bond-market measures of price pressures—will widen.”

Another says “The Mexican election surprised people negatively, the Indian election surprised people negatively and the French election surprised people negatively.” In this instacnce, a Harris win would be viewed by these guys as a negative. Or would it? One of the consequences of a Trump win might well be a drop in foreign direct investment by parties who shy away from political instability. That would be the folks who do not pay off Trump under the table.

Another political issue is how equities respond to the inevitable Trump charges of cheating and fraud when he loses, and the long string of court cases that will follow. Last time Trump lost, there were over 60 court cases, all thrown out for lack of evidence. This time the election managers are armed to the gills, which will make the cases easier if not faster.

Reuters reports “Banks, brokerages, investment managers and exchanges are adding staff to handle high trading volumes on and around Election Day with markets expected to become volatile as results come in.

“Political events can trigger wild gyrations that can force market participants to quickly unwind bets, raising market, liquidity and other risks that could pressure trading systems and market infrastructure.”

Banks and brokers are hiring people to track sentiment on social media, man overnight desks, prepare to answer any and all client questions, and keep the computers humming. All this at vast expense and three guesses who is to blame.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat