This week, first up the US leading indicators, then the Bank of Canada on Wednesday

Outlook

This week, first up the US leading indicators, then the Bank of Canada on Wednesday. The useful data comes later on-- the PMIs for the eurozone, the UK and the US, plus Germany’s IFO. Now that we have so much strong data from the US, it’s not clear the fresh information will tip any scales against the dollar. Some of it might tip against the others.

The Economist magazine had a story about how in recent years, so-called high-frequency economic data has become price determinative in bonds (and FX). The story fails to credit two sides of the same coin—new data driven trading without human intervention, and humans having stopped thinking.

Also, we get speeches from a gaggle of Feds. Be on the lookout for a hint of delay. We also have the IMF annual meeting this week and we will get fresh forecasts from both the IMF and World Bank. These always get noted and hardly ever get heeded by anyone except journalists trying to make a point.

The CME FedWatch tool continues to show that over 90% of bettors think the Fed will cut by 25 bp in November., now 17 days away. Two things: the US presidential election is two day before than on the 5th but we will not know the final outcome by the time of the Fed meeting on the 7th and probably not until the weekend, if not longer. Any accusations of political bias are thus inherently unjustified.

Second, US data is strong. We lack hard evidence of wage-push inflation in the US but it always lurks in the bushes. Wage and salary growth was 6.3% y/y in August. See the Trading Economics chart. The Fed said it was more concerned about employment than about inflation, but this was a temporary shift in focus. The Fed has to remain worried about inflation, including wage-push as well as the unsettling refusal of shelter to obey lower rates.

To repeat the section from Key Events above: The Atlanta Fed issued another Q3 GDPNow on Friday, unchanged at 3.4% from the day before. In the eurozone, GDP rose 0.40% in 2023 and 0.60% in Q2 2024. We await the next quarterly. Growth matters to currencies.

Therefore, we see that 90% probability of a rate cut in November as overdone. The prospect of delay may well start getting priced in any day now. This is, of course, a push off the back foot for the dollar.

About Canada: We hesitate to speak about Canada because we get it wrong most of the time, but it seems silly for expectations to be so high on a 50- bp rate cut on Wednesday. The BoC has already cut three times—June, July and Sept. The Globe and Mail reports “Bank of Canada Governor Tiff Macklem has said in recent appearances that a half-point cut is on the table if inflation and economic growth come in lower than expected. On both counts, the data have undershot the bank’s forecast.

“The quarterly Monetary Policy Report from July expected GDP to grow at an annualized rate of 2.8 per cent in the third quarter. The latest Statistics Canada data suggest the actual growth rate is somewhere between 1 per cent and 1.5 per cent.

“Inflation, meanwhile, seems to have returned to a normal level ahead of schedule. The latest decline in headline inflation was driven largely by falling oil prices, which the bank tends to play down, given their volatility. But measures of core inflation, which strip out volatile prices, are getting close to 2 per cent, and price pressures are becoming far less widespread across a broad range of goods and services.”

Perhaps the economic data seems to justify yet another rate cut, and apparently commentators (like Pimco) feel the CAD has already fallen as much as it’s going to (and the BoC doesn’t worry too much about it, anyway), but we suspect the BoC doesn’t want to be so out of step with the Fed.

Forecast

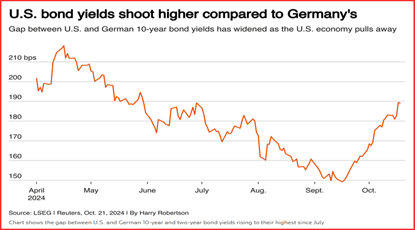

The dollar is tracking the 10-year higher. Factors behind the yield gain include looming US deficits no matter who gets elected, plus sticky inflation and better-than-expected growth that can hold the Fed back. We therefore wonder if that rate cut in November is not as certain as the betting market thinks. These factors plus geopolitical issues are strong dollar support, and any pullback will likely be just normal profit-taking and Big Bank re-positioning. See the Reuters chart. The dollar has a big head-start.

Political Tidbit: It is obvious to most finance folks that if Trump wins the election, there be dragons. The deficit will rise and by a lot, meaning yields must rise to offset. To the extent the dollar is influenced by the yield differentials, this favors the dollar if for a lousy reason.

The markets have been willing to ignore US deficits. Maybe not this time.

Then there are those Trump tariffs, which raise consumer prices and give the Fed a headache. That’s assuming Trump doesn’t fire the entire Fed on Day One (except his favorite Bowman). Then yields must go higher still. It’s not clear this causes “rotation” out of the stock market, though, because the Trump tax cuts favor big business.

Some smarty-pants are calling these outcomes the “red wave.” They should not be snarky about it. It’s not a wave—it’s a tsunami.

We remain astonished that anyone would vote for a guy who spent 12 minutes at his last rally talking about one guy with a giant Johnson and the crowd loved it. This is macho bullshit on steroids. As for contesting the election, that’s a dead cert, no matter how wide the margin. The only consolation is that this time Trump will not be the president and thus lack some of the opportunities he had in 2020 (like delaying the National Guard). The case will still get dragged out in court and we can only hope it doesn’t make it to the Supreme Court populated with judged biased in Trump’s favor. This could turn out to be another Bush v. Gore situation. Be afraid.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat