US Dollar Weekly Forecast: Attention remains on data and Fedspeak

US Dollar Index climbs further and tests the 103.00 level for the first time since August.

The majority of Fed officials favour a rate cut in November.

A 25 basis point rate cut next month appears increasingly likely.

It was another positive week for the US Dollar (USD), building on the gains from the previous period.

In the US money market, short-term yields remained steady within a consolidative range near multi-week highs, while yields in the mid- and long-term segments showed a strong recovery, reaching levels last seen in the summer.

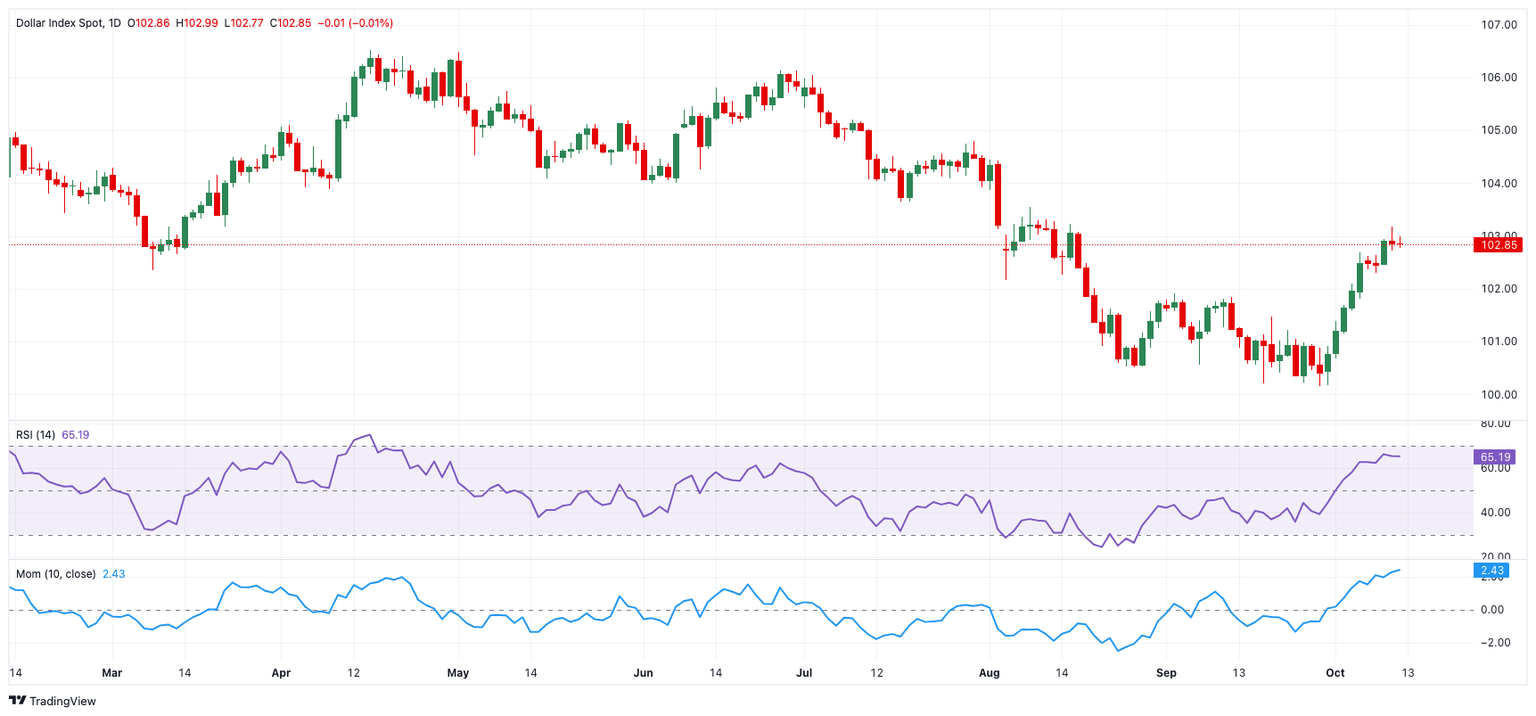

Meanwhile, the US Dollar Index (DXY) tested the 103.00 level for the first time since mid-August, continuing its climb from recent lows around the key psychological 100.00 region and the 200-week SMA around 100.60.

As we previously noted, the Dollar's strength persisted despite the Federal Reserve’s (Fed) unexpected half-point rate cut on September 18. A resilient US economy, alongside a gradual cooling of the labour market and rising expectations of a 25 basis point (bps) instead of a 50 bps rate cut next month, have supported further gains for the Greenback.

Looking forward, the Dollar’s price action suggests firm support around the 100.00 psychological level, while the next major upside target is the 200-day Simple Moving Average (SMA), currently at 103.75.

Safe-haven demand continued to bolster the Greenback

Just like the previous week, the US Dollar continued to gain momentum over the past five days as global markets turned to risk aversion following Iran’s missile strike on Israel in early October. This escalation led to a spike in market volatility, with the VIX index — commonly known as the "panic index" — rising above 23, reaching levels unseen since September.

The heightened demand for safer assets provided additional support for the already-strong Dollar, while simultaneously weighing heavily on the risk-sensitive universe.

I see a 25 basis point rate cut

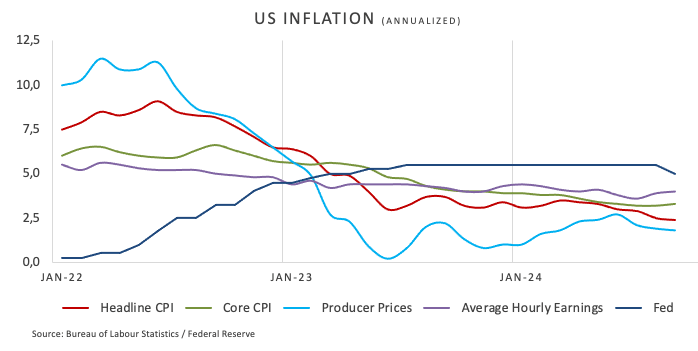

Following the unexpected 50 basis point rate cut in September, market participants have turned their attention to the performance of the US economy to gauge the likelihood of further reductions. This focus aligns with the Federal Reserve’s shift toward monitoring the labour market, although inflation, especially excluding food and energy costs, has been proving more stubborn than previously thought.

On September 30, Fed Chair Jerome Powell noted that the US economy appears to be on track for further declines in inflation, which could give the central bank room to lower its benchmark interest rate further and eventually reach a neutral level that supports economic growth. Powell also indicated that future rate cuts of 25 basis points at each meeting could become the standard approach.

Federal Reserve officials expressed a range of views regarding future interest rate cuts during the week, although the majority of them appear to lean towards a quarter percentage point reduction next month.

That said, St. Louis Fed President Alberto Musalem supported additional rate cuts depending on economic conditions, highlighting that future policy decisions would be data-driven.

New York Fed President John Williams, in a Financial Times interview, suggested gradual rate reductions over time following the significant half-percentage-point cut in September.

Fed Governor Adriana Kugler expressed strong support for the recent rate cut and indicated her willingness to back further cuts if inflation trends downward as expected.

Boston Fed President Susan Collins argued that while inflation remains elevated, progress is being made towards the central bank's target, with inflation expected to ease to 2% by late 2025.

Dallas Fed President Lorie Logan noted that despite supporting last month's cut, she favoured smaller reductions moving forward, cautioning against premature easing due to lingering inflation risks and uncertainties in the economic outlook.

Fed Vice Chair Philip Jefferson emphasized that the recent rate cut aimed to sustain labour market strength while inflation declined.

San Francisco Fed President Mary Daly echoed support for the September cut and suggested that further cuts could be possible depending on how economic conditions evolve.

Atlanta Fed President Raphael Bostic expressed a more cautious approach, suggesting that the central bank might skip a rate cut at the next meeting due to recent volatility in inflation and employment data.

Following the release of a higher-than-expected US Consumer Price Index (CPI) for the month of September, the CME Group's FedWatch Tool now predicts around 82% likelihood of a 25 basis point rate cut at the November 7 event, a significant increase from the nearly 50% probability estimated just a month ago.

The global debate: Where are interest rates headed?

The Eurozone, Japan, Switzerland, and the United Kingdom are facing growing deflationary pressures, with economic activity fluctuating unpredictably.

In response, the European Central Bank (ECB) executed its second interest rate cut on September 12 and has adopted a cautious stance on further actions in October. While ECB officials have not committed to additional cuts, markets are expecting two more reductions before the end of the year.

Similarly, the Swiss National Bank (SNB) lowered its rates by 25 basis points also on September 26.

The Bank of England (BoE) recently kept its policy rate unchanged at 5.00%, pointing to persistent inflation, elevated service sector prices, strong consumer spending, and stable GDP as factors behind the decision.

Meanwhile, the Reserve Bank of Australia (RBA) also held rates steady at its September 24 meeting but maintained a hawkish tone in subsequent statements, with analysts forecasting potential rate cuts by the end of the year or early 2025.

The Bank of Japan (BoJ), in its September 20 meeting, kept its dovish policy unchanged, with money markets anticipating only a modest rate hike of 25 basis points over the next 12 months.

The politics-economics nexus: A delicate balancing act

With the November 5 election approaching, recent polls suggest a tight race between Vice President Kamala Harris, the Democratic presidential candidate, and Republican challenger, former President Donald Trump.

A Trump win could lead to the reimplementation of tariffs, potentially disrupting or reversing the current disinflationary trend in the US economy, which might accelerate the timeline for Federal Reserve rate cuts.

On the other hand, some analysts believe that a Harris Administration might pursue higher taxes and could advocate for more accommodative monetary policy from the Fed, especially if signs of an economic slowdown start to emerge.

What’s up next week?

The upcoming US economic calendar will highlight Retail Sales and the weekly Initial Jobless Claims as key data releases in what seems to be a week initially overshadowed by the European Central Bank’s (ECB) interest rate decision on Thursday.

Additionally, market participants will be closely monitoring speeches from several Federal Reserve officials, with primary attention focused on the potential direction of the Fed’s interest rate policy.

Techs on the US Dollar Index

After the recent sharp rally in the US Dollar Index (DXY), the next key target appears to be the 200-day Simple Moving Average (SMA) at 103.75.

Although the downward pressure on the DXY has eased in the past days, a strong support level remains at the YTD low of 100.15, set on September 27. Should selling pressure resume, the DXY could test the psychological 100.00 level, with a potential retest of the 2023 low at 99.57 from July 14 if that support is breached.

On the upside, the ongoing recovery is likely to encounter resistance first at the 100-day SMA at 103.25, followed by the more significant 200-day SMA. A break above this area could pave the way for a move toward the weekly high of 104.79, recorded on July 30.

Additionally, the Relative Strength Index (RSI) on the daily chart has surged beyond the 66 mark, still leaving room for further gains in the near term. However, the Average Directional Index (ADX) has eased to around 30, indicating a loss of momentum in the current trend.

Economic Indicator

Retail Sales (MoM)

The Retail Sales data, released by the US Census Bureau on a monthly basis, measures the value in total receipts of retail and food stores in the United States. Monthly percent changes reflect the rate of changes in such sales. A stratified random sampling method is used to select approximately 4,800 retail and food services firms whose sales are then weighted and benchmarked to represent the complete universe of over three million retail and food services firms across the country. The data is adjusted for seasonal variations as well as holiday and trading-day differences, but not for price changes. Retail Sales data is widely followed as an indicator of consumer spending, which is a major driver of the US economy. Generally, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Thu Oct 17, 2024 12:30

Frequency: Monthly

Consensus: 0.3%

Previous: 0.1%

Source: US Census Bureau

Retail Sales data published by the US Census Bureau is a leading indicator that gives important information about consumer spending, which has a significant impact on the GDP. Although strong sales figures are likely to boost the USD, external factors, such as weather conditions, could distort the data and paint a misleading picture. In addition to the headline data, changes in the Retail Sales Control Group could trigger a market reaction as it is used to prepare the estimates of Personal Consumption Expenditures for most goods.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.12% | -0.12% | 0.34% | 0.13% | -0.30% | -0.38% | 0.06% | |

| EUR | 0.12% | -0.05% | 0.39% | 0.19% | -0.20% | -0.32% | 0.13% | |

| GBP | 0.12% | 0.05% | 0.45% | 0.25% | -0.14% | -0.27% | 0.19% | |

| JPY | -0.34% | -0.39% | -0.45% | -0.20% | -0.61% | -0.72% | -0.35% | |

| CAD | -0.13% | -0.19% | -0.25% | 0.20% | -0.41% | -0.51% | -0.04% | |

| AUD | 0.30% | 0.20% | 0.14% | 0.61% | 0.41% | -0.14% | 0.30% | |

| NZD | 0.38% | 0.32% | 0.27% | 0.72% | 0.51% | 0.14% | 0.46% | |

| CHF | -0.06% | -0.13% | -0.19% | 0.35% | 0.04% | -0.30% | -0.46% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.